II-VI: Milestones of its first leader

In the first of a pair of features to mark the fiftieth anniversary of the compound semiconductor powerhouse II-VI, Richard Stevenson discusses the formative years with co-founder Carl Johnson

RS Carl, how did you meet your co-founder, James Hawkey? And what provided the catalyst for getting the venture going?

CJ I was looking for a high-quality crystal of cadmium telluride for use in my PhD thesis work at the University of Illinois. I was there from 1967 to 1969. I located a two-man crystal growth company near Pittsburgh, PA, where Hawkey was the crystal grower. They supplied the crystal that enabled and underpinned the measurements that I made at Illinois while investigating the electro-optic properties of cadmium telluride using far-infrared lasers and spectroscopy.

In 1971, after I had graduated and worked for a couple of years elsewhere, I contacted Jim Hawkey. We started talking and generated a mutual interest in founding a company to commercially manufacture CO2 laser-grade, cadmium telluride optical parts. In the spring of 1971 we met one night for dinner and left with a name for the company, II-VI Incorporated. We also had recorded, on a restaurant paper napkin, a first-year, rough-cut budget – what we thought it would cost us to get up and get started.

RS How did you fund this initiative?

CJ I went out and raised $125,000 from family and friends, including former professors and business associates. The thirteenth share holder came in about a year later and topped off that $125,000. He was the landlord of our factory. He was curious, observed what we were doing, and decided to invest.

RS What were II-VI’s initial products, and what markets could they target?

CJ The first product we envisioned was just the cadmium telluride material. We were going to make the material and sell it to optical shops, who would fabricate good optical parts for multi-hundred-watt CO2 lasers. At that time the highest-power experimental lasers were around a kilowatt, but there were several versions in the 300 to 700 watt range.

Without exception, each of the thin-film coating vendors that we tried were unsuccessful in their attempts to make these optical parts. We had no choice but to tackle that and do it ourselves by vertically integrating. Once we had reasonably good optical coatings, we started supplying lenses, windows, mirrors, output couplers and the like to builders and users of CO2 lasers.

After a year, we were in a position to supply single-crystal, cadmium telluride, electro-optic Pockels cells. Those would allow people to modulate or pulse-slice a CO2 laser beam, shape the beam in time, and turn it on and off. You could modulate both in frequency and in amplitude with these Pockels cells.

We were the sole supplier of several optical parts to the CO2 laser fusion programme at Los Alamos that started in the fall of 1972. They used a lot of these crystals during the 1970s, and they were our largest customer.

These modulators are still part of the offering that II-VI has today. II-VI sells into the supply chain for a number of high-power, high-performance CO2 lasers. In the case of extreme-UV lithography, with wavelengths as short as 13.5 nanometres, the CO2 laser is a key part of the process by which those wavelengths are emitted from a tin droplet. So this product idea has had a fifty-year life.

When we started out, we’d turn on the lights with the polycrystalline cadmium telluride optics line, but the profits came from that electro-optic modulator. We could charge a fair price for that device. If we sold five of them in a month, it was a very good month.

The first vertical Bridgeman furnace designed and built by II-VI, used to produce cadmium telluride material. Operating the furnace is co-founder James Hawkey.

CJ Absolutely. Our skill sets were quite well matched, with Hawkey leading the crystal growth activities and equipment innovations. He was very hands-on, having a lot of experience with electronics, electrical, plumbing, welding, construction ... you name it. I would analyse and evaluate the crystals Jim was growing, study the results and suggest follow-on experiments in our joint collaboration to continuously improve the growth process and material.

When Jim had graduated from high school, he couldn’t afford to go to college. He picked up all of his many skills along the way and through a lot of self-study. In the late 1960s, he got a chance to work with a professor at Carnegie Tech, growing bulk gallium arsenide crystals. That’s where he learned to grow compound semiconductor crystals, and later branched off into the II-VI compounds by building on III-V experience.

Our combined knowledge, skills, experience and determination were a really good match to the unexpected challenge we faced when our survival as a company required that we quickly learn how to cut, grind, polish and apply thin-film coatings to our cadmium telluride materials. We accomplished that project in four to five months.

During the fall of 1972, II-VI devoted much effort to learning how to cut, grind and polish cadmium telluride (left), undertake optical measurements on this material (middle), and apply optical thin-film coatings (right, with co-founder Carl Johnson pictured).

CJ I could probably list twenty or so such events that happened. You can have one or two problems at a time, but you can’t have a lot of them, so we tried to resolve the encountered issues as quickly as possible.

In 1972, during our pre-revenue period, we missed several payrolls for Hawkey and myself, but we never missed a payroll for our two shop-floor employees. What happened was that our just-in-time successes at shaping, polishing and thin-film coating of cadmium telluride parts led to a late 1972 uptake in the sales of optics and Pockels cells. That saved the company.

