CS substrate market to double by 2027

SiC for power applications will represent the largest sector, growing at CAGR of 25 percent, say Yole

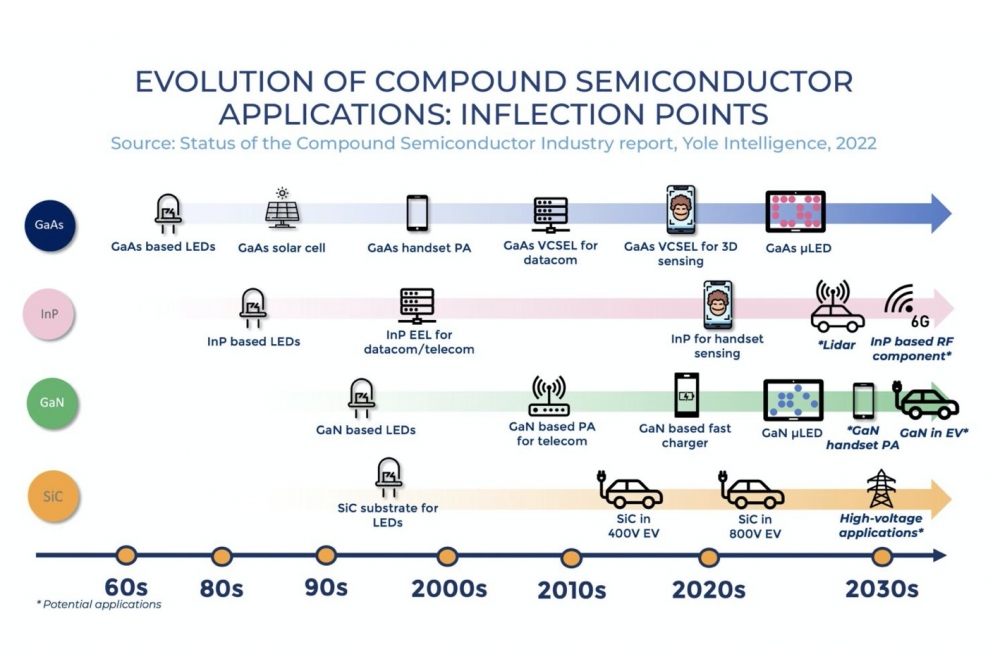

As the world demands ever greater power and efficiency, the market for compound semiconductor substrate materials is set to more than double by 2027 – with SiC for power applications expected to significantly increase its market share compared to silicon. All mega trends (electrification, 5G/6G, cloud computing…) have an increase use of compound semiconductor devices in their roadmap.

In its new 'Status of Compound Semiconductors 2022' report, Yole Intelligence, predicts the CS substrate material market to grow from $945 million in 2021 to $2.3 billion in 2027, at a 17 percent CAGR.

By 2027, SiC for power applications will represent the largest sector, growing at a CAGR 2021-2027 of 25 percent and increasing its market share among compound semiconductor substrates by around 50 percent. The photonics InP market will also increase its share and grow at a 20 percent CAGR. The third major market, RF GaN, which encompasses the substrates silicon and S.I. SiC, will maintain its market share but continue to grow with other applications at a 11 percent CAGR 2021-2027.

The electrification of vehicles and high-voltage applications are driving demand for SiC materials, and there have been ongoing moves by major players to secure or grow their substrate supply.

In 2021, ON Semiconductor (today Onsemi) acquired American SiC manufacturer, GT Advanced Technologies. The same year, Hunan Sanan Semiconductor opened a $2.5 billion Chinese SiC production line that covers the entire supply chain – from crystal growth to power devices, packaging and testing – in a bid to increase its market share in power electronics. Wolfspeed, an existing leader in SiC substrates, epiwafers and processes, recently announced a new 8 inch SiC facility in Germany to cement its leading position and expand into the SiC device market. And, semiconductor giant Infineon partnered with automaker Stellantis in 2022. The deal, worth more than €1 billion, will see Infineon reserve manufacturing capacity and supply SiC chips in the second half of the decade to Stellantis’ Tier 1 suppliers.

The RF GaN market is expected to grow in terms of size but not market share, partly as a result of the impact of the United States sanctions on Huawei in 2019, which impacted the GaN-on-SiC supply chain. In 2023, the market is expected to gain momentum to grow again, thanks to the 5G base station market in various countries, such as India.

