Soitec confirms FY’24 guidance and looks ahead

Company continues to anticipate significant growth in its three end-markets

Soitec, the semiconductor materials firm, has confirmed its guidance for the fiscal year 2024 (ending on March 31st, 2024) and provides some preliminary indications about its prospects for the fiscal year 2025.

Soitec confirms that it expects revenue for FY’24 to decline by around 10 percent at constant exchange rates and perimeter and an EBITDA1 margin for FY'24 of around 34 percent, in line with the guidance given on February 7th, 2024.

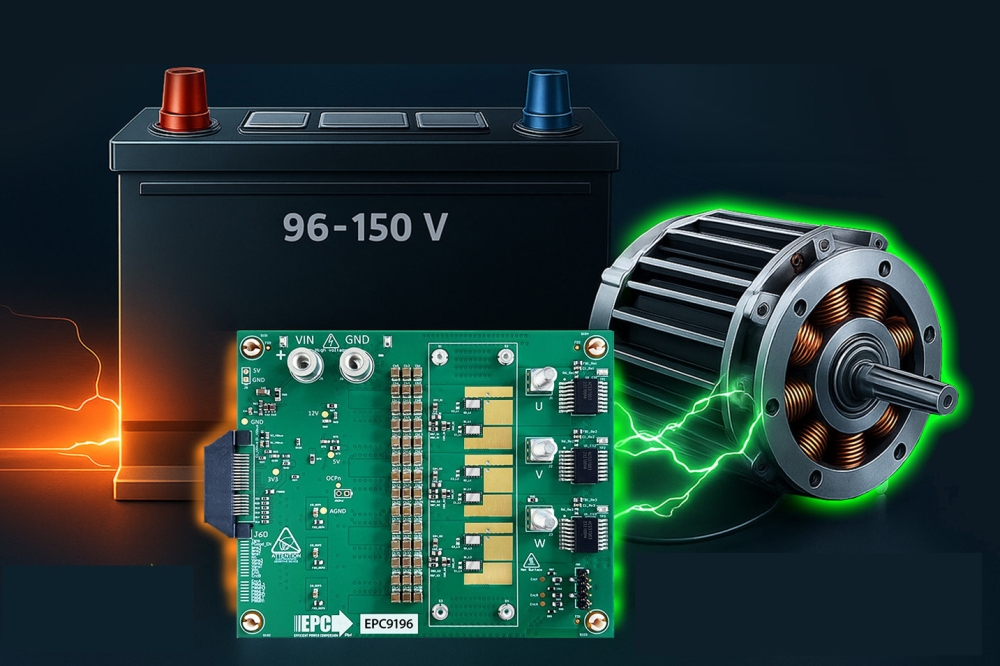

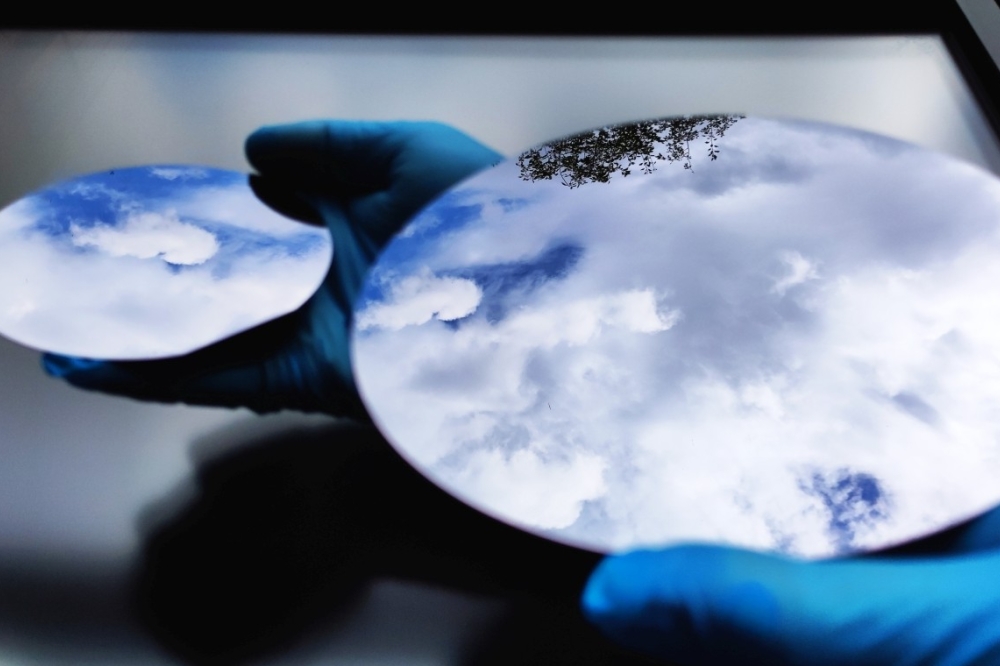

Looking ahead, Soitec continues to anticipate significant growth in its three end-markets, where it is strengthening its leadership in SOI, and successfully executing on its expansion in compound semiconductors, particularly POI and SmartSiC.

