CREE and INFINEON BUCK THE TREND

The share prices of many compound semiconductor companies have taken a battering over the last twelve months. But that’s not the case for Cree and Finisar – their valuations are soaring.

BY RICHARD STEVENSON

In the run-up to last New Year, stories of turmoil on the stock markets grabbed the headlines. The technology-focused NASDAQ and the FTSE 100 were caught in a bear market, and would exit 2019 at a lower value than they started.

Since the start of this year, there has been something of a recovery. Stock markets are up considerably, recovering to near the peaks experienced last summer. So while the last twelve months have not been a great time for shareowners, many of them will not have suffered substantial losses, and the canny ones may even have made a small profit.

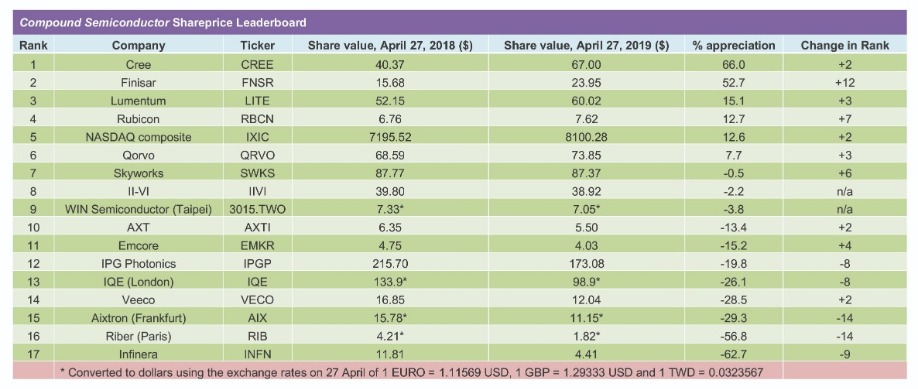

Unfortunately, if your portfolio of shares draws heavily on the compound semiconductor industry, it’s odds-on that your investment will have fallen, as many of these firms have struggled. But if you have backed the right horses, you could have done very well. Only four of the 16 firms on our Shareprice Leaderboard have had a positive last 12 months, but two of them have done exceptionally well over this timeframe. Cree has led the way – although its shares bobbed up and down in 2018, they have climbed throughout this year, to increase by over 65 percent compared with the end of April last year. And taking second place on the Leaderboard is Finisar, with shares up by just over 50 percent over the last 12 months.

Cree’s superb transition

Cree’s success has to be credited to its CEO, Greg Lowe, who has shifted the focus of the company. Once renowned for industry-leading LEDs and the development of a lighting business, its future now lies in the power electronics and RF sectors. Under Lowe’s leadership, capacity in these areas has increased, while margins have been maintained.

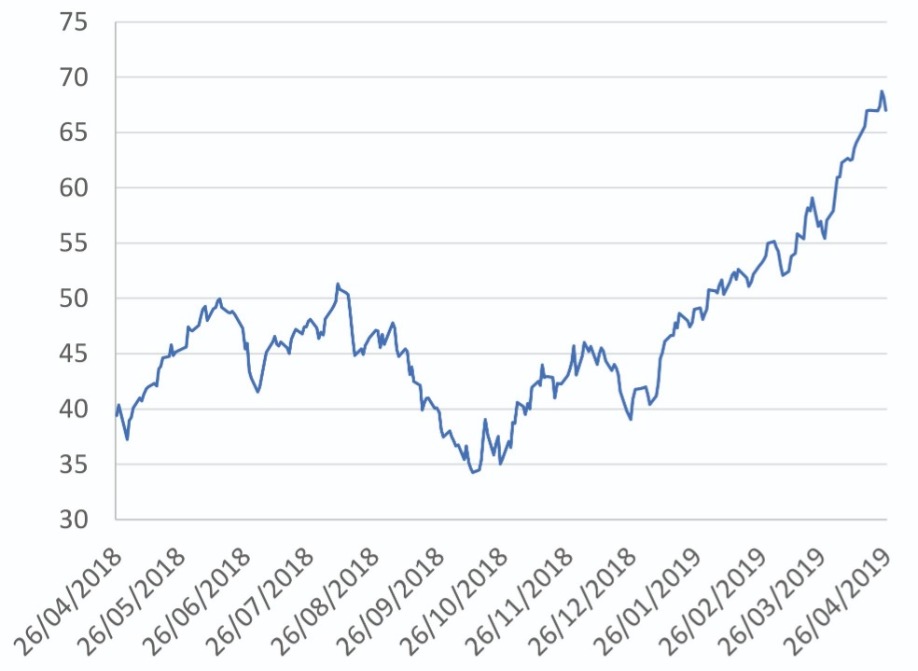

The value of Cree’s shares has climbed substantially over the last six months.

