Wolfspeed reports Q2 results

Wolfspeed has announced results for the second quarter of fiscal 2025. Highlights include consolidated revenue of $181m (compared to $208m in Q1) with Mohawk Valley Fab contributing $52m in revenue, (compared to $12m).

GAAP gross margin was - 21 percent, compared to 13 percent. Non-GAAP gross margin was 2 percent, compared to 16 percent. These margins include the impacts of underutilisation costs primarily in connection with the start of production at the Mohawk Valley SiC Fab. Underutilisation was $28.9m as compared to $35.6m in Q1.

Wolfspeed reecutive chair, Thomas Werner said: “Since stepping into the executive chairman role in November, I have been acutely focused on aggressively pursuing our plans to achieve our financial and operational targets.

"Myself, the board, and the management team have aligned on an operating plan driven by three key immediate priorities designed to put us on a path toward long-term growth and profitability: improving the financial performance of the company to accelerate the path to operating free cash flow generation, taking aggressive steps to strengthen our balance sheet, and raising cost-effective capital to support our growth plan. We have already made significant progress on these initiatives, evidenced by our completion of our $200m at-the-market equity offering which puts us one step closer to finalising our CHIPS funding.”

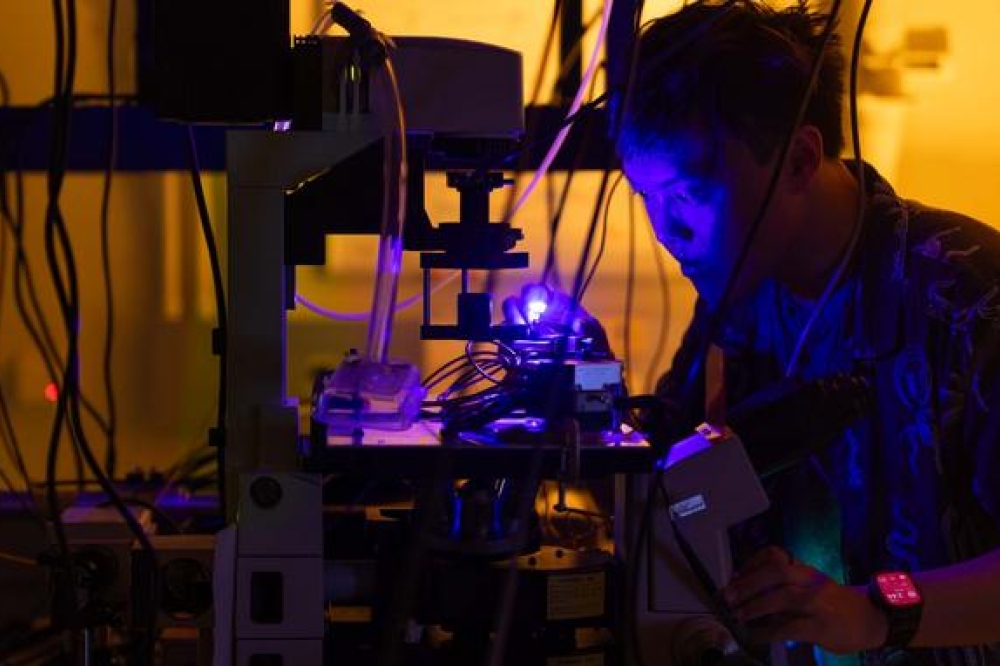

Werner continued, “Many of the world’s most advanced technologies increasingly require SiC for high‐voltage solutions and we are looking forward to propelling the industry forward with American IP at the forefront of the transition.”

Business outlook

For Q3 of fiscal 2025, Wolfspeed targets revenue from continuing operations in a range of $170m to $200m. GAAP net loss is targeted at $(295)m to $(270)m, or $(1.89) to $(1.73) per diluted share. Non-GAAP net loss is targeted to be in a range of $(138)m to $(119)m, or $(0.88) to $(0.76) per diluted share.

The loss per share includes the impact of issuing approximately 27.8m shares of common stock under its ATM program. Targeted non-GAAP net loss excludes $157m to $151m of estimated expenses, net of tax, primarily related to stock-based compensation expense, amortisation of discount and debt issuance costs, net of capitalised interest, project, transformation and transaction costs and restructuring and other facility closure costs.

The GAAP and non-GAAP targets do not include any estimated change in the fair value of the shares of common stock of Macon Technology Solutions acquired in connection with the sale to Macon of our RF product line (RF Business Divestiture).

