A Coherent plan for SiC

Backed by substantial investment from two of the biggest names in power

electronics, Coherent has a well-devised plan for expanding the quality

and quantity of its SiC portfolio.

BY RICHARD STEVENSON, EDITOR, CS MAGAZINE

Driven on by lucrative opportunities in the burgeoning electric vehicles market, many makers of SiC materials and devices are establishing substantial expansion plans. Just this year Wolfspeed announced its intention to build the world’s largest SiC fab in Germany, only to be eclipsed this summer, when Infineon boasted a similar claim for its new SiC facility, to be constructed in Malaysia. And this October Coherent has been grabbing the headlines by creating a subsidiary devoted to SiC.

Supported by investment from Denso and Mitsubishi Electric that totals $1 billion – a transaction scheduled for completion in the first quarter of 2024 – efforts to create this subsidiary are already underway. In exchange for these two substantial cash injections, each $500 million, the Japanese firms will each receive a 12.5 percent non-controlling ownership interest, as well as long-term supply agreements that support their SiC activity. Coherent will ship SiC substrates, both 150 mm and 200 mm, to Mitsubishi Electric and Denso.

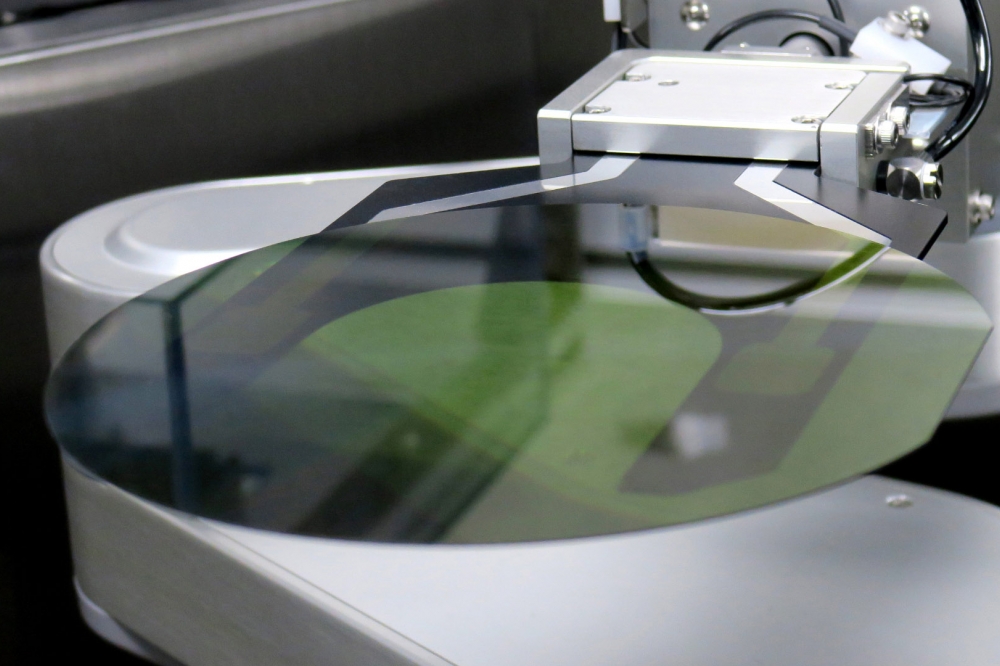

150 mm wafer populated with SiC devices

Heading up the new subsidiary is Sohail Khan, Coherent’s executive VP, Wide-Bandgap Electronics Technologies. Khan is definitely delighted with this modus operandi.

“You always want to have the leading system companies as your lead customers,” remarks Khan, who points out that Denso is a leading tier-one supplier to the automotive industry and Mitsubishi Electric is a leading provider of industrial and automotive power systems.

Coherent, which has its II-VI heritage to thank for its SiC prowess, could have turned to a number of different options for funding the growth of its new subsidiary.

Some may see investment from other firms as questionable – but not Khan, who argues that it’s an asset. “Our view was that when you have ownership, you have the right interest and motivation. I would go as far as saying not all money is the same.”

Note, though, that Khan is not advocating that any partner will be beneficial. “It is important to have the partners who have validated your technology, have used your technology, and have the confidence in your technology and capability.”

He adds that for the relationship to blossom, a partner also needs assurance that they will be supplied with high-quality products, in volume, at a competitive price.

Confident of meeting all these requirements, the Coherent subsidiary will benefit from getting “maximum learning”. The leadership at II-VI always considered this as a vital pillar to market success, and this philosophy still lies at the centre of Coherent and its subsidiary.

Another benefit of working with Mitsubishi Electric and Denso is that it allows Khan and his team to get much closer to the end suppliers to the market. “That’s absolutely critical,” argues Khan.

The insights gained from the new venture will help to continually refine the production processes of this vertically integrated Coherent subsidiary, which as well as making substrates and epiwafers is expanding into devices and modules.

200 mm substrate

Open to all

Khan is very keen to point out that the subsidiary is not just there to serve Mitsubishi and Denso. “I want to emphasise that we are not going to be a captive supplier. It is just an investment from these companies into the silicon carbide business.”

He adds: “The idea is to be a merchant player, learning from other customers and providing our products at every level.” The Coherent subsidiary will engage with some companies at the substrate and epiwafer level, and others at the device or module level.

Khan is responsible for around 650 staff in the US, spread over a number of facilities. In addition, there is a site in Fuzhou, China, that provides contract manufacturing.

Investment in the Coherent subsidiary will increase capacity and support growth. Capital and operational expenditure will follow, ranging from the installation of additional furnaces and epi-reactors to improved R&D capabilities that support the development of devices and module designs.

Substrates produced by the subsidiary are already available in 150 mm and 200 mm diameters. According to Khan, lines for processing the larger size are now being brought up, with tools undergoing qualification. However, this will take time – and Khan expects it will be 2025 before 200 mm is the dominant diameter for substrate shipments.

Through the licensing of General Electric’s SiC MOSFET technology, Coherent has been qualifying 1200 V and 1700 V devices that meet the Automotive Electronics Council AEC-Q101 standard.

“If you look at the power market, they guarantee 175 degrees C,” says Khan. “We guarantee 200 degrees C operation. Our devices are very rugged and go through extensive tests on reliability.” These MOSFETs are now being sampled at pre-production levels.

The degree of success that will come from Coherent’s SiC subsidiary will be disclosed in quarterly results. Khan is confident of rising sales in a global market now worth around $3 billion, and forecast to generate revenue of more than $20 billion by the end of the decade.

It is possible that sales may even outstrip this figure, suggests Khan, arguing that once newer technologies prove themselves, they always replace the incumbents. “No one has a crystal ball, but we have seen predictions anywhere from 30 percent to 80 percent penetration of [silicon carbide] in EVs.”

Should deployment veers towards the upper end, the Coherent subsidiary will enjoy tremendous success, along with its two Japanese investors.

Main image: 150 mm substrates on a robotic arm