SiC and power GaN continue to grow

According to Yole’s Compound Semiconductor Quarterly Market Monitor on SiC and GaN applications, SiC device market revenue continues its growth and is expected to exceed $3 billion by 2025 with EV/HEV the killer application.

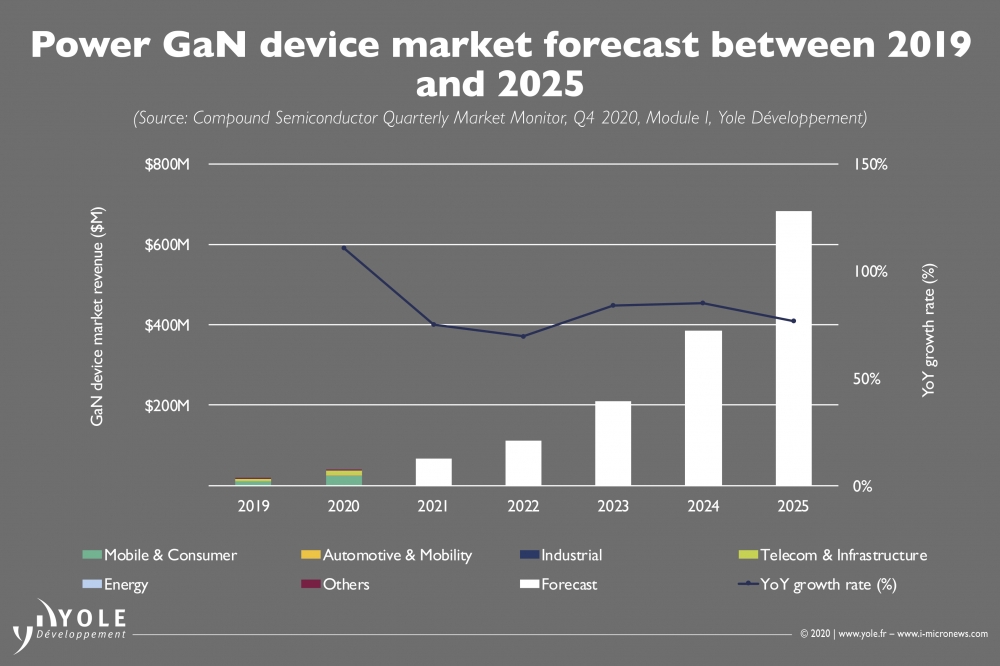

Meanwhile, Yole projects that the power GaN business will reach beyond $680 million in 2025. It says that the adoption of GaN HEMTs for Oppo’s in-box fast charger at the end of 2019 boosted the penetration of this wide bandgap material.

The GaN RF device market is smaller and will reach beyond $2 billion by 2025, says Yole, with a 12 percent CAGR between 2019 and 2025. The market is driven by telecom and defence applications. GaN RF devices for military use is expected to increase rapidly, with revenue expected to exceed $1 billion by 2025. GaN RF business is not only dependent on OEM choices, but also on the geopolitical context.

RF GaAs die market will rise from around $2.8 billion in 2019 to over $3.6 billion in 2025. The market is driven by the rise for 5G and WiFi6 demand for handset applications.

The rise of GaN

“In the dynamic 5G infrastructure market, there is a continuous race for more efficient antenna types. Switching technology from RRH to AAS will transform the RF front ends from a low number of high-power RF lines to a large number of low-power RF lines” says Ahmed Ben Slimane, technology and market analyst, Compound Semiconductor Monitors at Yole Développement (Yole).

Meanwhile, deployment of higher frequencies in the sub-6GHz as well as in the mm-wave regimes, pushes OEMs to look for new antenna technology platforms with larger bandwidth, higher efficiency, and better thermal management. In this context, GaN technology has become a serious competitor to LDMOS and GaAs in RF power applications, showing continuous performance and reliability improvement leading, potentially, to a lower cost at the system level.

Following its penetration into the 4G LTE telecom infrastructure market, GaN-on-SiC is expected to maintain its strong position in 5G sub-6Hz RRH implementations. However, in the emerging segment of 5G sub-6Ghz AAS - massive MIMO deployments - the rivalry between GaN and LDMOS continues. While cost-efficient LDMOS technology carries on with noteworthy progress in high-frequency performance for sub-6GHz, GaN-on-SiC offers remarkable bandwidth, PAE , and power output.

GaAs the choice for handset PAs

The handset market is the big driver for GaAs devices with PA content increasing per phone. In general, 4G LTE cellular phones need to cover up multiple frequency bands, with an increasing number of PAs per phone. The 5G demand for PAs is at least a factor of two more than for 4G. Adding to that the stringent requirements for linearity and power make GaAs the material choice for PAs in the RF FEM . Even though CMOS has lower cost per chip, it will not necessarily have the advantage over GaAs when it comes to modules and performance.

“For mobile connectivity, Wi-Fi 6 began to enter the market in 2019”, explains Poshun Chiu, technology and market analyst, Compound Semiconductors & Emerging Materials at Yole. He adds: “Some OEMs launched new phones with Wi-Fi 6: Samsung’s Galaxy S10 in Q1-19, Apple’s iPhone 11 in Q3-19, and in Q1-20 Xiaomi was the first Chinese handset company to have Wi-Fi 6. GaAs solutions are becoming of great interest owing to their linearity and high power output, compared to traditional solutions”.

Power SiC

Since the first commercialisation of SiC diodes, the power SiC device market has been driven by power supply applications. Nevertheless, automotive is becoming the killer application, following SiC’s notable adoption for Tesla’s main inverters in 2018.

Since than announcements from different carmakers for SiC solution design wins have multiplied. In 2020, BYD has also adopted SiC based main inverter solution for their premium models. Other carmakers, such as Audi, Volkswagen, and Hyundai are expected to adopt SiC in their next generation models. In the prospering SiC power market, the automotive segment is undoubtedly the foremost driver, and as such will hold more than 60 percent of total device market share in 2025.

“However, following the global Covid-19 outbreak, almost all automotive OEMs had to shut down and the supply chain faced significant disruption,” comments Yole's Ezgi Dogmus. “In this context, we expect the power SiC market’s Y-o-Y (year over year) growth to slow down to 7 percent in 2020, with a significant impact in Q1-2020 and Q2-2020.”