Car radar market $7.5B by 2022

Yole Développement forecasts the global automotive radar market will reach $7.5 billion in 2022 (at the module level) growing at around 23 percent CAGR between 2016 and 2022 despite small growth (~3 percent) in global car sales until 2022. Autonomous driving is the long-term driver for radar technology growth.

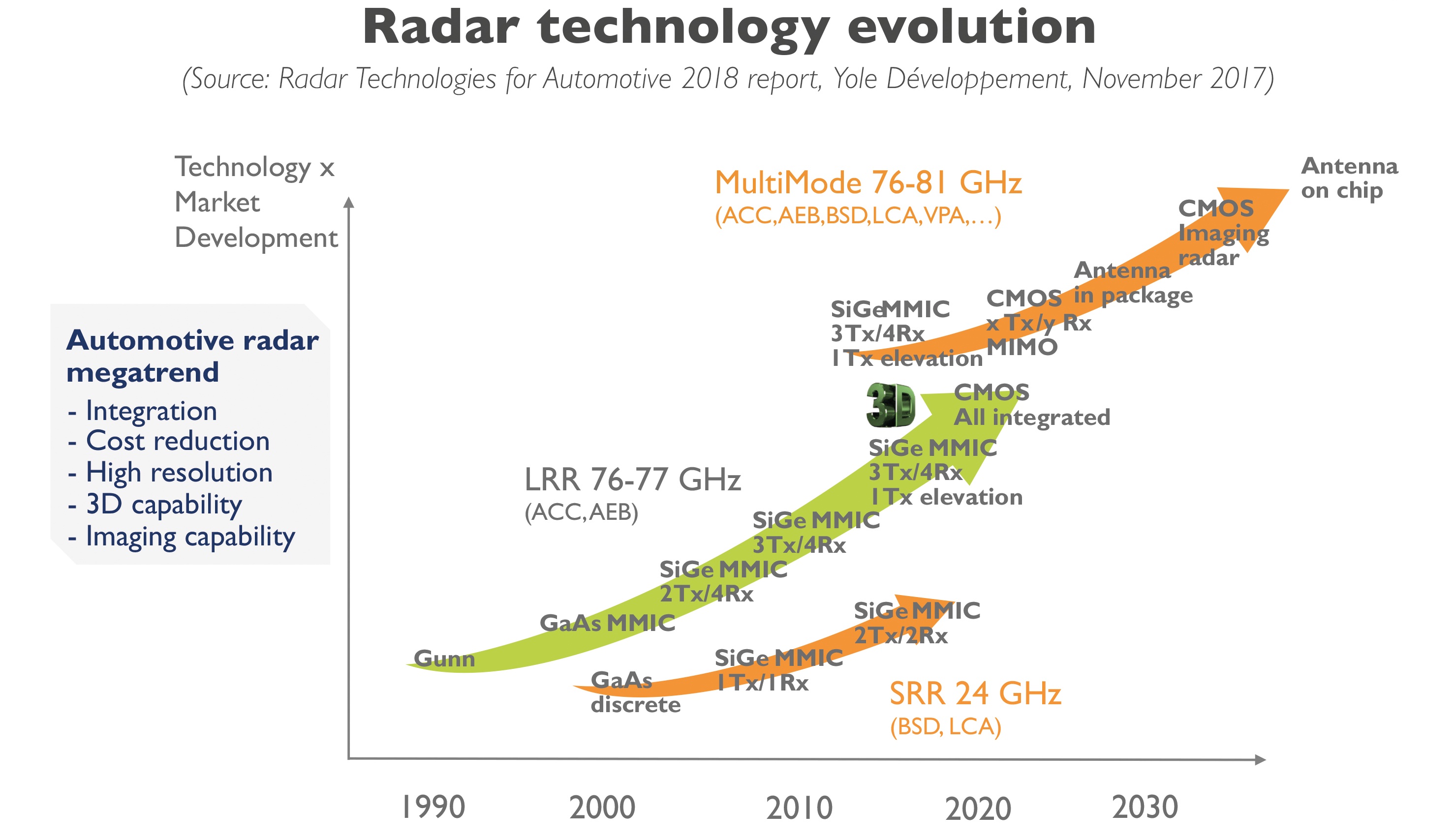

77 GHz radar in W band development is overtaking the current mainstream 24 GHz offer in the unlicensed ISM (industrial, scientific, medical) band. 77 GHz radar combines better range coverage (thanks to its "full power" mode) and larger available bandwidth, thus improving range resolution and accuracy by a factor of 20x. Other benefits include its 3x smaller form factor and improved velocity resolution. Radar architectures have reached a new level of complexity, requiring innovation in antenna design, complex modulation techniques, and target resolution algorithms. Multi-beam, multi-range requirements have led to complex antenna arrays that are multiplying transmit-and-receive paths and adding 3D detection capability.

Automotive 77 GHz radar chips are mainly based on a 130nm SiGe platform, with NXP and Infineon Technologies as the top suppliers. But RFCMOS technology is entering the market with semiconductor companies such as Texas Instruments with an intermediate technology node of 45nm. And technology scaling has started with Analog Devices offering products based on advanced 28nm CMOS nodes and also foundries that are positioning their advanced process capabilities in this ecosystem. For example, Globalfoundries and its 22FDX platform support innovative start up Arbe Robotics with a 4D high resolution radar for autonomous cars.

System Plus Consulting, a Yole partner company involved in reverse engineering and costings prepared a report on the world's first single-chip radar developed by Texas Instruments (TI). "Ahead of its competitors in RFCMOS applications, TI has begun manufacturing highly integrated radar sensor chips "“ the latest of which is the AWR1642," asserts Stéphane Elisabeth, expert cost analyst, RF, Sensors & Adv. Packaging at System Plus Consulting. "But rather than integrating all transmitters, receivers, and local oscillators in a single chip, TI went further and integrated a MCU and a DSP on the same chip."

Innovative startups such as Metawave and Uhnder are bringing other technologies to the market to support high resolution sensor requirements either with ultra-thin steerable beam and AI engine for a deep learning approach or with unprecedented high channel number for high resolution imaging radar. Those innovations attract new comers in automotive radar field for instance with Magna and also well established players through the whole supply chain: Infineon Technologies, Denso, Toyota, Hyundai. It will certainly reshape the competition with the current leaders Continental and Bosch.

"It is exciting to see such a wide diversity of technology offerings, a clear confirmation of the automotive radar market's traction," comments Cédric Malaquin from Yole. "However, penetrating the automotive market with new technologies is no easy task. On the contrary, entering and maintaining a position in the automotive supply chain is a long, trust-based process."

"We are certainly entering a new "radar age", with many developments, disruptive technologies, and new entrants positioning this technology as the primary sensor - along with imaging (cameras) for ADAS and autonomous vehicles", comments Claire Troadec, division director, Power & Wireless Division at Yole.

System Plus Consulting and Yole Développement will be speaking at a couple of upcoming exhibitions.

At European Microwave Week (September 23-28 "“ Madrid, Spain), Cédric Malaquin from Yole with present 'The automotive radar market' and Stéphane Elisabeth from System Plus Consulting 'Automotive Radar Technology and Cost Overview'.

At Semicon Europa (November 13-16 "“ Munich, Germany) Claire Troadec from Yole will speak on '5G - Who has the most to win (and lose)?'