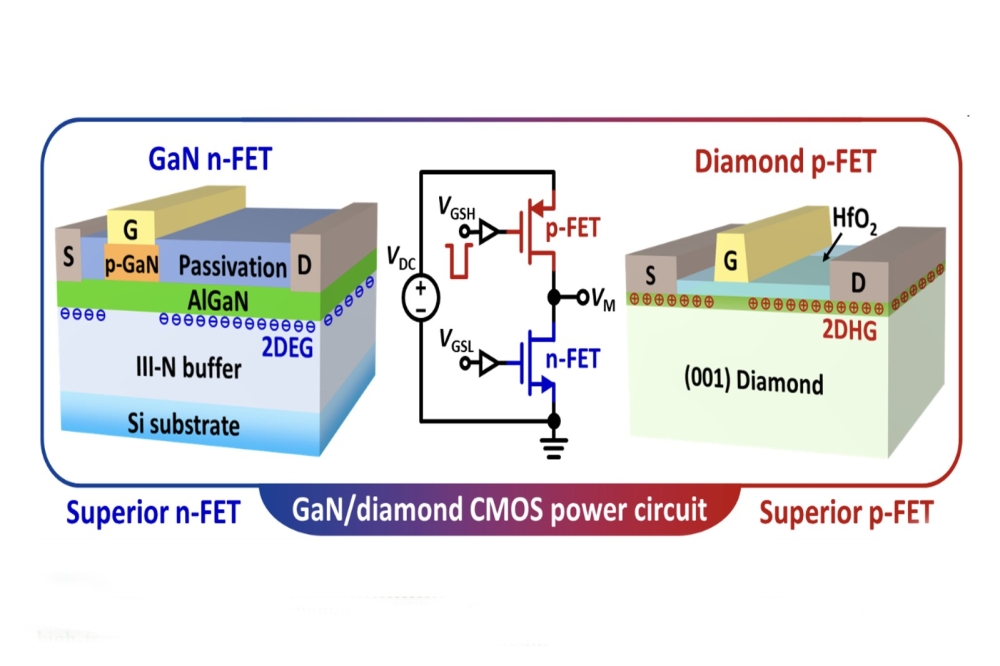

Restructuring and facility closure

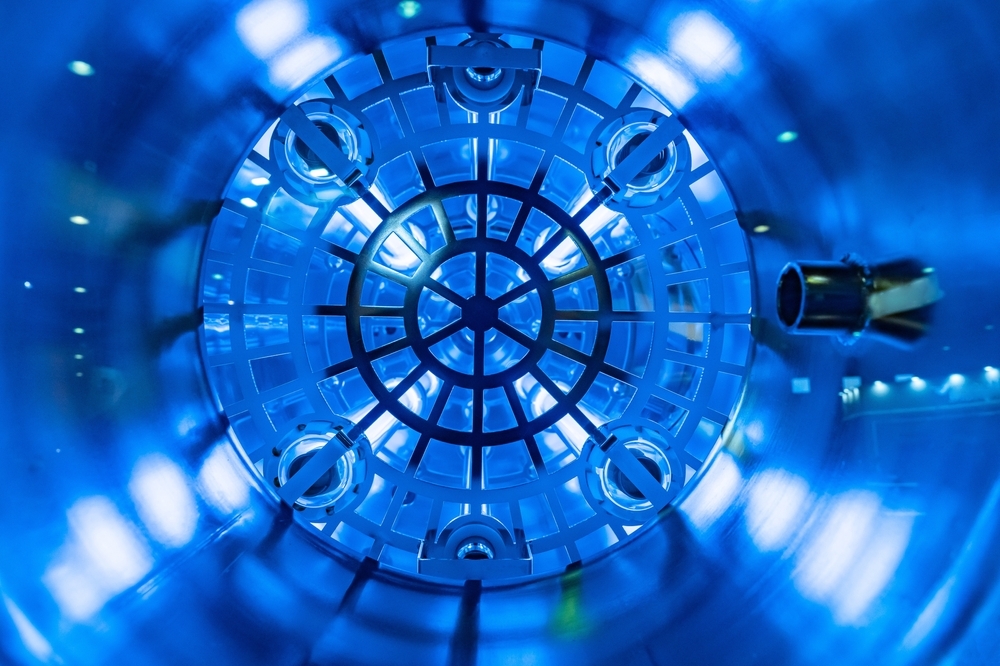

During the first quarter of fiscal 2025, Wolfspeed initiated a facility closure and consolidation plan to optimise its cost structure and accelerate its transition from 150mm to 200mm SiC devices. The costs incurred as a result of this restructuring plan include severance and employee benefit costs, voluntary termination benefits and other facility closure-related costs.

Wolfspeed incurred $188.1m of restructuring-related costs in the Q2 2025, of which $31.4m were recognised in cost of revenue, net and $156.7m were expensed as operating expense in the statement of operations.

For the Q3 2025, the company expects to incur $72m of restructuring-related costs, of which $35m will be recognised in cost of revenue, net and the remaining $37m will be recognised as operating expense.

Start-up and underutilisation costs

Wolfspeed says it is incurring significant factory start-up costs relating to facilities the company is constructing or expanding that have not yet started revenue generating production.

Wolfspeed incurred $22.8m of factory start-up costs and $28.9m of underutilisation costs in Q2 2025. Wolfspeed incurred $10.5m of factory start-up costs and $35.6m of underutilisation costs in Q2 2024.

For Q2 2025, operating expenses are expected to include approximately $26m of factory start-up costs primarily in connection with materials expansion efforts. Cost of revenue, net, is expected to include approximately $31m of underutilisation costs in connection with the Mohawk Valley Fab.