Navitas, which employs a GaN-on-Si platform is making moves within SiC with its recent acquisition of GeneSiC, which is expected to see it launch new GaN and SiC technologies in power electronics. Most recently, Infineon Technologies has signed a deal to acquire GaN Systems for $830 million, which is by far the largest sale to date within the power GaN sector, representing around 18 percent of Infineon Technologies’ power electronics’ revenue and 4 times higher than the value of the entire power GaN market as of 2022.

Photonics

In the photonics sector, mergers & acquisitions are helping companies competing in the sensing and telecom/datacom sectors gain more market share and join-up competencies in InP and GaAs. For example, Coherent’s acquisition by II-VI saw its competencies in InP and GaAs become more distributed across materials, components, and systems. Lumentum’s acquisition of NeoPhotonics soon after II-VI’s purchase of Coherent provided gaining expertise in GaAs devices such as drivers used in data centres.

The acquired competencies will allow the companies to better compete in emerging applications – where 3D sensing in smartphones and LiDAR, µLEDs, and the transition of 5G to 6G will be important drivers. In particular, the consumer 3D sensing market has witnessed a strategic move by the tech giant Apple. InP-based proximity sensors replaced traditional GaAs VCSELs in 2022 to shrink the notch size in iPhone 14. This has triggered certain traditional GaAs players to expand their product portfolio to InP.

MicroLEDs, on the other hand, is a serious growth vector for the GaAs photonics market. Ams Osram announced the construction of a 800M euro MicroLED fab in Malaysia, which will be ready for mass production in 2024, to supply Apple with MicroLED displays for smartwatches. Several companies have benefited from the move of Apple in the MicroLEDs business. Aixtron will supply Ams-osram with 8” MOCVD reactors while AXT and Freiberger, has already demonstrated 8 inch GaAs substrates and are in competition to qualify as a main supplier to Apple.

As well as its photonics activities, Coherent is also a major supplier of SiC substrates for power and RF applications. Here, the company is attempting to move from the substrate to device level through its partnership with GE, which it recently expanded for three years. Coherent is also working to enter the RF GaN device market following on from its lead in RF GaN substrates through II-VI’s competencies – it is partnering with Sumitomo Electric Device Innovations (SEDI) to do so.

Lumentum, on the other hand, has a contrasting business model. While its R&D is in house, Lumentum uses foundries such as IQE and Win Semiconductors for manufacturing before supplying devices to Apple. This model helps it to deal with the seasonal nature of demand in the consumer market.

Other companies are attempting to gain a foothold in additional material segments or enter the market at a different level – in substrate, epiwafer or process. In its report, Yole highlights 10 major CS players and their specific positions in the ecosystem. In addition to Wolfspeed and Coherent expanding from substrates into devices in SiC, Win Semiconductor and Freiberger Compound Materials are moving to gain business in the photonics InP market. Win Semiconductor, which has photonics GaAs processes, is accommodating InP in its foundry, driven by demand for VCSELs – while Freiberger is hoping to expand its lead in GaAs substrates into inP.

Wolfspeed’s dominance in SiC and also RF GaN substrates means all major device manufacturers have partnered with the company to ensure supply – most recently in December 2022 – and in turn this helps it to secure business at the device level. As of 2023, the only other companies to offer competencies in both power SiC and RF GaN are Coherent and Chinese player SICC.

The growth of the power SiC and photonics markets, and subsequent need to increase manufacturing capacity, is creating opportunities for silicon fabs. As CS players move from 2, 3, and 4 inches to 6- or 8-inch platforms to scale production, there is a synergy with silicon fabs that have had well-established processes using larger diameter wafers for decades.

In its report, Yole maps the major CS players and silicon fabs in terms of substrate size and highlights potential opportunities where platforms could align as CS companies increase capacity. The meeting point between these two groups sits at 6- and 8-inch platforms. CS companies such as IntelliEPI, GCS, and Sanan IC, which typically have only worked on smaller diameters, are starting to look towards 6 or 8 inches to remain cost competitive, and silicon fabs such as TSMC, GlobalFoundries, Intel, and Vanguard, have long-established 6- and 8-inch Si processes that could be adapted for CS manufacturing.

The market for CS substrates is growing as the demand for high-power devices drives manufacturing advances and sees CS players moving into different material segments.