In the early days, we did blow up a few vertical Bridgeman furnaces. No-one was ever hurt, but you can’t disable your furnace every third run and survive. We eventually solved that problem by finding a different way to synthesize the material. Jim knew how to get around those things, and I got really good at rebuilding furnaces. I could have the damaged furnace ready to go again in 24 hours, about the time it took Jim to prepare the next load.

Our IPO in 1987 was launched five days before the October stock market crash. By that time, we had run up a half-a-million dollars or more of legal and accounting and investment-banking bills. If you don’t have a successful IPO, you probably can’t even pay those bills. That was another really close call.

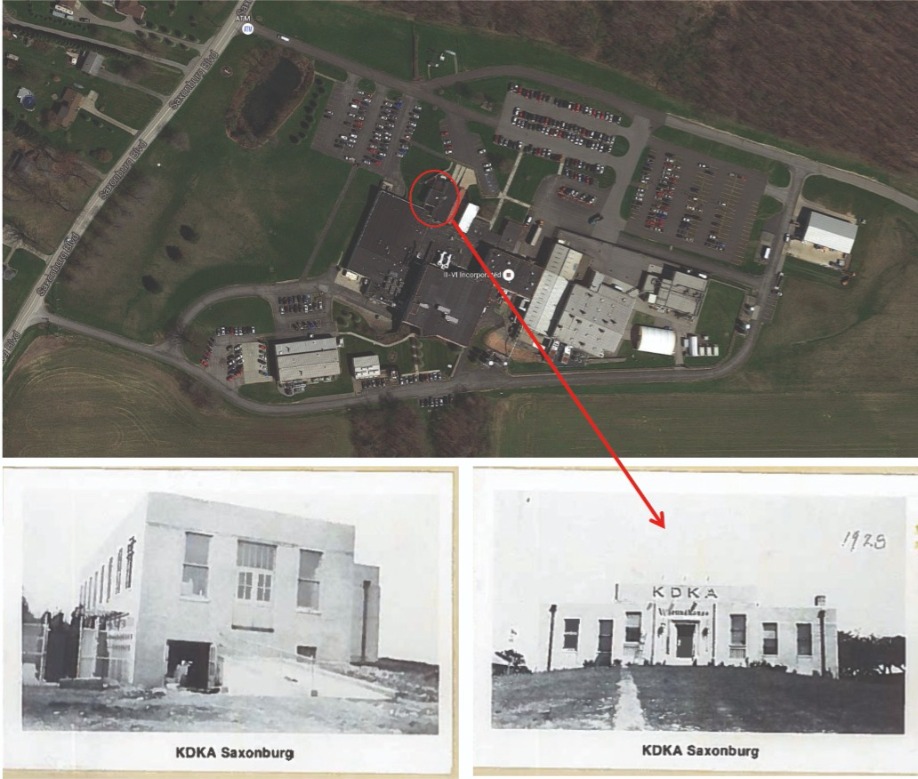

The Saxonburg site of II-VI contains buildings previously owned by KDKA, the world’s first commercially licensed radio broadcasting station, which took to the waves around 1928. The site was expanded by Carnegie Tech and the US Nuclear Regulatory Commission to become a world-class, 400 Mev Synchrocyclotron Research Facility by the late 1940s. II-VI acquired the property around 1978, and again expanded the site as shown in this aerial photo, taken about three years ago.

CJ From the outset I was leading the company. I raised the seed funding, organised a professional Board of Directors, and led the sales and customer relations activities during the start-up period.

Jim Hawkey was a critical contributor in his role as the materials manufacturing and development leader. He continuously increased production capabilities in cadmium telluride, and eventually – and it’s very significant – in zinc selenide. His accomplishments in the materials area allowed II-VI to become a uniquely positioned supplier in the high-power, mid- and long-wavelength infrared laser space.

Jim’s legacy is embodied in today’s company tag-line: Materials That Matter.

RS In 1986 James Hawkey left the company to found, with his son, Keystone Crystal Corporation. What motivated him to leave II-VI and pursue this venture?

CJ It was an unwanted departure on my part, at least. When you work shoulder-to-shoulder for 15 years, you are going to miss each other.

Here’s the real story. We had gone about as far as we could by the educated-guess, cut-and-try empirical methods. Even the Air Force was encouraging us to apply more engineering and science to the materials problems they wanted us to solve. As we began bringing in materials-science thinking and talent to enable further company developments, Jim Hawkey became uncomfortable – he had a hands-on kind of approach and was as intuitive as you could hope anybody could be, but he was still a cut-and-try guy – so he chose to leave.

RS What did the launch on the stock market allow II-VI to accomplish?

CJ Two things. First, it was the only way we could get our shareholders a fair price. For some of them there was quite a bit of pressure to sell, as 16 years is a long time to hold that stock. We were able to get them 56 times their original investment.

The second is that we didn’t have enough funding to go ahead and build additional expensive zinc-selenide chemical vapour deposition furnaces. We wanted to build three or four quickly. The IPO allowed us to move aggressively and smartly ahead with our zinc-selenide manufacturing capacity expansion.

