Acquisitions in power

Interest in GaN technology for cars is driving buyouts, says Yole

In the power GaN industry’s second major acquisition in a year, following Infineon Technologies’ purchase of GaN Systems, US-based Transphorm is to be acquired by a subsidiary of Renesas Electronics Corp of Tokyo, Japan.

The acquisition adds to the billions of dollars invested in the power GaN industry since 2019 through partnerships, the construction of facilities, and M&As.

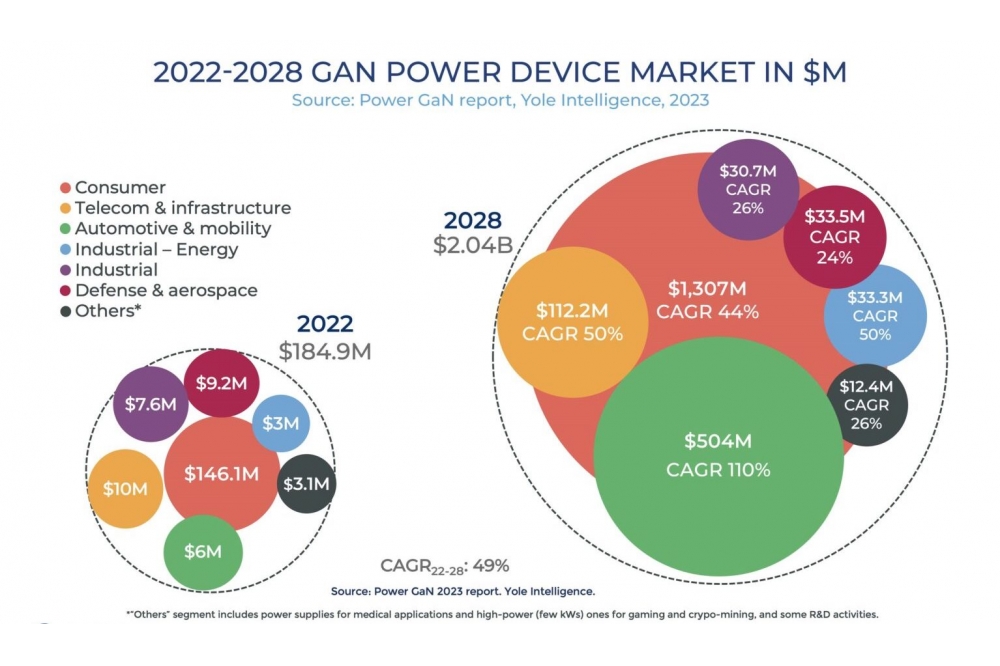

Yole Group’s experts Milan Rosina and Taha Ayari say the automotive market is driving this activity. Yole Group predicts the sector to be worth $504 million by 2028, growing at a 110 percent CAGR (source: Power GaN report, Yole Intelligence, 2023).

The sector is attractive for players such as Renesas and Infineon Technologies because it experiences higher margins and ROIs than the consumer sector.

