GaAs: technical breakthroughs pushed by photonics

Total GaAs wafer market will reach more than $348 million by 2025 with a CAGR of 10 percent, says Yole

In the past few years, the GaAs wafer market has been dominated by RF applications. As of 2020, according Yole Développement's latest research, photonics and LEDs represent the main drivers for this markets.

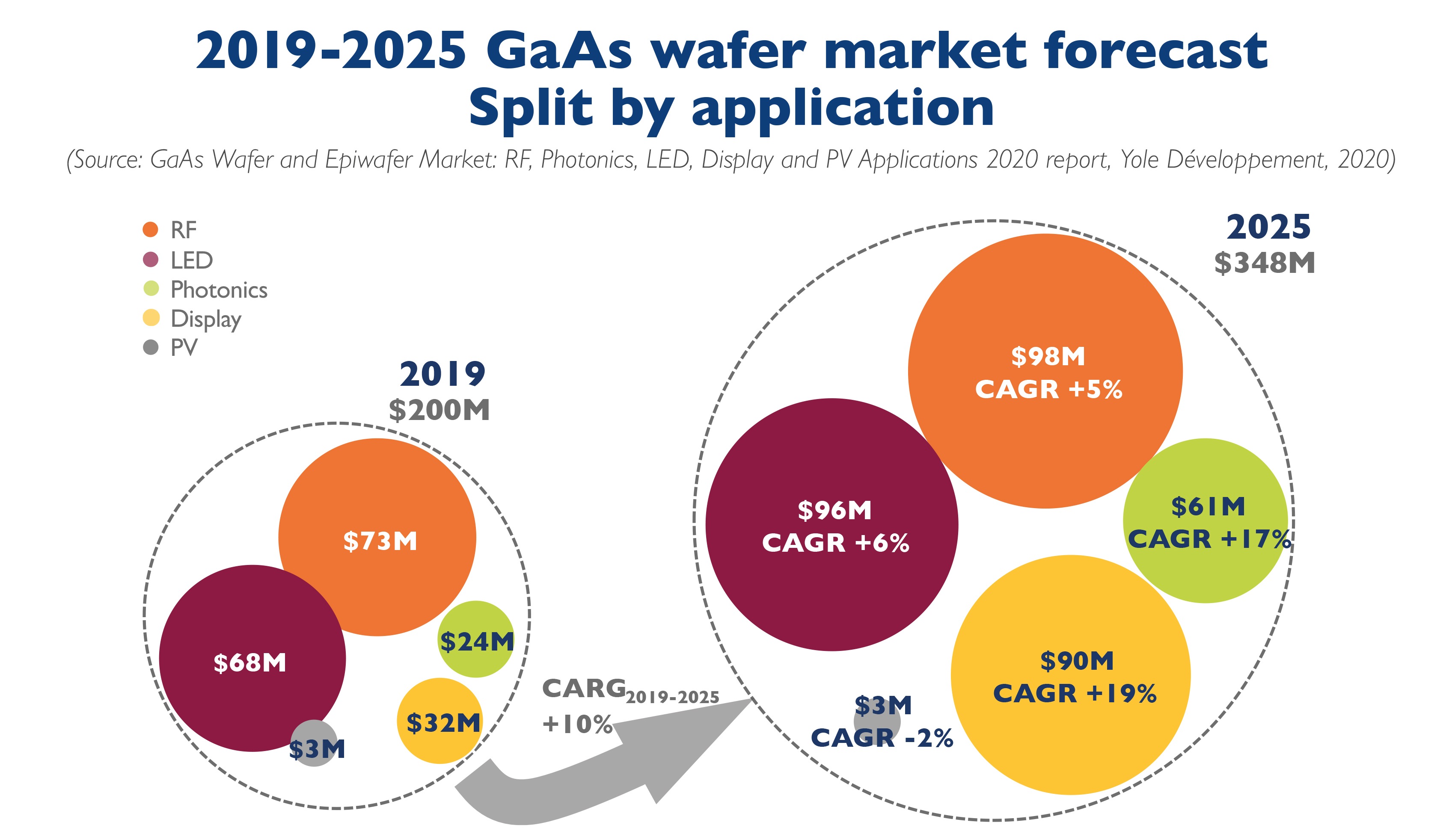

The new study forecasts the the total GaAs wafer market will increase from $200 million in 2019 to more than $348 million by 2025, with a CAGR of 10 percent.

Ezgi Dogmus, member of the Power & Wireless division at Yole said: “RF is the historical market driver for GaAs wafers. In 2019 it represented 33 percent of market volume and 37 percent of market value. RF represents 67 percent of the GaAs epiwafer open market. GaAs RF demand is mainly driven by handset evolution, with the transition to 5G resulting in greater penetration of GaAs PAs for the high-end sub-6GHz phones”.

In parallel, photonics has a 5 percent share of wafer volume, corresponding to a $24 million market. However, the photonics market will have a double digit CAGR2019-2025, with GaAs VCSEL technology strongly dominating this market. In this context, photonics applications represent 32 percent of the GaAs epiwafer open market.

With the transition of LEDs from low-end applications to high-end applications, such as horticulture lighting or automotive, LEDs still represent the highest GaAs wafer market volume with 41 percent share. Automotive will be the main driver for visible LEDs and IR LEDs, with a dynamic 6 percent CAGR envisaged from 2019 to 2025.

GaAs will find another source of growth in the display market, driven by hot new applications such as microLEDs. Yole analysts forecast the CAGR of the display market to be 19 percent in the 2019-2025 timeframe.

Without doubt consumer and automotive market segments will be strongly modified by the COVID-19 crisis. Consequently, the compound semiconductor team from Yole decided to include three different scenarios in its GaAs technology & market report, especially focused on the market evolution and production recovery.

In the mobile market segment, Yole predicts the most likely scenario is an estimated 20 percent production drop in 2020 as compared to 2019. Analysts also notice that some major OEM s, such as Samsung and Apple, have re-positioned their products. In fact, OEMs expect a shift from high end to middle end and even entry level smartphones, due to a reduction of household revenue. Regarding automotive applications, Yole forecasts a production drop around 30 percent...

From a supply chain point of view, the GaAs epiwafer supply chain is constantly changing.

Yole analyst Ahmed Ben Slimane explains: “In the photonics market, the epiwafer business model is application dependent. In datacom, it is mostly integrated, dominated by Finisar, Avago and II-VI. However, for 3D sensing and other VCSELs for smartphones, manufacturers prefer to outsource the epitaxy, a less complicated strategy adopted by Apple, which is supplied by IQE. IQE remains the biggest epiwafer supplier, with 61 percent photonic epiwafer market share in 2019. But, with increased adoption of 3D sensing, numerous players such as VPEC, II-VI, Sumitomo Chemicals and Landmark are ramping up their production”.

The RF GaAs epitaxy market is about 90 percent outsourced. Previously it was largely dominated by IQE, nevertheless it has lost share to the Chinese-Taiwanese supply chain. As of 2019, IQE and VPEC represent more than 80 percent of the RF epi market. The LED epiwafer market remains almost entirely integrated within very well-established companies like Osram, San’an, Epistar, and Changelight.

In terms of GaAs wafer supply, Freiberger, Sumitomo Electric, AXT and Vital Materials lead the market in 2019. The top players have a bigger market share in high end applications, and due to stringent laser grade wafer specifications, they will keep their advantage for the next 5-8 years. The outlook for new Chinese GaAs suppliers is challenging, they recently entered the market with low-end products for LED. However, their transition to high-end products and expansion out of China is risky due to potential IP infringement issues.