MiniLED backlight units set to outshine OLEDs?

Yole Group, PISÉO, and DXOMARK provide combined analysis

MiniLEDs have attracted over $14 billion of investment during the 2019-2021 period. But the theory that miniLED-based LCDs could compete with OLEDs – whose cost and performance continue to improve – remains unconfirmed.

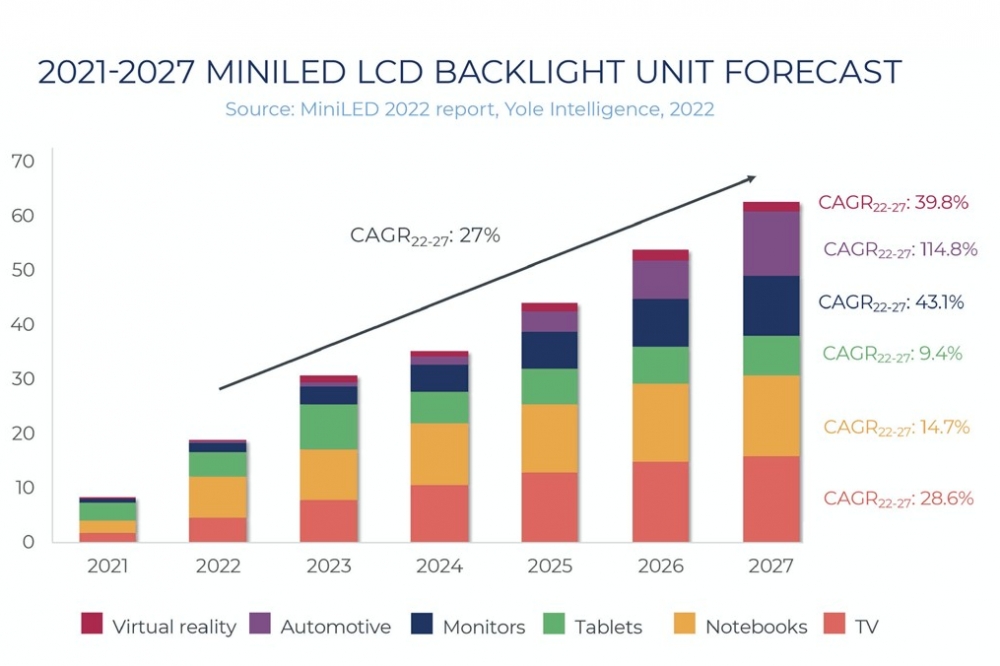

Overshadowed for a long time by the OLED-dominated high-end display market, LCDs are back in the spotlight thanks to miniLED technology. Overall, miniLED backlight LCDs are expected to grow at a 27 percent CAGR.

By integrating miniLEDs into the LCD backlight unit, a greater number of dimming zones are created, offering finer backlighting control, thus better managing contrast and halo. With this enhanced performance opportunity, LCD manufacturers intend to get a foot in the door of the high-end display market, further facilitated by greater existing manufacturing capacity and lower investment requirements compared to OLEDs.

But capturing this value means having to make technological choices that are not yet industry staples. All along the supply chain, many questions need to be answered: how many miniLEDs, at what size, how many zones, how many drivers, what kind of driving, what technology complexity for the miniLED chips and the driver chips, how is the optical stack assembled in the backlight unit, does it depend on the underlying chips, and so on. And overall, given the choices made, does it really bring LCD performance closer to OLED?

With display manufacturers struggling to position themselves around miniLED technology, Yole Intelligence, Yole SystemPlus, PISÉO, and DXOMARK have joined forces to provide in-depth analyses of a selection of four representative displays. These include:

- TCL MiniLED X9 85 inch TV backlight Unit: considered a pioneer in miniLED backlighting technology, the Chinese manufacturer TCL is promoting its third generation of miniLED TVs with an OD-zero solution to reduce the thickness of the backlight unit and the screen. It is interesting to see how they do this and whether their experience in the domain will allow them to further extend their technological leadership.

- MiniLED backlight Unit in Samsung’s Neo QLED TV: first to market with LEDs, then with quantum dots, Samsung is eager to take the reins of the high-end TV market and knock LG and its OLED product range off the top of the leaderboard. It is worth taking a look at this unique all-in-one plate construction and its impact on the TV assembly. From a broader point of view, will Samsung manage to close the performance gap with OLED?

- MiniLED backlight unit in Samsung’s Odyssey Neo G9 49 inch Monitor: in a market that OLEDs struggle to enter, it is interesting to focus on Samsung’s technology choices to implement miniLEDs into the so-called first curved miniLED PC monitor and to compare these choices with the Samsung TV.

- MiniLED backlight Unit in the Apple iPad Pro 12.9 inch: as a leader in the consumer market, all eyes are on Apple’s choices to figure out the market and technology trends. In addition, the successful integration of a miniLED backlight unit in 12.9 inch displays could accelerate the adoption of the technology by the automotive display market.

- And a technology, process, and cost report of the Skyworth Q72 TV MiniLED with a Chip-on-Glass BSI is also available. Skyworth is the first manufacturer to integrate very large Chip-on-Glass technology for the BSI.

For each of them, there are two reports: a technology, process, and cost report powered by Yole SystemPlus; and a performance report powered by PISÉO and Yole Group’s partner DXOMark.