GaN’s stalwart sector: Consumer electronics

While makers of GaN power electronics enthuse about the opportunities associated with AI and EVs, fast chargers will be the dominant application throughout this decade and beyond.

BY RICHARD STEVENSON, EDITOR, CS MAGAZINE

Pick up a handful of press releases from the leading makers of GaN power devices and it’s easy to spot a common theme – the tremendous opportunities associated with AI, and to a lesser extent, EVs. Both these applications demand efficient delivery of high voltages at high power densities, a task GaN is great at fulfilling.

Given the frenzied excitement and great importance ascribed to AI and EV by leading manufacturers of GaN power devices, it would be easy to fall into the trap of assuming that these applications are already significant – and if they are not dominating now, they soon will be.

So, given this state of affairs, the latest GaN report from Yole Group delivers a valuable, much-needed reality check. Yes, the EV and AI markets are growing very fast – but they are dwarfed by that of consumer electronics, and that’s not going to change throughout this decade.

According to Yole Group’s latest forecast, detailed in its Power GaN 2025 report, in 2024 sales associated with the consumer electronics market totalled $250 million, and they will climb with a compound annual growth rate (CAGR) of 35 percent to $1.53 billion by 2030. In comparison, the CAGRs for the ‘telecom & infrastructure’ and ‘automotive, mobility’ sectors will be much higher over the same timeframe. They are forecast to have CAGRs of 53 percent and 73 percent, respectively, with corresponding annual revenues rising to $384 million and $540 million by 2030.

Offering insight into these trends, Yole Group’s Roy Dagher, who holds the role of Technology and Market Analyst, Compound Semiconductors, explained that in 2024 about 70 percent of GaN power device revenue came from the consumer segment, a figure that will fall to 53 percent in 2030.

Dominating sales within the consumer sector are fast chargers, accounting for a share of around 90 percent in 2024. However, this sector is diversifying, with GaN power devices seeing increasing deployment in ‘white goods’, which includes home appliances, such as fridges, freezers and TVs. “We believe that it's going to grow massively in the next few years,” remarks Dagher.

The consumer electronics sector also includes GaN devices for overvoltage protection. It’s an application Innoscience is championing, in the form of a bi-directional switch technology that allows two devices to be replaced with just one.

To put the current status of the AI market in perspective, sales of GaN power devices to the telecom & infrastructure sector totalled just $29 million in 2024. In today’s data centres, these devices provide DC-to-DC and AC-to-DC conversion.

The sector that Yole Group refers to as ‘automotive, mobility’ is even smaller, with last year’s revenue worth just $20 million. In this market, GaN devices are used for DC conversion in automobiles, and in power supplies for lidar systems. For the latter, Yole Group forecasts sales of GaN power devices to generate revenues of around $200 million by 2030.

Margins matter

For

any chipmaker, sales are only part of the equation. Profit margins are

also critical, and this accounts for the high levels of interest in the

AI and EV markets.

According to Dagher, consumer electronics is the go-to market for newcomers. One of is appeals is its fast time-to-market.

“There's a lot of competition,” says Dagher. “Margins are low, because there's a lot of players there. Prices get cut down.”

Promises of higher profits are not limited to sales in EV and data-centre markets, and extend to industrial applications. They include motor drives, a sector that EPC and Infineon are targeting, as well as photovoltaics, with Enphase deploying GaN power devices in its micro-inverters.

The big players

Topping

the list of producers of GaN power devices is the Chinese chipmaker

Innoscience, which enjoyed a 30 percent market share in 2024, a figure

expected to nudge a little higher this year.

