MicroLED reaches a make-or-break phase, says Yole

The microLED industry is transitioning from hype to reality according to Yole's latest two reports: 'MicroLED Markets, Applications, and Competitive Landscape 2025' and 'MicroLED Technologies, Equipment, and Manufacturing 2025'.

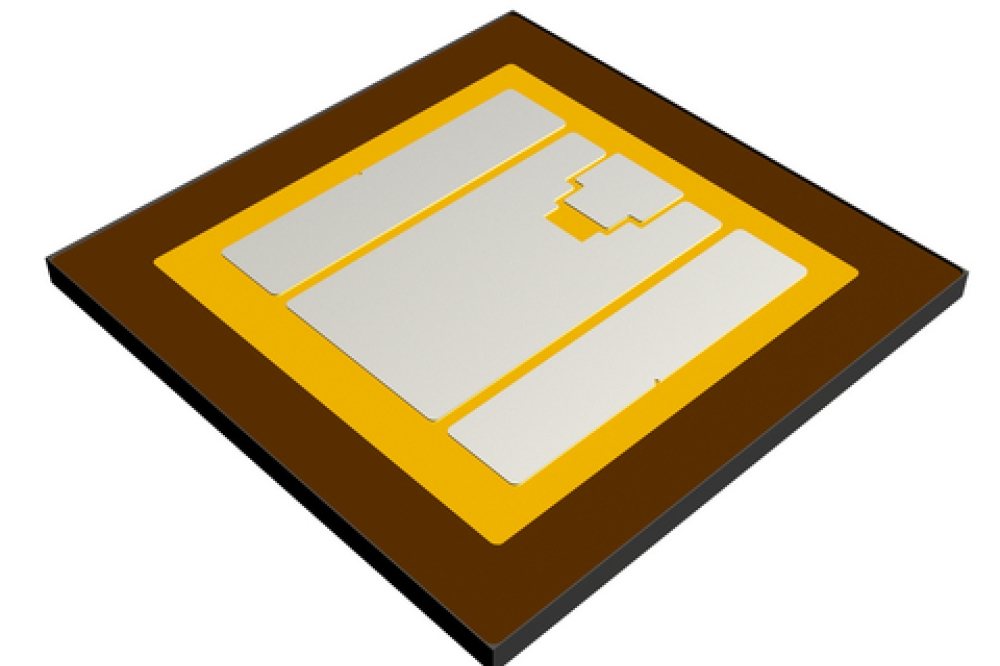

After years of development, the first commercial displays, Garmin’s smartwatch and Sony-Honda Afeela’s automotive exterior display, will enter low-volume production in 2025, manufactured on AUO’s G4.5 line. Yole says this moment represents a critical test: the industry must prove that yields, manufacturability, and costs can converge toward a viable commercial path beyond niche B2B and LED-on-Silicon applications.

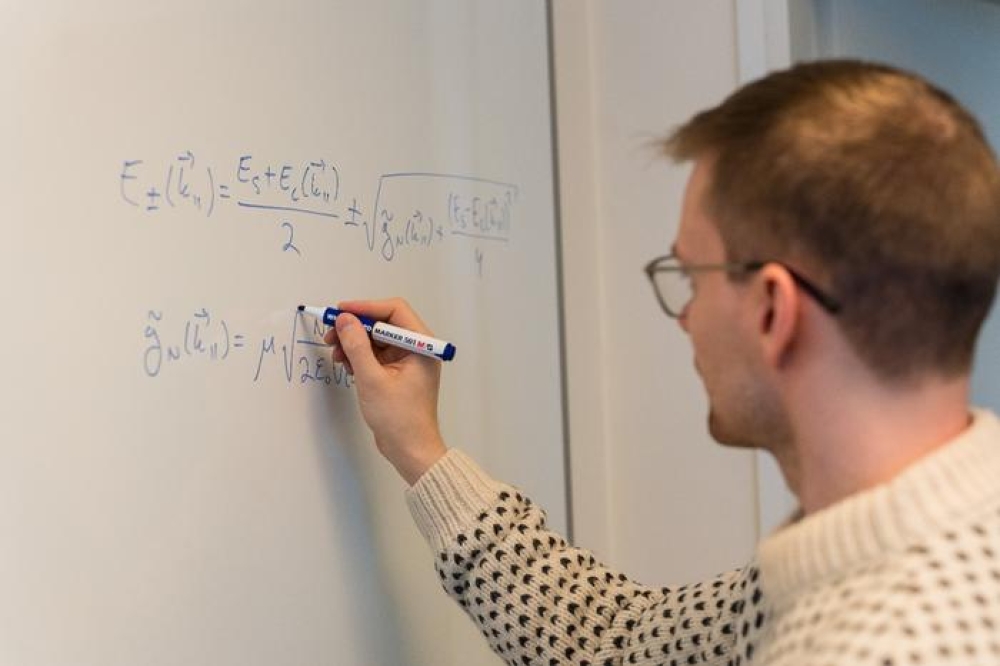

Raphaël Mermet-Lyaudoz, technology and market analyst in photonics and display at Yole Group commented: "MicroLED has progressed enough to exist without depending on a single flagship product. The momentum is returning in 2025, supported by a clearer understanding of strengths, limitations, and realistic timelines."