In the short term, Soitec therefore anticipates continued strong performance in FD-SOI, POI and Power-SOI, as well as the start of SmartSiC ramp-up.

Regarding RF-SOI, the second half of FY’24 benefited from restocking by major customers in anticipation of a smartphone market rebound in 2024, and significant orders from new customers. As already reported in the Q3’24 release the level of RF-SOI inventories at foundries level remains high and will impact the performance of H1 FY’25. However, Soitec starts to see signs of improvement with some inventory digestion downstream at OEMs and at Fabless level.

As a result, Soitec expects revenue for FY’25 to be stable at constant exchange rates and perimeter as compared to FY’24 with a potential upside if the RF business recovers earlier, with strong seasonality effect.

H1’25 revenue is expected to decline by around 15 percent year-on-year at constant exchange rates and perimeter, with especially a low point expected in Q1’25. Soitec then expects revenue to rebound in H2’25, driven by the end of RF-SOI inventory correction with foundries, the strong structural growth of its SOI products, the continued adoption of POI and the start of the SmartSiC ramp-up in the second half of FY’25. EBITDA1 margin2 for FY’25 is expected to be around 35 percent.

Mid term outlook

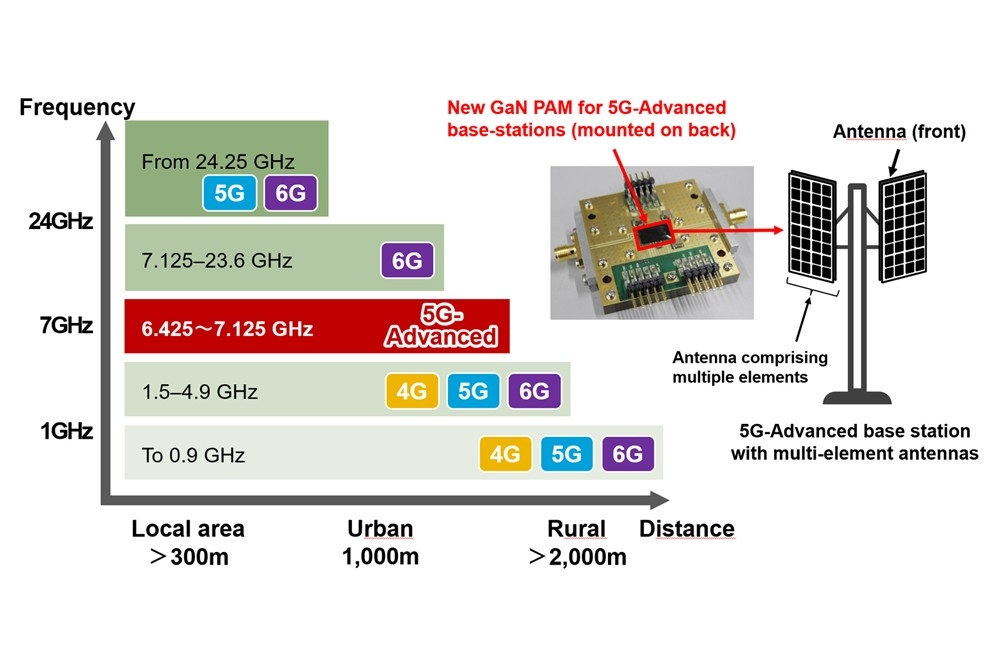

Soitec expects the RF-SOI inventory correction to end in FY’25, and its long-term growth trajectory to resume rapidly thereafter. It says it is confident in its growth engines supported by the strong penetration of 5G, the advent of electrification and the acceleration of artificial intelligence, as well as the successful expansion of its product portfolio, in SOI and Compound semiconductors.

This expected strong rebound will be driven by the resumption of growth in RF-SOI, the progression of SOI products (FD-SOI, Power-SOI, Photonics-SOI), the continued acceleration of POI, and the significant revenue generated by SmartSiC.