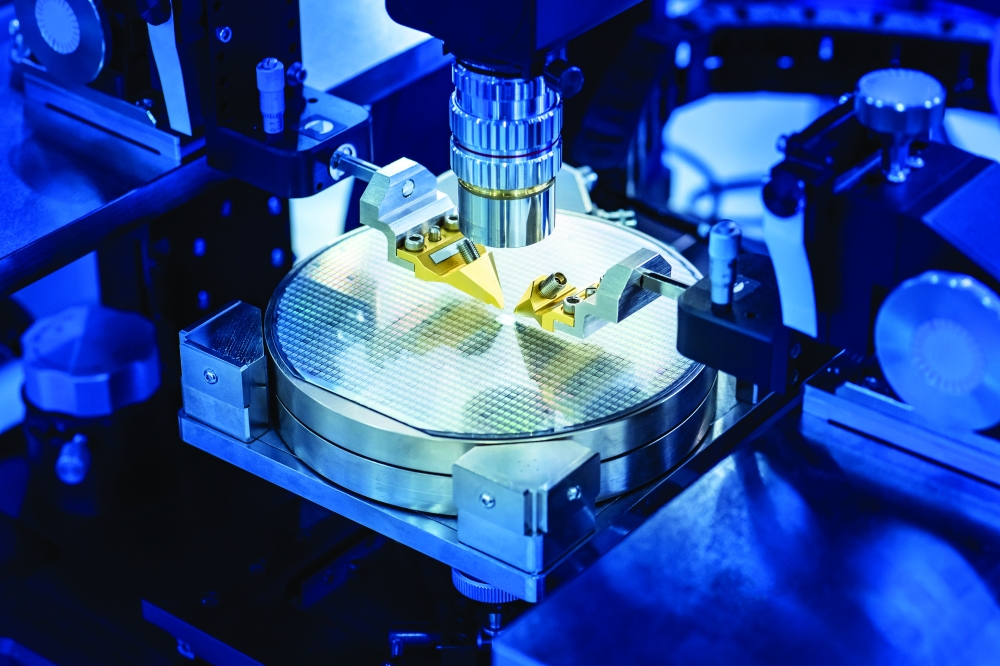

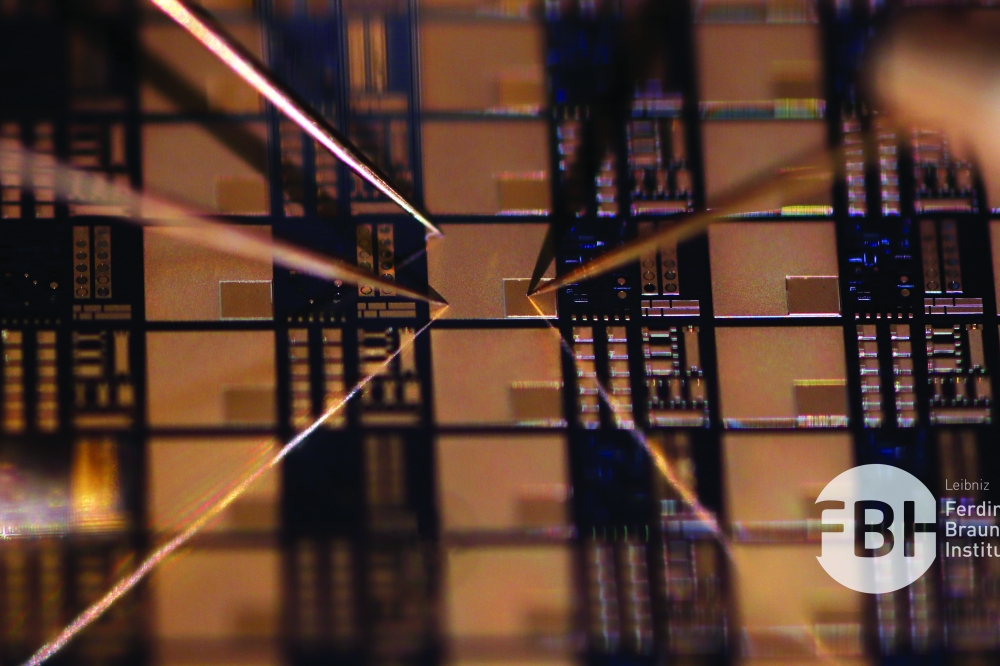

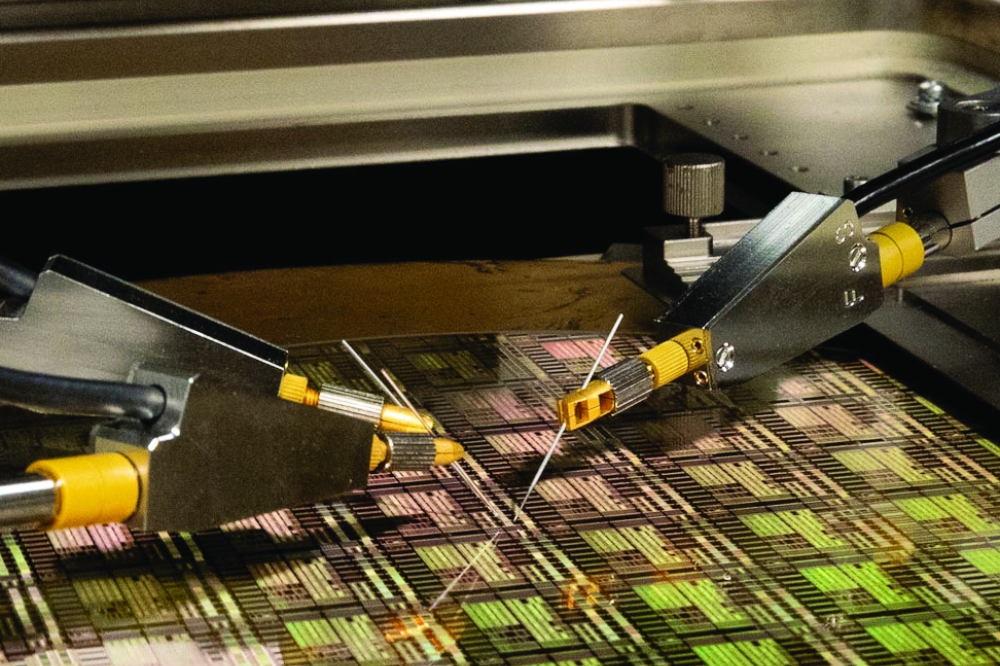

Dagher attributes this success to a number of factors, including a high production capacity and Innoscience’s migration to 200 mm substrates ahead of all its rivals.

“They have this strategy to capture market share by cutting down prices and increasing volume,” argues Dagher, who points out that Innoscience also benefits from a strong domestic supply chain.

Leaders of the chasing pack include: Navitas; Power Integrations; EPC; Infineon, which acquired GaN Systems in March 2023; and Renesas, which bought Transphorm in summer 2024.

When considering all those on this list, plus smaller players, Dagher notes that one trend is the move towards vertical integration. “Companies are trying to control the supply chain, from epitaxy to packaging.”

Backing up this claim, Dagher notes that the fabless company Navitas recently hired a senior epitaxy director. He also points out that EPC, which has fab-lite business model and partners with Vanguard and Episil, has its own epitaxial lines; and that Power Integrations is undertaking its own epitaxy.

“There exist some foundry services that could help these companies go a long way. But in future, the IDM model will control most of the market.”

While those looking for a foundry partner can no longer work with TSMC, there are many other companies offering these services for the production of GaN power devices, including a number of new entrants, such as Global Foundries, PSMC, Polar Semi and Samsung.

Another trend that Dagher is forecasting for the coming years is an increase in the blocking voltage provided by GaN products, so that they can start to compete directly with SiC MOSFETs and diodes. Efforts in this direction, which will propel GaN to 1200 volts and beyond, include the introduction of multi-level topologies. There’s also EPC’s stacking of devices, an approach it refers to as series output parallel topology that’s employed to increase the blocking voltage of products for data centres. Further innovation on this front includes Onsemi’s release of GaN-on-GaN vertical transistors, and Power Integration’s devices that are grown on sapphire.

“[Power Integration’s] has today already commercialised 1,250 volts. They plan to use it in the data centre,” says Dagher, who points out that this company has also produced a variant operating at 1700 volts – but it can only handle low powers.

Gains in performance and/or pricing may also results from the introduction of engineered substrates, such as the QST platform from Qromis, and Infineon’s efforts to produce devices on a 300 mm line.

So, while the dominant application for GaN is unlikely to change in the next five years, this part of the power electronics industry will certainly not be standing still.