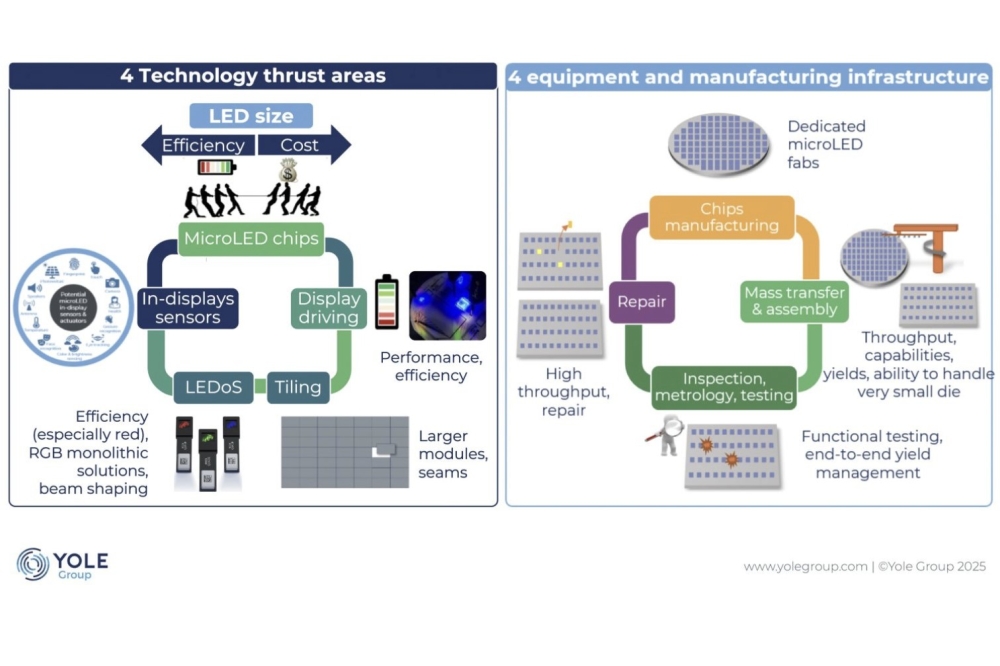

Yet, the challenges remain significant. MicroLED must match OLED’s cost while delivering differentiating performance, a demanding requirement that intensifies pressure on die efficiency at small pixel sizes, mass-transfer yields and throughput, repair strategies, and TFT-backplane limitations. Although investments in fabs and pilot lines continue, decision-makers remain cautious as processes and tools are still maturing.

The industry also faces a structural bottleneck: a lack of process standardisation. Today, most microLED display makers pursue unique architectures that require customised equipment that is costly and complex. While some equipment suppliers, including Hardram, Coherent, Contrel, and PlayNitride, continue developing new generations of tools, others have stepped back due to uncertain prospects and daunting development challenges.

According to Eric Virey, principal analyst, display at Yole Group: "MicroLED supply chains are becoming clearer, with stronger alignment between chip makers and panel makers. However, strategic questions remain, particularly around foundry models, CoC/CoC2 assembly distribution, and the maturity of large-stage, high-throughput tools."

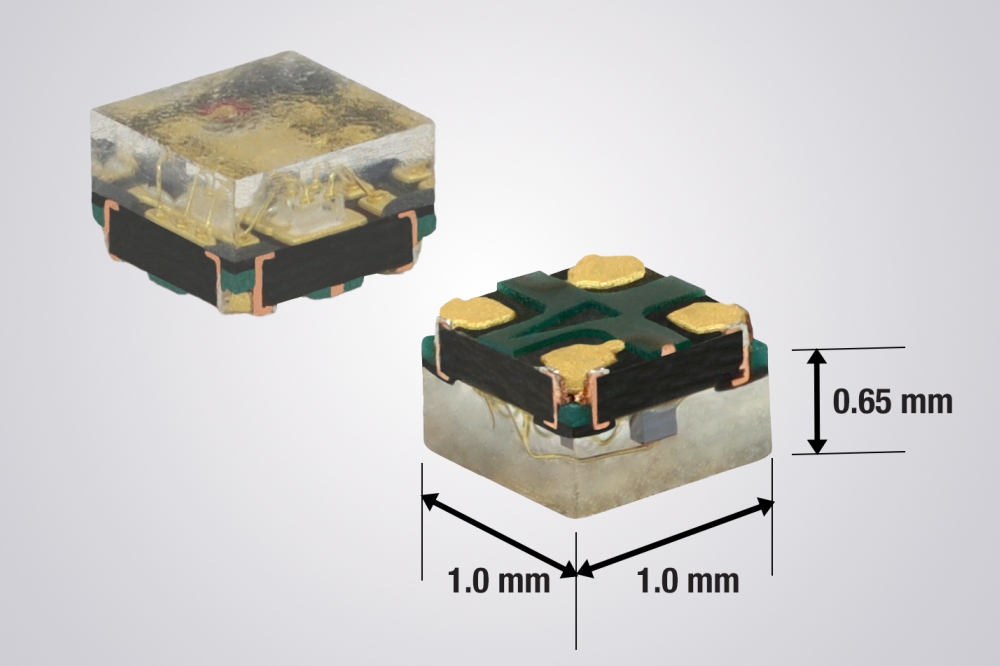

Meanwhile, LED-on-Silicon (LEDoS) is emerging as the most promising volume driver, fueled by AI-accelerated demand for AR glasses and high-performance microdisplays. China leads the charge with JBD as the only player shipping in volume, while Sitan, Saphlux, Hongshi, Innovision, and Raysolve scale new fabs. Outside China, alliances are forming around Porotech, PlayNitride, Micledi, Mojo Vision, Aledia, and others, each pursuing distinct architectures, materials, and manufacturing strategies.

MicroLED is also attracting growing interest for optical interconnects in data centers and high-performance computing, supported by major stakeholders such as TSMC, Intel, NVIDIA, and Microsoft. Startups, including Avicena and Hyperlume, have raised significant funding to accelerate development in this emerging field.

MicroLED is entering a decisive phase, one defined by cautious investment, advancing supply-chain alignment, and a growing focus on manufacturability over the long term.