LiDAR: dropping prices and low volumes

By 2025, Yole expects only 3.2 percent of personal cars to adopt LiDAR

LiDAR has seen a massive price drop in the past three years according to market research consultants Yole Développement. However, it’s not the result of mass-production because volumes have not grown significantly and mass adoption of LiDAR is yet to happen. Instead, it’s due to the strategies of different companies.

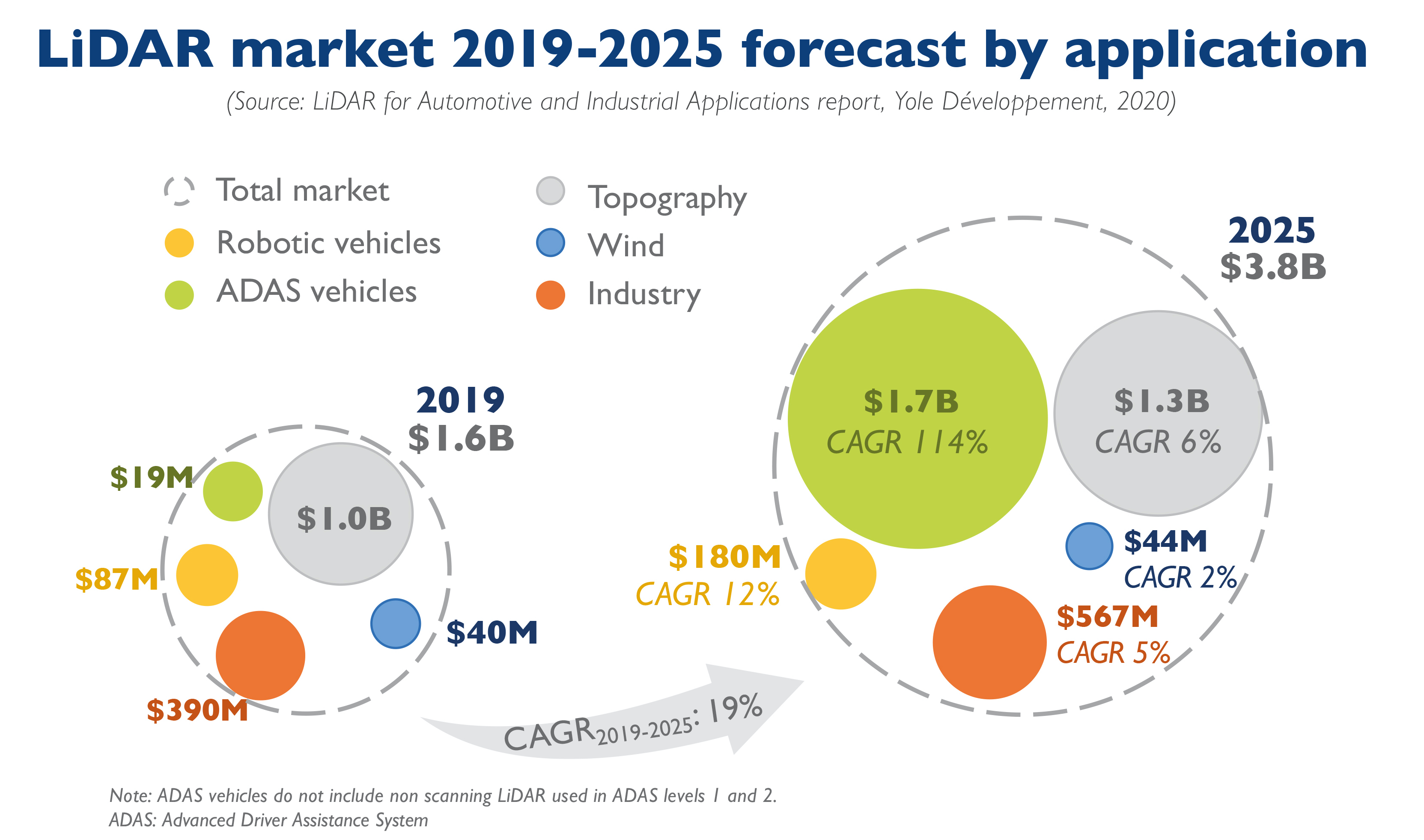

In this complex and rapidly evolving environment, Yole’s analysts predict that the LiDAR market for automotive and industrial applications will be $1.7 billion in 2020. Growth is expected to be 19 percent. Yole’s forecast is a revenue of $3.8 billion in 2025.

