Power SiC faces overcapacity downturn, says Yole

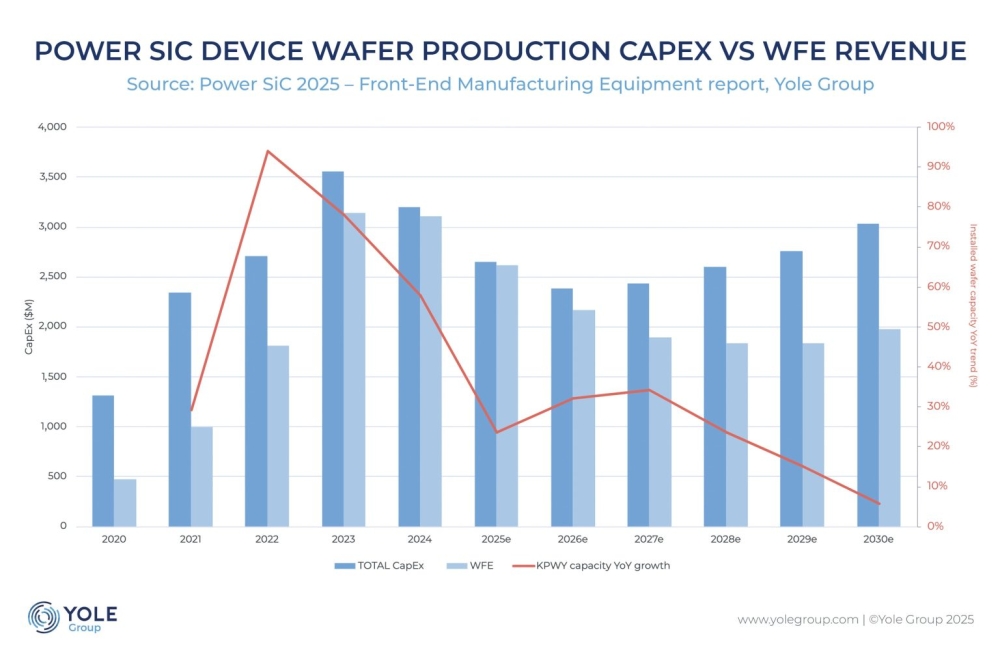

The Power SiC market continues its transformation. Following an unprecedented investment wave between 2019 and 2024, the industry is now entering a correction cycle, according to Yole Group’s latest report, 'Power SiC 2025– Front-End Manufacturing Equipment'.

Yole says the slowdown in the automotive market has reduced the demand for SiC, transforming the SiC supply chain. The cycle of falling utilisation rates, excess capacity, and reduced investment is raising concerns among industry players. Yet, despite the slowdown, SiC remains central to the electrification roadmap, with device revenue forecast to reach nearly $10 billion by 2030. The industry’s first major investment cycle, driven by the 2019–2024 CapEx boom, created significant upstream overcapacity.

As of 2025, utilisation rates have dropped to around 50 percent for upstream processes and 70 percent for device lines . The downturn is expected to persist until 2027–2028, when renewed growth will come from 8-inch production platforms and next-generation trench and superjunction MOSFETs.

Taguhi Yeghoyan, principal technology and market analyst, Semiconductor Equipment at Yole Group said: "SiC has entered a necessary correction phase. Indeed, after five years of massive investment, the market must absorb capacity before new tools and technologies can drive the next expansion."

Much of the new equipment CapEx is centered in Mainland China, where the government’s strategy encourages local procurement of equipment. In 2024, Chinese players already captured around 40 percent of SiC wafer and epiwafer capacity and are rapidly expanding into device manufacturing. While the equipment ecosystem is not yet fully self-sufficient, domestic suppliers have made significant progress in PVT and HTCVD tool segments.

“China is catching up fast on SiC front-end capability,” adds Yeghoyan. “Local vendors now compete head-to-head in SiC crystal growth and epitaxy, even as international players retain leadership in thinning, metrology, and advanced ion implantation.”

Equipment ecosystem outlook

- PVT (boule growth): Mature ecosystem with 8-inch capabilities established. The open PVT equipment market, led by Naura, is expected to contract sharply before stabilising with about -11 percent CAGR growth from 2024–2030.

- Epitaxy (HTCVD): European players ASM International and Aixtron lead, followed by NuFlare and TEL. Chinese vendors Naura, JSG, and NASO Tech are expanding aggressively.

- WFE tools: Require SiC-specific adaptation for etch, CMP, ion implantation, and inspection. The market will maintain roughly -7 percent CAGR through 2030, supported by upgrades of the existing installed base.

- Overcapacity in burn-in systems offset the overall growth in test-related equipment, leading to a modest 3 percent CAGR.

Despite the downturn, IDMs continue strategic investments in 200mm SiC capacity and advanced MOSFET architectures, maintaining global leadership even as China’s domestic ecosystem gains traction.

Poshun Chiu, principal technology and market analyst, Compound Semiconductor at Yole Group said: "After a period of accelerated expansion, the power SiC industry is recalibrating. The short-term slowdown masks a long-term transformation toward 200mm production, localised supply chains, and new device architectures that will define the next growth cycle."