Power electronics: facing rapid capacity expansion

According to Yole's 'Status of the Power Electronic Industry, 2024' report, the power electronics market will reach $35.7 billion by 2029, growing at a CAGR of 7 percent from 2023, when it was $23.8 billion.

The power electronics supply chain has recently rapidly expanded its manufacturing capacity, particularly for SiC and silicon devices, as well as SiC wafers. However, this will consolidate, driving technology innovations, price reductions, and new strategies, says Yole.

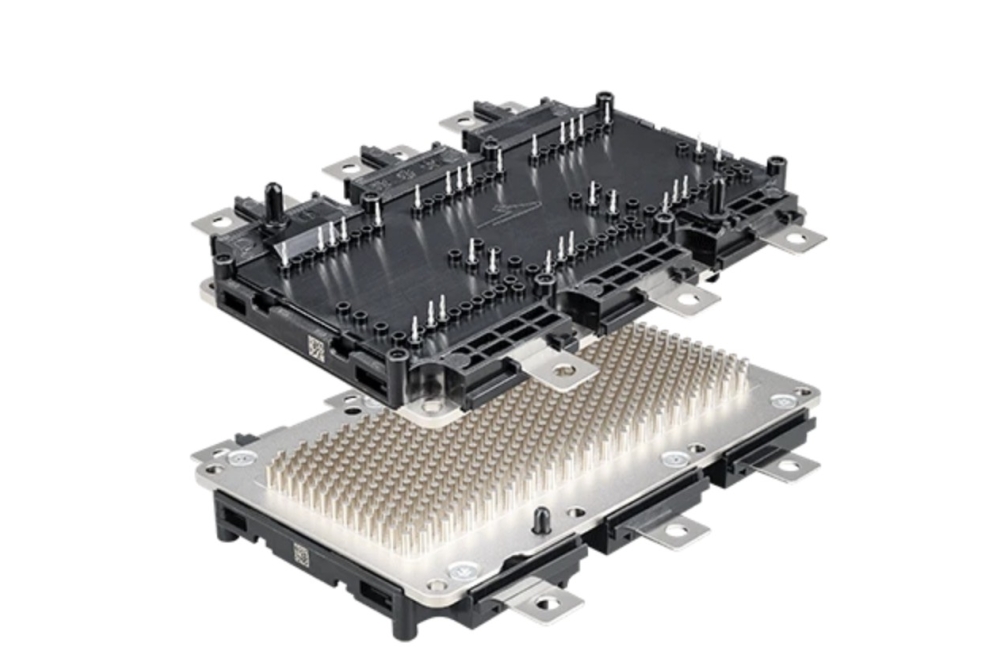

The discrete market, valued at $15.5 billion in 2023, is projected to grow at a 3.9 percent CAGR to $19.5 billion by 2029, driven mainly by xEV , OBC , DC-DC converters, and charging infrastructure. Automotive and consumer are the biggest market segments. Power modules, pushed by battery energy storage, EV DC chargers, and xEVs, are set to reach $16.2 billion by 2029, with a 12.0 percent CAGR.

