This article was originally featured in the edition:

PIC Magazine Issue 8 - March 2018

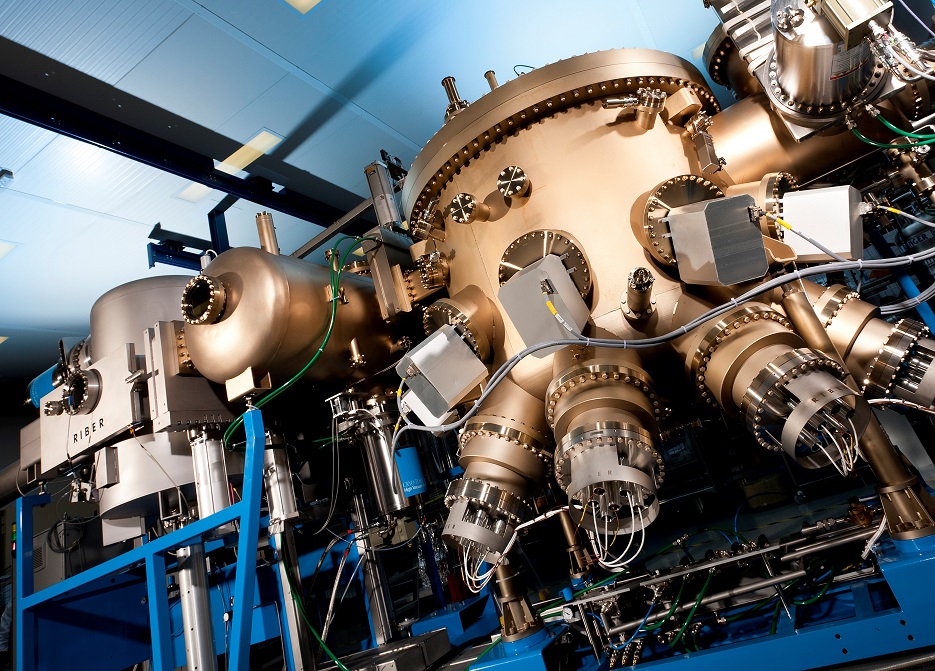

Riber sets sights on market dominance

For France-based semiconductor equipment business, Riber, 2018 has so far been very productive. Aided by buoyant market conditions, Riber's revenue grew 42% year-on-year for the first nine months of 2018, largely driven by sales of its MBE systems almost tripling.

And with analysts tipping the MBE system market to mushroom in coming years, Riber's growth looks set to continue.

"Riber has always invested around 10% of its sales into research and development and we also have had a lot of collaboration with many European laboratories," says Riber chief executive, Philippe Ley. "While research markets have been steady for many years, we are now seeing a lot of growth in production markets."

"This is the era of IT and telecommunications, and MBE can produce very efficient devices for these markets," he adds. "So for me, it is now all about improving existing equipment and developing new systems."

Ley joined Riber in June this year, following an eight year stint as production and operations director as well as management board member. Tasked with driving company development as the MBE market grows, much has happened since he took the position of chief executive.

In July this year, Riber opened its 100% owned subsidiary, Riber Semiconductor Technology Shanghai, to strengthen the company's presence across China.

As Ley points out: "Customers in China wanted better service, maintenance, help and after-sales service so this supports them, and provides the same service that you would get in Europe."

Indeed, Riber already has 21 MBE customers in China with an installed base of 48 MBE machines. Six of these are production systems, giving Riber the largest installed MBE base in China and a market share of more than 75%.

What's more, in the same month, China-based laser systems developer, Acken Optoelectronics, ordered a MBE 6000 multi-wafer production system from Riber. And the company recently revealed a further sale to a 'new customer from Asia', to manufacture optoelectronic systems for fibre-optic interconnection markets.

Rising sales come at a time when several massive government projects are under negotiation to roll out large-scale fibre-to-the-home and 5G networks to serve Chinese markets.

"We know that Chinese customers would like to have more MBE systems in China so they can make more of their own electronic components, rather than buying them abroad," says Ley. "People want fibre-to-the-home and 5G, and companies wish to be more independent... so yes, they will need more machines and our new subsidiary will be important."

Philippe Ley hopes to have a Riber 'dream' MBE machine ready by 2021.

Looking beyond China, MBE system sales worldwide, show an incredible 193% growth in the last nine months, compared to the same period in 2017. And Riber's MBE systems order book is also looking very healthy, with orders increasing by a hefty 120% to Euro 22.2 million in the last year.

According to the company, twelve systems - comprising seven production and five research machines - are scheduled for delivery between 2018 and 2019. In contrast, four production and two research systems were delivered in 2017.

Given this solid schedule, Riber predicts full-year revenues of Euro 35 million for 2018 and at least 15% year-on-year growth. And Ley is confident the company will hit its targets, saying: "We have good prospects and a good plan and expect to see steady growth over the next three years."

Dream machine

So what next for Riber? Right now, the company is intent on delivering what Ley calls its 'dream MBE' by 2021. As he explains, the next-generation MBE system will be 'entirely user-friendly' with a higher level of integration of in-situ characterisation tools, relative to current systems. Such tools will include optical-based flux monitors and pyrometers, and will provide the necessary deposition data to optimise quality control during epitaxy.

"You can sub-contract many of these tools, but we want to have an intelligent machine that can better use the system information to produce higher quality layers and better wafers," says Ley. "It needs to be easy to use and have a high efficiency... we have many new customers around the world, and for sure in China, but not all have enough MBE knowledge."

"Many customers do not want to make many tunings themselves, so such a system would really increase productivity," he adds. "Our target is to develop a first system next year and have the final machine ready to be sold in 2021."

But what about competition from MOCVD systems, perceived by many to be more user-friendly? Ley remains unfazed and as Riber chairman, Michel Picault, tells Compound Semiconductor: "MOCVD is a good tool for mass production while MBE is better for higher end performance devices."

"This is why we are seeing rising demand and potentially a very large market for these devices, including laser diodes and VCSELs, in 5G and fibre optic networks, and many more applications," he adds.