The latest significant move in this transformation came this March, when Cree announced that it would be selling its Lighting Business to Ideal Industries for $310 million, including an upfront cash payment of $225 million.While updating investors on the details of this sales and its significance, Lowe revealed how far Cree had come in last 18 months or so to make this company a “semiconductor powerhouse” in SiC and GaN technologies.

“Over that timeframe, we have grown Wolfspeed by 100 percent, acquired the RF Infineon Power business, more than doubled our manufacturing capacity of SiC materials, and signed long-term supply agreements, which are, in aggregate, in excess of $500 million dollars,” remarked Lowe.

He pointed out that the company now has a faster growth profile than before, alongside higher margins and a cash balance approaching $1 billion.

This story of success is echoed in the most recent quarterly earnings, provided on 30 January 2019. Second-quarter results showed that the Wolfspeed division, associated with RF and power devices and SiC substrates, operated at a gross margin of nearly 48 percent, while LED products had a gross margin of 30 percent, and that figure for Lighting Products was just below 26 percent. So, based on gross margins, selling off the Light Products unit makes much sense.

Right now, the LED Products and the Wolfspeed divisions are generating similar sales. But Wolfspeed will soon take the lion’s share. Based on figures for the second fiscal quarter, its sales grew by 92 percent year-over-year to $135 million. Although that has been aided by the acquisition of Infineon’s Power business, even when that is taken out of the equation, revenue has rocketed by 50 percent. In comparison, LED Products netted $145 million, down 5 percent year-on-year and 1 percent sequentially.

Lowe believes that the company’s technologies lie at the forefront of the automotive industry’s transition to zero-emission electric vehicles, the telecommunication industry’s move to faster 5G networks, and the continued ramp-up of LEDs for speciality light applications, such as the light sources for the Valeo Picture Beam – it is a high-definition vehicle lighting product that combines road marking with high-performance low-beam and high-beam functions.

“Within the electric vehicle market, the interest in silicon carbide is extremely high, because the value proposition is so strong,” said Lowe, when speaking to investors during the call that discussed second quarter earnings. “Utilising silicon carbide saves space, reduces cooling requirements, and allows for a smaller, lower-cost battery. These benefits far outweigh the incremental cost.”

Another opportunity for SiC lies in electric vehicle charging. Owners want the time to charge their vehicles to be as short as possible, but this requires a quicker transfer of energy. “They’re going to do that with higher voltages and that’s going to be a natural fit for silicon carbide,” said Lowe.

The growth in sales of electric vehicles is helping Cree to increase its sales of SiC power devices.

During the call, Lowe argued that the wireless telecom market is moving towards GaN, because this enables faster 4G and the transition to 5G, thanks to its wider bandwidth, higher frequency and higher efficiency. “The outlook is very promising, and we are in the process of adding GaN production capacity to meet the increasing demand that we’re seeing.”

Over the next 24 months, Cree will re-double the production capacity for its SiC and GaN products. This latest phase of build-out is aided by the long-term wafer supply agreements. So far, these have been signed by Infineon, STMicrolectronics, and a third, undisclosed firm. Additional contracts may follow. “I think we’re not done yet,” said Lowe. “I would also say that the more we get into conversations, the more excitement there is about doing these longer term deals, because people are very concerned about having the capacity to meet their plans.”

As well as an increase in sales from the Wolfspeed unit, margins from this unit are expected to rise, to eventually exceeds 50 percent. Such a high level of profitability, along with around $1 billion in cash, should assure Cree of a very bright future.

Finisar’s fortunes

Second on our Leaderboard is Finisar, a manufacturer of components and sub-systems to networking equipment manufacturers, datacentre operators, telecom server providers, makers of consumer electronics and automotive companies. In general, Finisar’s share price has climbed steadily over the last 12 months, but it did take a substantial leap in November 2018, when it was announced that the company would be acquired by II-VI this summer.

II-VI holds Finisar in very high regard, and believes that the deal will enable the new entity to realise annual revenues of $2.5 billion. Increases in scale and efficiency after the merger are anticipated to lead to cost savings of $150 million per year.

Speaking to investors at the time of the announcement of the deal, Finisar CEO Michael Hurlston said that the merger should accelerate growth across the board. In addition, he thought that the terms of the transaction were good for Finisar shareholders.

“It provides immediate cash value, while providing the opportunity to participate in the significant upside potential of our combined organisation once the transaction is completed.”

II-VI agreed to buy shares in Finisar at $26.00, a premium of 38 percent, according to the closing price prior to the announcement. Once the deal goes through, Finisar’s shareholders will own about a third of the combined company.

While the market considered this a great deal for Finisar, with its share price shooting up from around $17 to $21, they thought it wasn’t ideal for II-VI. Shares in this company plummeted by around 20 percent.