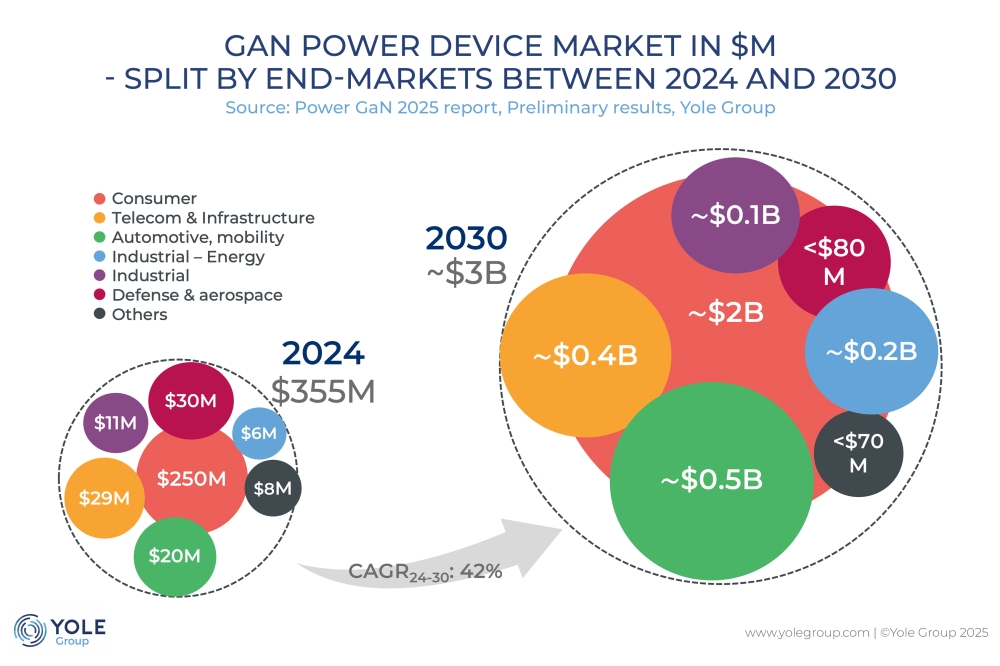

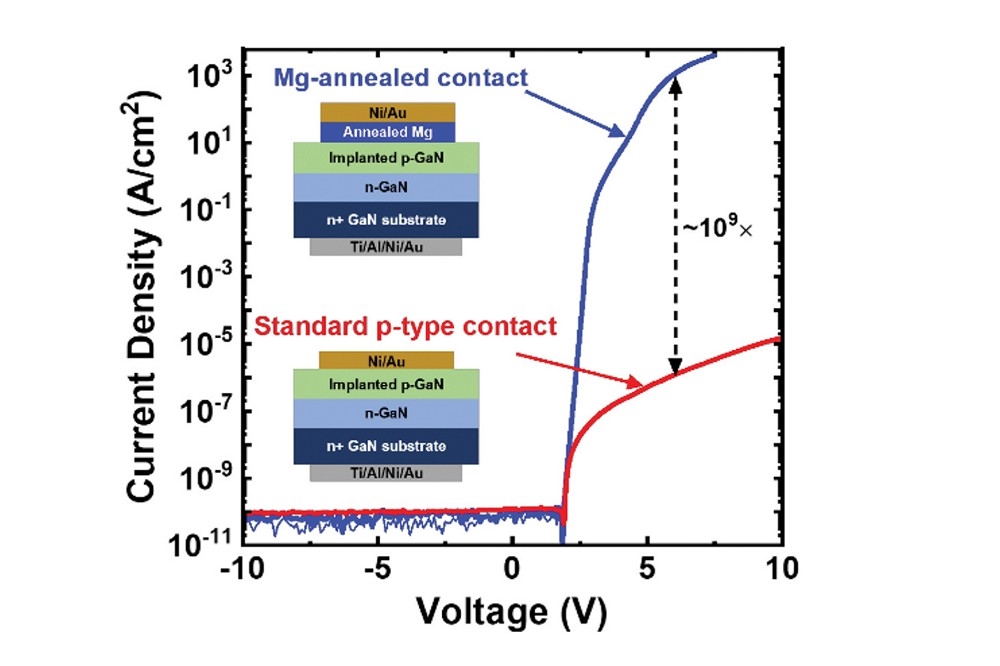

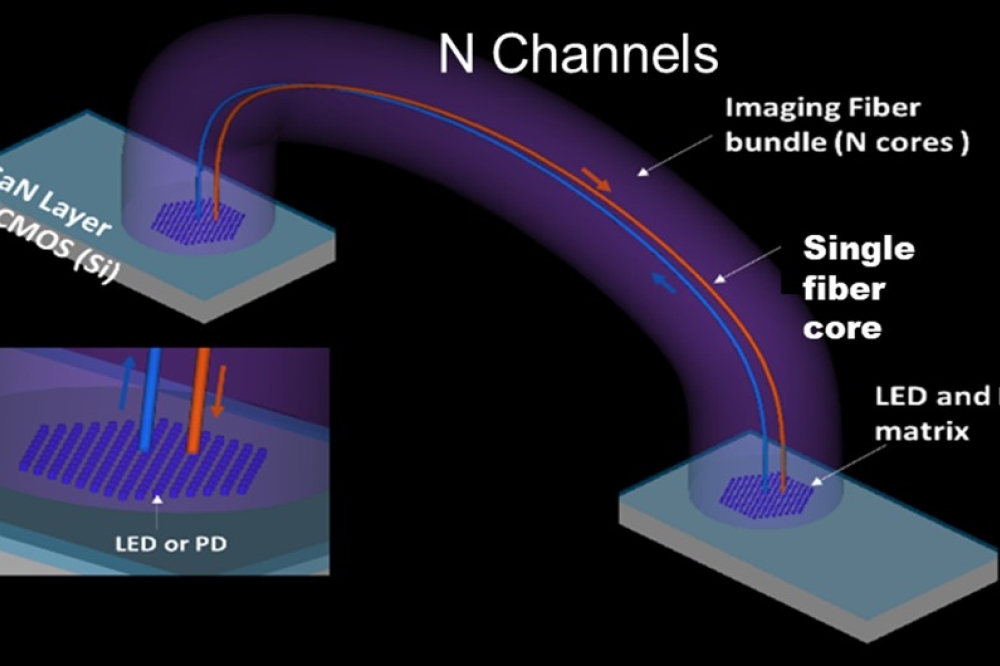

Milan Rosina, principal analyst for power electronics & battery at Yole Group, said: “The power device market is led by silicon, with SiC gaining ground in xEV and industrial applications, while GaN serves consumer power supplies and e-mobility. Gallium oxide (Ga2O3) could become a future contender.”

Wafer demand is rising, especially for 12-inch silicon wafers, with GaN-on-Si using 6- and 8-inch wafers. SiC wafer capacity is expanding, risking oversupply due to lower xEV demand. SiC wafer size will largely remain at 6 inches, though with a growing use of 8-inch wafers.

Power electronics supply chain

The power electronics supply chain is evolving due to five main factors, according to Yole. These are: expansion in wafer and device manufacturing capacity, with a shift toward larger wafer diameters; an increase in new silicon and SiC wafer manufacturers from China; mergers and acquisitions across wafer, device, packaging, and system manufacturers; device manufacturers diversifying technology portfolios (Si, SiC, GaN); and finally system makers horizontally integrating into various applications including photovoltaics, wind, EV DC charging, and battery energy storage systems.

“Recent years have seen rapid growth in manufacturing capacity, particularly for SiC and silicon devices and wafers,” says Rosina. “However, despite the demand drivers, the slowdown in xEV demand and the rush to increase capacity has led to overcapacity, especially in the SiC segment. This will likely lead to consolidation in the supply chain, fostering innovation, reducing prices, and creating new strategies. More partnerships, mergers, and acquisitions are expected in the coming years.”

Chinese companies have a strong presence in end-systems like PV installations, wind energy, electric vehicles, and EV DC charging infrastructure and in power converter manufacturing. They also have extensive involvement in silicon and SiC wafer production and power device packaging.

The Chinese government and businesses are focused on addressing their reliance on foreign suppliers for bare dies, aiming to boost the market share of Chinese power device manufacturers in the near future.

Yole Group will participate in the upcoming PowerUP and Fortronic Conference & Exhibition on September 18th and 19th in Milan, Italy. A presentation on 'WBG, Renewables: Technology Innovations and Market Dynamics' will be given by Milan Rosina and Amine Allouche, Yole's technology and cost analyst for semiconductor substrates & materials, on September 19.