A record year for Infineon

Company defines "an even more ambitious target operating model"

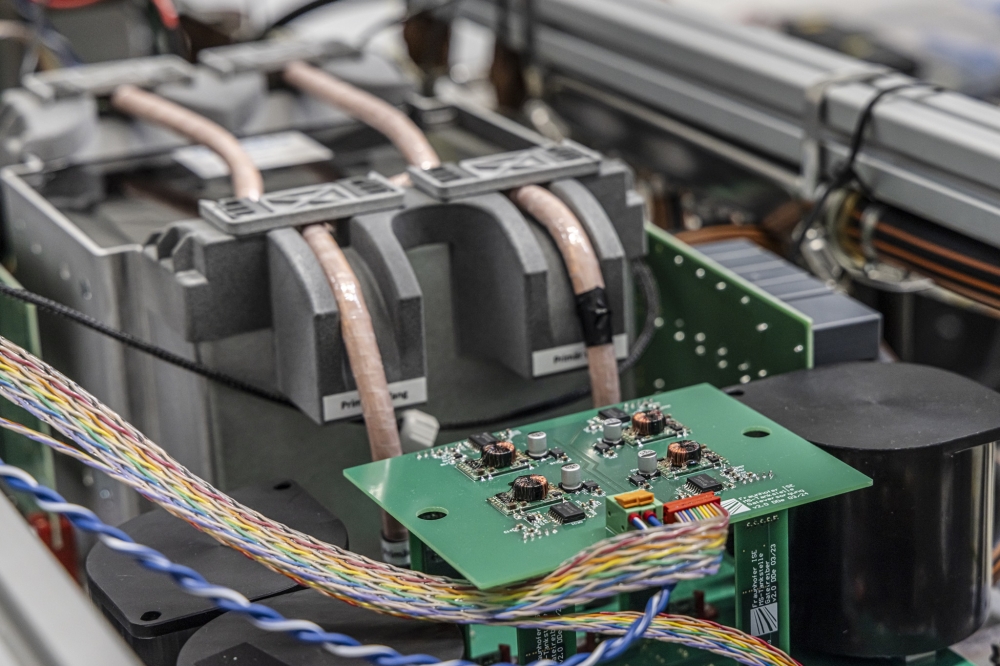

After a record 2022 fiscal year, Infineon is increassing its long-term financial targets, and is planning a major investment in a new factory in Dresden.

“Decarbonisation and digitalisation are causing structurally increasing demand for semiconductors. Infineon will benefit disproportionately from this development thanks to its strategic positioning. This dynamic has further accelerated, so now is the right time for us to define an even more ambitious target operating model," says Jochen Hanebeck, CEO of Infineon.

"Furthermore, by the planned investment in a new factory we are continuing the consistent execution of our strategy and are broadening the base for our accelerated profitable growth trajectory in a forward-looking way. We are pleased to have political support for an investment at the Dresden site (Germany) and we are counting on adequate funding through the European Chips Act, " he added.

"We concluded the challenging 2022 fiscal year very successfully, with an excellent fourth quarter. The 2023 fiscal year has also started well. In view of ongoing macroeconomic and geopolitical uncertainties, heightened vigilance is required in the coming quarters. We are prepared to act swiftly and flexibly if necessary."

In its target markets automotive, industrial and IoT applications, as well as renewable energies Infineon sees increasing dynamic and strong structural growth drivers. The company is therefore upgrading its target operating model, which defines financial targets over the cycle. In future, based on an exchange rate of US$1.00 to the euro, the expected average rate of revenue growth will be more than 10 percent, increased from 9 percent + previously.

Growth will in particular be driven by electromobility, autonomous driving, renewable energies, data centres and IoT, such growth being accompanied by a significant improvement in profitability: the Segment Result Margin is expected to reach an average level of 25 percent, compared with 19 percent to date.

The main factors influencing the rise in earnings will be an increasing proportion of system solutions, a higher-value product/technology mix due to portfolio management, the expansion of cost- effective 300mm production, and operational expenses rising at a lower rate than revenue due to digitalisation and economies of scale.

Infineon is planning to continue expanding its 300 mm manufacturing capacity, to enable the expected acceleration in growth of analogue/mixed-signal and power semiconductors. The intended location is Dresden (Germany).

Adequate public funding is required for the investment decision. With a planned total investment of €5 billion, this would be the largest single investment in Infineon’s history. The new factory is expected to create up to 1,000 new highly qualified jobs and according to planning could be ready to start production in autumn of 2026.