Since the announcement of the acquisition, Finisar’s share price has fallen slightly towards the end of the year, before steadily climbing in 2019. This reflects the solid performance of the company. For example, results for the third fiscal quarter 2019, announced at the end of February, show a modest increase in revenue – it is up $2.2 million, or 0.7 percent, compared to the previous quarter – due to greater sales of wavelength-selective switches and VCSEL arrays for 3D applications. Gross margin also increased sequentially, rising by 2 percent. This has been attributed to a favourable product mix and a continued focus on reducing manufacturing overhead.

Lumentum’s recovery

The third-placed company on the Leaderboard is Lumentum, best known for its VCSEL products. It’s shares have been up and down over the last 12 months, but thanks to a recent steady climb, have gained nearly 20 percent since last April.

That’s is a good recovery, given the nosedive in early November, when shares plummeted from almost

$60 to around $37, due to a fall in orders from a major customer. Although not named, it is widely assumed that the reduced demand came from Apple, which accounts for around 30 percent of sales – it uses Lumentum’s VCSELs in its facial recognition systems in its premium smartphones.

The loss off business forced Lumentum to update its quarterly guidance a little more than a week after it gave its first forecast. Initially predicted to be between $ 405 million and $430 million, sales would now be around $70 million lower.

The figures for that quarter came out this February. Revenue from the existing business met with guidance, with total sales hitting $374 million, due to a $30 million contribution from Oclaro, acquired by Lumentum on 10 December 2018.

Speaking to investors on 5 February, in a call to discuss earnings for the second fiscal quarter 2019, Lumentum’s CEO, Alan Lowe, explained the rationale for the acquisition: “It gives us a differentiated leadership position across a range of photonic chips on which the datacom, wireless, and access market is critically relied. This creates new avenues to profitable growth through meaningful chip sales and more cost-competitive transceivers.”

Lowe believes that this acquisition, which equips Lumentum with InP technology, could be the first of many such moves in the optical communications industry. In his view, there has been a long-term need for consolidation.

Cost savings should result from the acquisition. During the call, company interim CFO Christopher Coldron told investors that within 12 to 24 months savings could be in excess of $60 million per year – and even in just a few months, they were worth around $10 million.

In the Smartphone sector, Lumentum is not tied to Apple, but also shipping to makers of Android products. “We continue to make excellent progress with additional Android customers and additional new design wins. The market for laser-based sensing is still in its infancy,” remarked Lowe.

He is very upbeat about the long-term opportunities in this sector, believing that the company’s products could be used to enhance security, safety and new functionality in billions of electronic devices. “The seeds for this long-term market opportunity continue to be planted.”

Another promising product within the portfolio is the fibre laser. Lumentum realised record revenue for its kilowatt-class fibre lasers, with sales up 12 percent sequentially, and up a whopping 133 percent compared to the equivalent quarter of the previous year.

Guidance for the third fiscal quarter is for an increase in revenue to $420 million to $440 million, and operating margins slightly lower, at between 16 percent and 18 percent.

Infinera’s slump

At the bottom of the Leaderboard is Infinera. It has had a torrid twelve months, with the share price dropping from around $12 to nearly one-third of this value. The decline has been steady, with the trade war between the US and China contributing to the company’s woes.

Against a backdrop of a steady decline, there have been two sharp drops in May and November 2018, when the company reported its first and third fiscal quarter results for 2018. The 20 percent drop in share price associated with the first quarter results on 9 May did not result from missing guidance figures. Quarterly sales of $203 million were towards the top of guidance, and gross margins exceeded expectations by 2 percent.

However, the sharp drop in valuation may have reflected the guidance given at that time, with expectations of only a slight increase in sales, and no gain in gross margin.

When the earnings came out for the third fiscal quarter, the share price fell from just over $6 to below $4.50. Revenue and gross margins were within guidance, but towards the bottom end.

In the most recent fiscal quarters, revenue is far higher, due to the acquisition of Coriant, bought on 1 October 2018. That purchase helped sales to swell to $332 million for the fourth fiscal quarter, and although integrating the new company has hit gross margin, it is expected to recover.

Speaking to investors on 21 February, 2019, during a call detailing fourth fiscal quarter results, company leaders spoke very positively about the acquisition of Coriant. CFO Brad Feller explained that by enlarging the company, it had a stronger negotiating position with suppliers, and had been able to reduce purchase prices by up to 35 percent. The bottom line will also benefit from better gross margins, with an increase of over 10 percent targeted by 2021.

If significant strides towards this goal are met by April 2020, it would be surprising to see Infinera footing the table this time next year. And should they return to the share price of $12 or so, of late April 2018, that would give them an appreciation of 200 percent, a figure surely high enough to top the table.

Can they do that? Stay tuned to find out.