Yole forecasts big changes in Epitaxy market

Epitaxy equipment market for 'More than Moore' devices to reach more than $6 billion by 2025

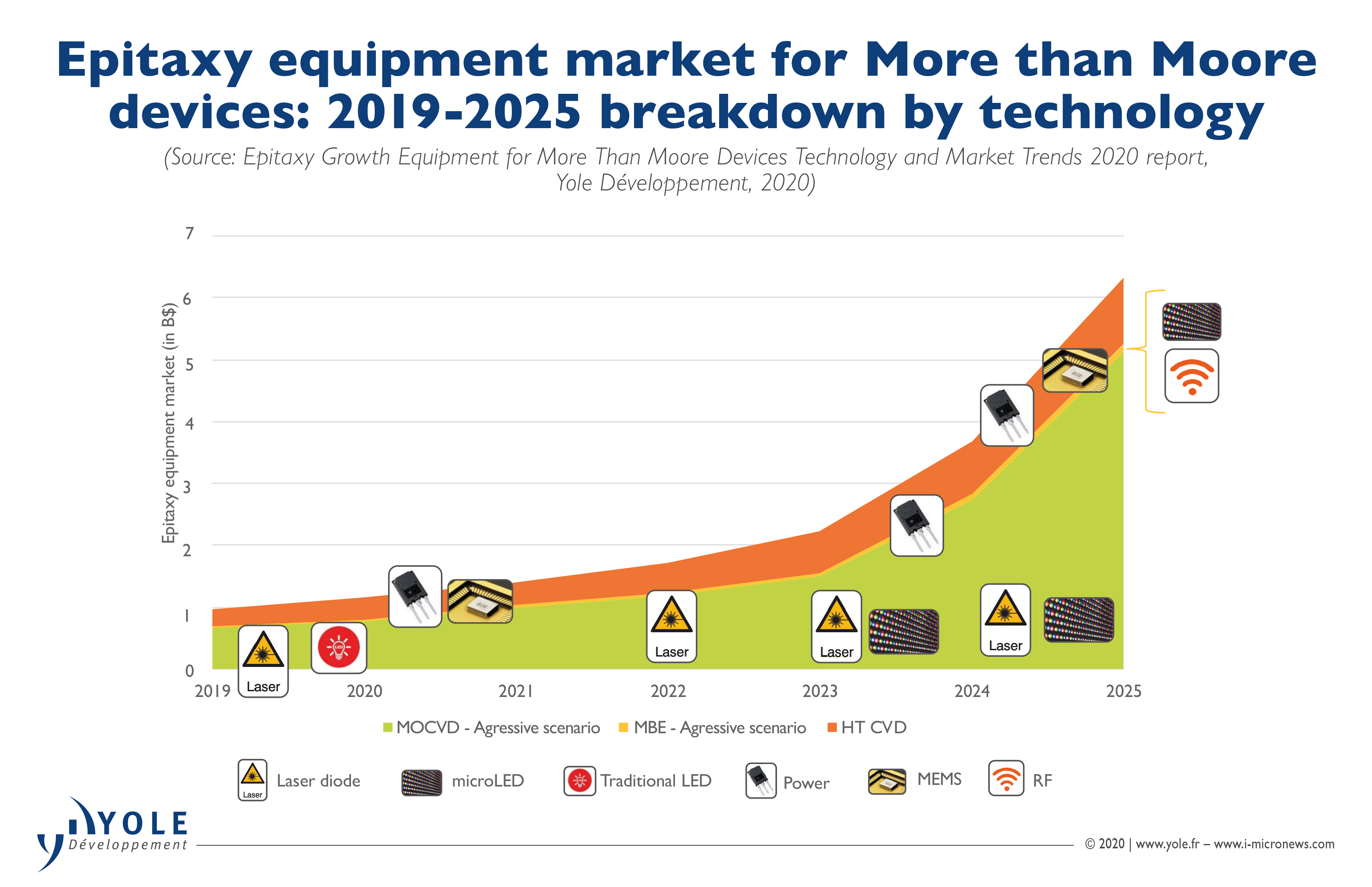

The epitaxy equipment market for 'More than Moore' devices was worth close to $940 million in 2019 and is expected to reach more than $6 billion by 2025, according to Yole Développement's latest market report, 'Epitaxy Growth Equipment for More Than Moore Devices'.

MOCVD services the majority of the III-V compound semiconductor epitaxy industry such as GaAs and GaN based devices. High-Temperature (HT) CVD serves the majority of mainstream silicon-based components and SiC devices…

Although silicon is by far the most dominant substrate today with more than 80 percent market share, alternative substrates like GaAs, GaN, SiC and InP are gaining momentum within the “More than Moore” industry.

GaN material represents the major epitaxy market after silicon substrates, mostly driven by LED GaN-devices. However, the overall visible LED industry is currently diversifying its activities to towards more specialised UV and IR LEDs based on GaAs substrates.

Additionally, LED manufacturers are developing new types of LEDs for consumer displays, such as miniLEDs and microLEDs. Apple is starting this with adoption in its higher-end 2021 smartwatch model. In the best case scenario, microLEDs could also spread into smartphone products, which will definitely reshape the epi-ready wafer market.

SiC substrates have found opportunities in the power electronics market. Despite the high price of SiC, such substrates are a strong asset for high-voltage applications, and thus are considered as a technology choice for some MOSFET and diode products.

Looking ahead, photonics products laser diodes like VCSELs operating in the IR spectrum and typically processed on GaAs, are making inroads into the epitaxy growth market.

With the cellphone transition from 4G to 5G, Yole expect GaAs to remain the mainstream technology for sub-6GHz instead of CMOS. It is the only technology able to meet increasing power level and linearity requirements imposed by antenna board space reductions as well as carrier aggregation and MIMO technology.

“As of today, the epitaxy growth equipment market is mainly driven by LED and power applications,” explains Amandine Pizzagalli from Yole. “In fact, massive subsidies in China have led to an excessive LED capacity build-up. The MOCVD market is now in a situation of significant overcapacity for GaN LED production compared to what is actually produced.

"MOCVD investment is particularly tough to forecast in the next few years and could change year to year. The situation could be reversed if the government decides to strictly prevent the major LED manufacturers from producing more GaN wafers.”

Different scenarios have been considered for the traditional LED and microLED markets in the epitaxy growth equipment for More Than Moore Devices report.

For traditional LED GaN-based devices, the MOCVD investment trends will not follow LED wafer demand. Specific upsides and downsides with respect to LED GaN devices might arise as used to happen in the past.

Given recent competitive trends in China, the general lighting and backlighting markets have become commoditised. Hence, epitaxy vendors do not expect significant revenue from these markets going forward.

However, requirements for microLED epitaxy in terms of defects and homogeneity are more stringent than traditional LEDs. There are credible roadmaps for improvement in tools and equipment to reach approximately 0.1 defects/cm2 or less based on defects larger than 1µm.

Tighter operating conditions are needed in clean rooms, including for automation and wafer cleaning, compared to traditional LED manufacturing. This is especially true for the smallest dies, below <10µm, which will have smaller killer defects.

Meanwhile, Yole says laser diodes represent an additional fast-growing opportunity as the consumer goods industry massively adopts edge-emitting lasers and VCSELs.

The MOCVD reactor market could be affected by possible technology transitions to MBE for compound semiconductor-based devices like laser diodes, microLEDs and VCSELs. MBE could bring greater advantages in terms of yield and uniformity for VCSELs but also for high-frequency 5G RF applications. In the case of SiC power, MOCVD manufacturers are trying to identify and develop new MOCVD technologies to address the SiC market where HT CVD is mostly used.