GaN RF market over $2 billion by 2025, says Yole

Driven by military applications and 5G telecom infrastructure, GaN RF continues growing

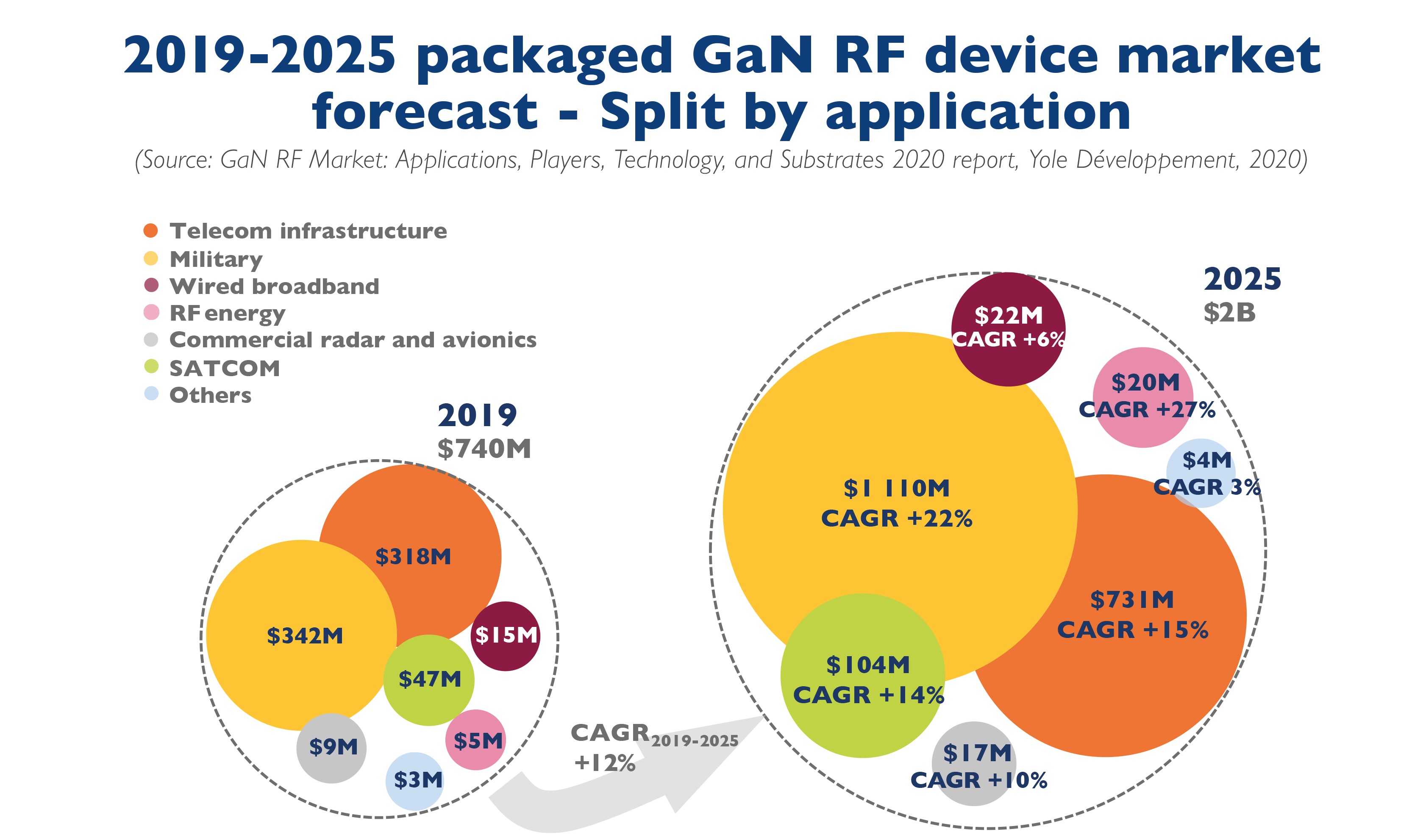

The total GaN RF market will increase from $740 million to more than $2 billion by 2025, with a CAGR of 12 percent, according to the market research and strategy consulting company Yole's annual RF GaN technology & market report.

In telecom infrastructure, the aftermath of US sanctions related to Huawei slowed the GaN-based RRH market in 2019 and pushed OEMs to restructure their supply chain for the coming years. Nevertheless, GaN deployment will remain the same for the longterm. In AAS , the increase in bandwidth will favor increasing GaN implementation. Also, small cells and backhaul connections will see an impressive deployment of GaN in the coming years. In military applications, with investments from governments to improve their national security by replacing TWT -based systems, defence will remain one of the GaN RF market’s main drivers.

“Radar is the main driver in military applications, mainly due to the increase of T/R modules in new GaN based AESA systems and stringent requirements for lightweight devices for airborne systems,” details Ahmed Ben Slimane, technology and market analyst at Yole. “The total GaN RF military market will surpass $1.1 billion in 2025, at a 22 percent CAGR,” he adds.

For handset, GaN’s high performance and small form factor could attract OEMs. The adoption of GaN PA will depend on the evolution over the next five years of GaN’s technology maturity, supply chain, and cost, as well as OEM strategies. What does the future hold for GaN PA in the handset market? This point is deeply analysed in Yole’s GaN RF report with a detailed understanding of GaN implementation in different market segments. It also includes an extensive overview of 5G’s impact on the wireless infrastructure and RF Front Ends (FEs), along with the GaN-based military market. Furthermore, Yole shares its view of the market’s current dynamics and future evolution.

It is not possible today to deliver a comprehensive and relevant picture of the RF GaN industry without taking into account the US – China conflict and COVID-19 outbreak. Indeed, both events have started deeply modifying the landscape of the semiconductor industry.

So, what is the status of the RF GaN market? What is exactly the impact and how will the industry evolve? Yole’s compound semiconductor team investigated the market evolution and had lot of debates with leading GaN RF companies.

China is the largest market for antenna systems and will remain so for the next several years. Due to US sanctions related to Huawei, the OEM’s supply chain has been restructured. As a consequence, Yole’s analysts identify positive impact on Asian IDMs and foundries, as well as European players. For example, the European foundry UMS doubled its GaN RF business in 2019, owing mainly to BTS market. The US-China trade war also makes it more urgent for Huawei and ZTE to have domestic suppliers...

“According to the industry feedback, despite the virus outbreak, leading Chinese telecom operators’ 5G construction goals remain unchanged and development continues”, adds Ezgi Dogmus, technology and market analyst at Yole. Thus, the virus outbreak is likely to have minor consequences for GaN deployment in 2020. “And we could also expect a market adjustment starting from H2-2020 in China as well as the rest of the world,”she says.

The GaN based military market, which is the second major segment will likely follow the same trend. Yole’s team only expects minor changes in long term as defence market is "on demand”. However, in short-term, some disruptions in the supply chain may slow the global military market.