Cree to set up SiC corridor

Why Cree has shifted SiC wafer expansion plans from North Carolina to New York state, reports Rebecca Pool.

As Cree forges ahead with its $1 billion SiC capacity expansion, company chief executive, Gregg Lowe, recently revealed a detour from the original plan.

Following a mighty $500 million grant from the state of New York, Cree will now build a new automotive-qualified 200mm power and RF wafer fabrication plant in Marcy, New York.

The company had set out to convert an existing facility into such a fab, in Durham, North Carolina. But as Lowe points out: “We got this tremendous offer from New York state which has allowed us to get a substantially bigger fab for substantially less money.”

According to Lowe, Cree was to spend some $450 million on retrofitting an existing structure at Durham to expand wafer capacity by thirty times. However, the company will now invest around $170 million in building a new facility with nearly forty times more capacity.

Crystal growth and materials expansion will continue at Durham, to the tune of $500 million. And as Lowe says: “[The New York state investment] is a pretty good deal for us.”

“We're creating this East silicon carbide corridor from New York to North Carolina and we reckon this is going to be very powerful,” he adds. “Customers see us continuing to invest in silicon carbide capacity and expansion, and everyone is super-excited.”

The new facility in Marcy, New York, is expected to bring in more than 600 new jobs by the end of this decade. Meanwhile the expansion of SiC crystal growth and epitaxy at Durham, North Carolina, will see a shift from lower-paid operator positions to higher-paid technician posts.

“We have partnered with local colleges in Durham to develop our own workforce, so our operators will be taking the necessary courses and associated degrees ready for this transition,” says Lowe. “Also, up-state New York has a great collection of universities that are deep into materials and electronic engineering; having a highly qualified workforce is going to be key to get this really moving.”

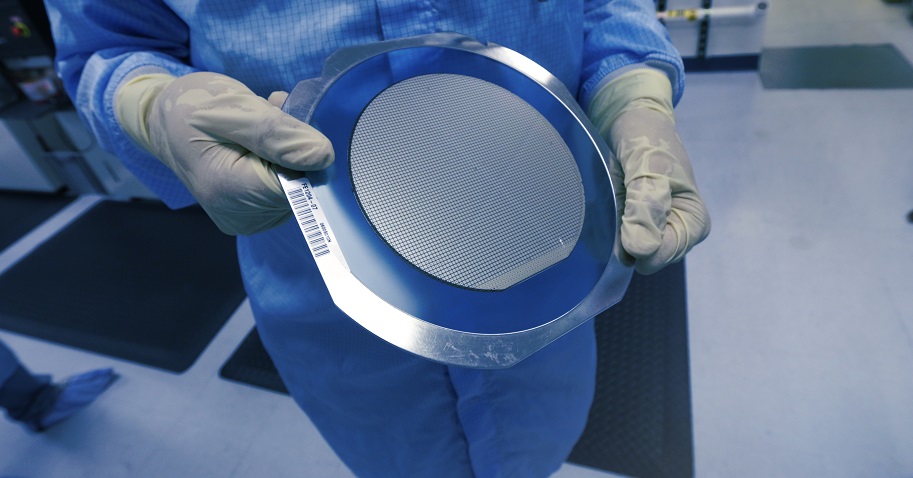

Proposed 200mm power and RF wafer fabrication facility, known as the “North Fab,” was to be built in Durham (pictured), but will now reside at a new location in New York state.

Right now, the site in New York is ready for development while materials capacity expansion is already taking place in North Carolina. Come 2022, and with materials production in place, Cree expects to ramp 150 mm wafer production at New York and then transition to 200 mm wafer sizes around two years later.

The timings coincide with Cree's recent contract with US-based automotive propulsion system developer, Delphi Technologies. Here, the company is to manufacture SiC MOSFETs for use in Delphi's 800 V inverters, with production scheduled to ramp during 2022.

“These inverters are for a global, European [car] manufacturer, and our increases in capacity will work nicely with the ramp of this product,” says Lowe. “We're quite certain that come this time our silicon carbide wafer fab will be the largest on the planet.”

Importantly, the Cree chief executive also reckons industry SiC capacity constraints are easing. He highlights how Cree is steadily increasing SiC crystal growth capacity every week while also increasing epitaxy capability. “I also think the customer shift on electric vehicles from silicon to silicon carbide has really happened too,” he adds. “Our customers are leaning very heavily towards silicon carbide right now.”

China changes

But right now, how is Cree weathering ongoing US-China tensions? Earlier this year, the US Bureau of Industry and Security added Huawei to its 'Entity List' banning the beleaguered China-based business from buying components from US companies, such as Cree.

According to Lowe, Cree's LEDs business is “still bouncing around a bit” which hasn't been helped by trade friction and the economic situation in China. But, as he highlights: “The enthusiasm for silicon carbide power devices as well as electric vehicles and solar power systems will be the growth engine for Cree going forwards.”

And while demand for electric vehicles has softened in China, following cuts in the nation's generous government subsidies, Lowe is unfazed, pointing out how subsidies are now aimed at cars with a relatively large driving range.

“The short-term has put a pause on the growth rate of the Chinese car market and car manufacturers are adjusting to these subsidy changes,” he says. “But silicon carbide enables cars to go further with the same battery-size so in the long-term this is good for us.”