Would Apple change the power GaN world?

GaN power device market faces two possible scenarios, says Yole

Power GaN offers clear technical advantages over traditional silicon MOSFETs nevertheless each manufacturer is presenting its own solution on die design and packaging integration. “This brings strong competition which will accelerate technical innovations in terms of integration and better performances,” says Elena Barbarini, head of department semiconductors devices at System Plus Consulting, part of Yole Développement .

Even though the current GaN power market remains tiny compared to $32.8 billion silicon power market, GaN devices are penetrating confidently into different applications.

The biggest segment is still power supply applications, i.e. fast charging for cellphones. This year, Navitas and Exagan introduced 45W fast-charging power adaptors with an integrated GaN solution. LiDAR applications are the other high-end solutions that benefit from high-frequency switching in GaN power devices.

The EV/HEV market is still dominated with SiC technology which is replacing silicon IGBTs in main inverters. (Yole announces a $450 million SiC market by 2023 in its latest Power SiC report).

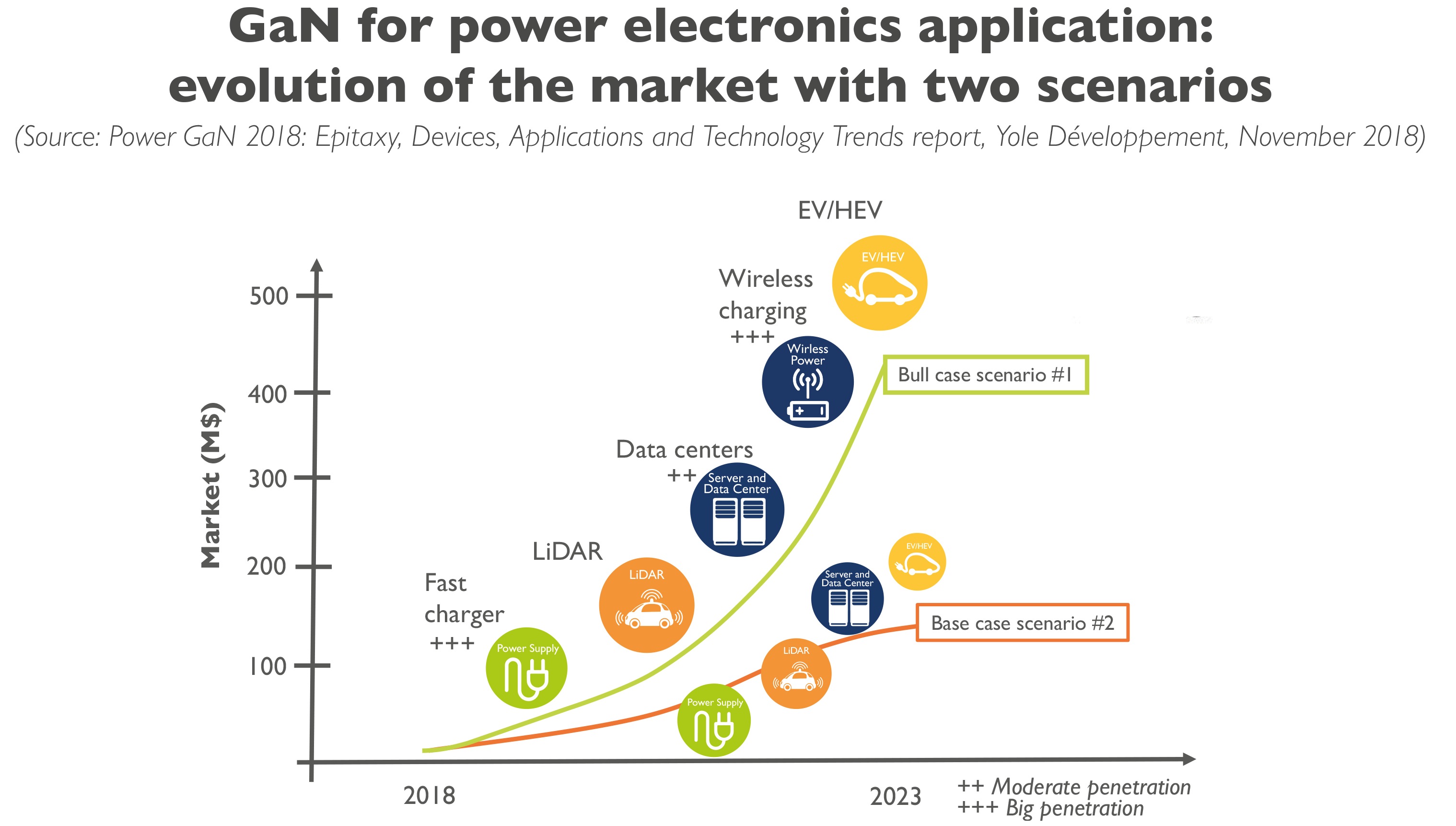

“The accumulation of the market growth in various applicative markets, especially the power supply market segment which is the most important in that case, confirms our first scenario,” comments Ana Villamor, technology and market analyst at Yole. “Under this Base Case scenario, GaN market is expected to grow steadily. At Yole, we announce a GaN market to grow with 55 percent CAGR between 2017 and 2023”.

However, this analysis is not the only way to see the tomorrow’s industry. Yole’s Power and Wireless team went further in their investigations. Is there any killer application that could cause the GaN power device market to explode? Yole’s analysts said 'yes' if Apple opted for GaN technology for its wireless charging solution.

“It goes without saying that the potential adoption of GaN by Apple or another smartphone giant would completely change the market’s dynamics and finally provide a breath of life to the GaN power device industry,” comments Ezgi Dogmus, technology and market analyst and part of the Yole’s Power and Wireless team. “Indeed we imagine that after a company like Apple adopts GaN, numerous other companies would follow on the commercial electronics market.”

What could be the added-value of GaN technology? Various players, such as EPC and Transphorm, have already obtained automotive qualification in preparation for GaN’s potential ramp-up. In addition BMW i Ventures’s investment in GaN Systems demonstrates the automotive industry’s interest in GaN solutions for EV/HEV technology. Globally, Yole’s second scenario, named Bull Case Scenario is much more aggressive, conditioned by the adoption of GaN wireless charging solution by leading consumer manufacturers.

According to the market research, in this context, the GaN power business could reach around $423 million by 2023, with 93 percent CAGR between 2017 and 2023.

These insights come from The Power GaN report, 2018 edition conveys Yole’s understanding of GaN implementation in different market segments.