Automotive applications are expected to be the main driver for LiDAR in the next five years, providing $1.8 billion growth between 2019 and 2025. With several partnerships between LiDAR manufacturers and car manufacturers, Yole expects 3.2 percent of personal cars to adopt LiDAR by 2025.

The impact of robotic cars on LiDAR will be modest due to lower deployment of robotic cars than once expected. LiDAR for personal cars could also be jeopardized. The COVID-19 crisis is putting financial pressure on car manufacturers. Regulations imposing reduced carbon emissions are pushing investments towards electrification.

Finally, the ambition of Tesla to rapidly achieve autonomous cars without LiDAR could make LiDAR less essential in the coming years. Alexis Debray, technology and market analyst, MEMS, Sensors & Photonics at Yole says: “A new trend in the LiDAR business appeared a few years ago, which might dramatically change the shape of the LiDAR market, namely dropping prices. Velodyne has announced a plan to reach an average unit price of $600 by 2024, from $17,900 in 2017”. And the story does not stop here.

Chinese LiDAR companies, which usually have LiDAR unit prices one-fifth of that of other companies and usually below $1,000, are gaining market share and expanding their business. LiDAR with lower unit prices is expected to enter new industrial applications including factory, logistics and security. However, because of lower LiDAR unit prices, the industrial segment is expected to have moderate growth between 2019 and 2025, expanding from $390 million to $567 million.

“LiDAR technologies could be adopted for most robots and smart facilities”, says Pierrick Boulay , technology and market analyst, Solid-state Lighting at Yole Développement (Yole).

Since the 2005 DARPA Grand Challenge, vehicles have been a major application for 3D real-time LiDAR. In 2017, Audi equipped some of its cars with the Valeo Scala, a long-range LiDAR. At the end of 2018, Waymo launched Waymo One, its robotaxi service equipped with its own mid-range and long-range LiDAR. Continental has announced short-range flash LiDAR for 2020. Aimed at ADAS cars, it could also equip robotaxis or even industrial platforms. Other LiDAR manufacturers that have partnership with car manufacturers, such as Innoviz, Velodyne and Luminar, are targeting long-range applications.

As a key player in the LiDAR industry, Hamamatsu has developed photodiodes and lasers for Livox’s Horizon LiDAR. According to Sylvain Hallereau, project manager Integrated Circuits, Power Semiconductors and LEDs at System Plus Consulting and author of the Hamamatsu Photodiode and Laser in Livox’s Horizon LiDAR report: “LiDARs are manufactured around four main components: the pulsed laser diode, avalanche photodiodes, opto-mechanical system (to scan the environment in front of the car), and the processor”.

The Livox LiDAR sensing module includes a custom six-photodiode array die from Hamamatsu, specifically developed for LiDAR applications. The photodiode dies are assembled in a package with a 905nm narrow bandpass filter.

Industrial applications of LiDAR have a longer history, with topographic applications dating from 1970s. This business is well-established and operated by large companies, explains Yole in its 2020 LiDAR report. Mining applications started to develop in 2008 with Komatsu and Caterpillar offering autonomous dump trucks. Their positions as solution and service providers have helped them operate these fleets.

Recently many new industrial applications have been emerging for LiDAR, including warehouse AGVs , terminal AGVs, delivery robots and drones, autonomous forklifts, inspection robots and drones, intelligent traffic systems, security and soon to come autonomous trucks and smart farming. Yole announces a 31 percent volume CAGR between 2020 and 2025 for logistics and other industrial applications.