RS In the 1990s and early 2000s, II-VI started to grow through acquisitions. A year before the launch of the first ever SiC diode to market, you decided to buy Litton System’s silicon carbide group. You have the touch of a visionary, don’t you?

CJ Litton System’s silicon carbide group came out of the Westinghouse Science and Technology Center in Churchill, Pennsylvania, after the group’s activity was shut down circa 1997. That put them only 35 miles from our home base. I went down there attempting to buy their equipment and hire some of those people – that’s how I got interested in silicon carbide. But Westinghouse didn’t feel comfortable selling and transferring people to a small company in Saxonburg, Pennsylvania. They choose to sell it to Litton. Litton put a wing on their Morristown, New Jersey, plant and moved as much of the group as possible over there.

Two years later, Litton had been acquired by Northrop Grumman. They too decided to shut that silicon carbide group down at a time when there was a lot of trouble in the electronic materials market. They tried to sell the gallium arsenide group and the silicon carbide group together, but II-VI wasn’t interested in the gallium arsenide activity.

I tried to find someone to team with us; they would take the gallium arsenide and we would take the silicon carbide. There were no takers on the gallium arsenide side and Litton literally pulled the plug on that activity. I pursued silicon carbide and finally was able to buy it.

We already had a silicon carbide group operating in Saxonburg, where we had three growth furnaces running. Within a year or two we combined the two activities. We shut the furnaces down in Saxonburg and moved them all to Pine Brook, New Jersey, which is still where a lot of that group is located. This was ideal. We were able to combine what II-VI had learned with what Northrup Grumman was doing, and what they had learned. Thus the legacy of II-VI’s present-day silicon carbide capabilities actually dates back to the early 1990s with respect and thanks going to Jim Choyke, Don Barret and their Westinghouse colleagues.

In 2007, after 37 years in charge, Carl Johnson (right) stood down as leader of II-VI. He continued to serve the company as Chairman of the Board until 2014. Francis Kramer (left) held the CEO role from 2007 to 2016.

CJ There are two. There are not too many times in the history of a company that you get to go out and acquire your largest and strongest competitor. We did, acquiring Laser Power Optics in 2000. During the prior ten years, we had met them everywhere in the world. In the late 1990s, they got in a bit of trouble and their board decided to sell the company. The acquisition had a huge impact on II-VI, making us much stronger than anyone else in IR optics. Fran Kramer, CEO of II-VI at the time, really supported this acquisition, and together we got it done. However, during the ensuing years, it was Fran Kramer who did a masterful job of leading the two-company integration and realizing the potential of every possible synergy.

Equally important to the development of II-VI was the acquisition of Photop in 2010, when I was Chairman of the Board. It was very appropriate that Chuck Mattera [current CEO] was deeply involved in this project, because of his photonics background. This acquisition gave us that starting point in the optical communications space that we were searching for.

RS By the time you stepped down from the CEO role in 2007, you had grown the company from just two employees to more than 6000. In addition to that legacy, you gave the STEM community the II-VI Foundation. Tell me a little about the latter?

CJ My wife and I had an interest in having a foundation that would go out and find kids that had this bent for science and technology and get them engaged early on. The first thing we did was to create a scholarship programme, to sponsor undergraduates who were going to go into science or engineering and had some industry experience. Previously, II-VI had created a Practicum Program, whereby we would go to selected high schools near our factories in the US, tell the science and math teachers that we would like to know who their best-performing students were, and ask whether or not these students would be interested in a summer job at II-VI after their junior year in high school. We had Practicum Programs operating in Pine Brook, New Jersey; Saxonburg, Pennsylvania; Dallas, Texas; and Temecula, California. These programmes served as an effective conduit for our fledging undergraduate scholarship programme. Eventually, the scholarship awardees didn’t have to work at II-VI, but they did need to have 9-10 weeks of working in an industry setting every year. 54 undergraduate scholarships have been awarded for the 2021-2022 academic school year.

Then we said: What do we do if these kids come out of college and want to go ahead for a graduate degree – either a master’s or a PhD? So we started up a ‘Block-Gift Program’ with the foundation. We sponsor a PhD programme with a professor at a university that attracts exceptionally good students and has a powerful group working in a technology area of interest to the company. We don’t pay overheads at the university. We insist that all the funds go the professor’s account to work on the technology. There have been, on average, about 12 awards per year.

In 2007, my wife and I donated shares of II-VI Incorporated to set up a $20 million endowment fund for the II-VI Foundation, a private foundation that has II-VI approval to utilize the II-VI name. Over the years, we’ve distributed $34 million of benefits, and the asset base is still around $20 million, thanks to the growth and performance of II-VI Incorporated.

In next month’s issue, we’ll track II-VI’s meteoric rise as a producer of various forms of laser diode, in an interview with the current CEO, Chuck Mattera.