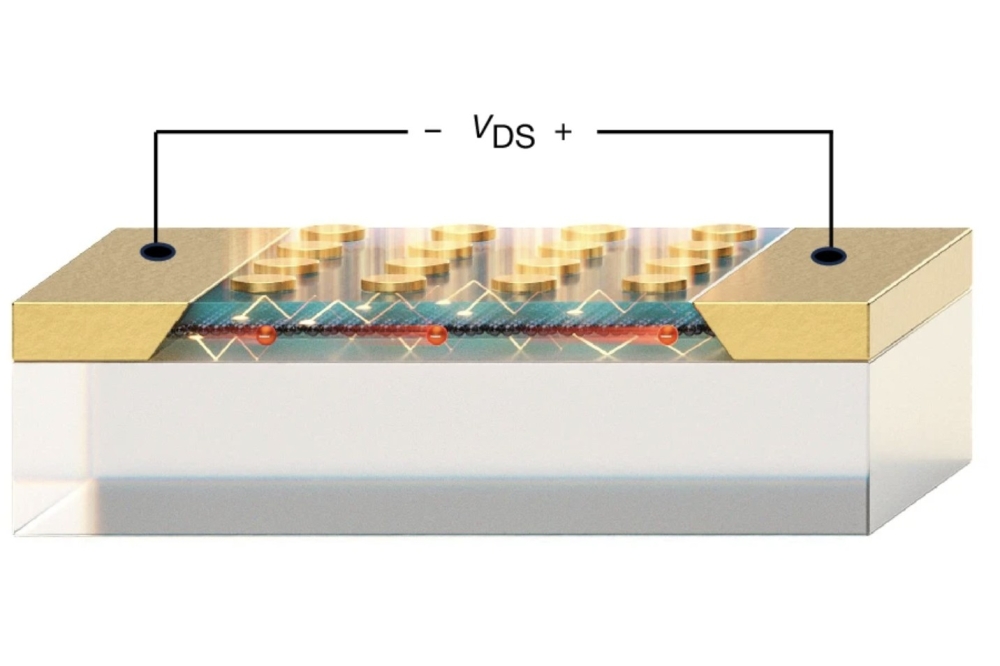

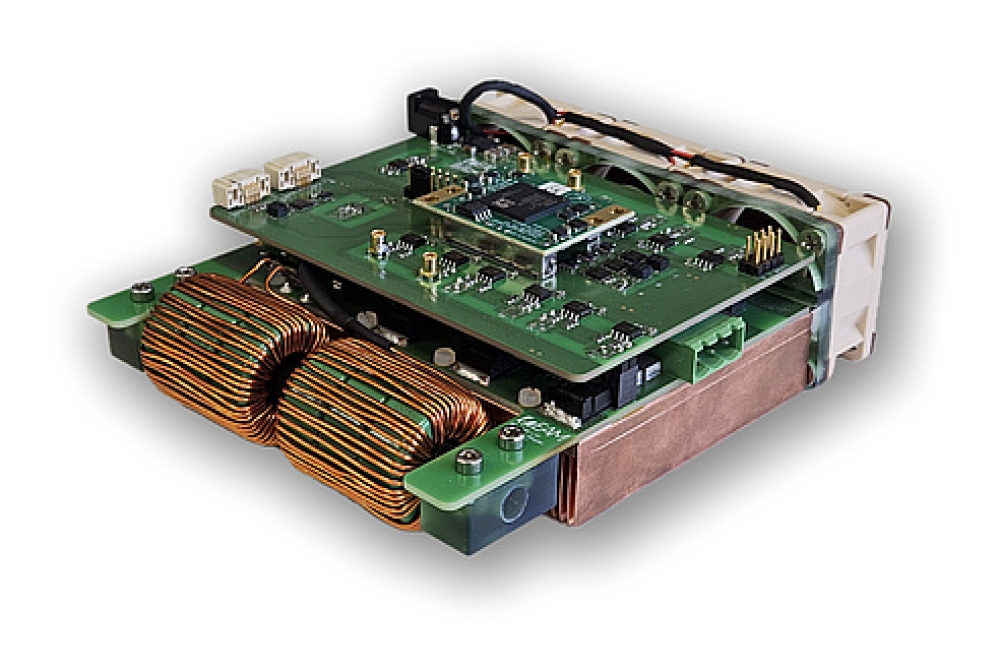

The trend toward more integrated systems is notable in electric vehicles in particular, where OEMs are moving from today’s 3-in-1 unit that integrates an EV drive motor, gearbox and inverter – to 5-in-1, or even 8-in-1 systems that also include power electronics controls such as DC-DC converters and on-board chargers. This is where the major opportunity lies for GaN to offer a high level of perceived value in reducing system costs, weight, volume and power losses.

Transphorm’s automotive-qualified GaN technology was mentioned explicitly by Renesas as a reason for its purchase, to enable the development of enhanced power solutions for EVs. This followed Renesas’ already strong ambition in targeting integrated power solutions for EVs with a recent partnership with Nidec, which will see the companies develop a 6-in-1 E-Axle.

Like Transphorm, GaN Systems has significant strength in the automotive sector, which was a major reason behind the Infineon Technologies acquisition in 2023. However, at $830 million, Infineon Technologies paid more than double the $339 million Renesas paid for Transphorm. With the two companies similar in size, with a comparable market share, and strong GaN expertise and IP – what could be the reason behind the stark difference in value?

Could it be that GaN System’s design-win pipeline is more attractive than Transphorm’s? In the automotive sector alone, it has partnerships with Hella, Vitesco, Canoo, among others. Unlike Renesas, Infineon Technologies already has in-house GaN capacity, so the upcoming business it could gain through design-wins is likely a big justification. And, thanks to design centres in Canada, the US, China and Taiwan, GaN Systems is in good stead to secure more of this type of business in the coming years. In this way, Infineon Technologies is playing the long game to secure a leadership position in the power GaN industry.

In contrast, it is likely that Renesas is satisfied with the in-house IP and GaN device production capacity it will gain (through Transphorm’s epitaxy capabilities and its interest in GaNovation’s AFSW wafer-fab). It is noteworthy that this AFSW fab is located in Japan, which may be considered as an advantage for Renesas to profit from a local GaN fab ready for high volume production.

Renesas already has experience on GaN technology, working with EPC and GaN Systems (now an Infineon company) to develop Systems like DC-DC converters and even space-grade devices (following the acquisition of Intersil). Upon the completion of Transphorm, Renesas will have a complete power electronics portfolio, with power ICs, Si power devices, SiC devices – after investing $2B in Wolfspeed to guarantee a 10-years SiC wafer supply – and Transphorm’s GaN products. Renesas is now on track to compete with the leading power electronics players such as Infineon and STMicroelectronics.

Nevertheless, there is still a question as to whether the acquisition, expected to close by mid-2024, will be approved, particularly with Transphorm’s work with the US government on several funded projects that can be related to Defense.

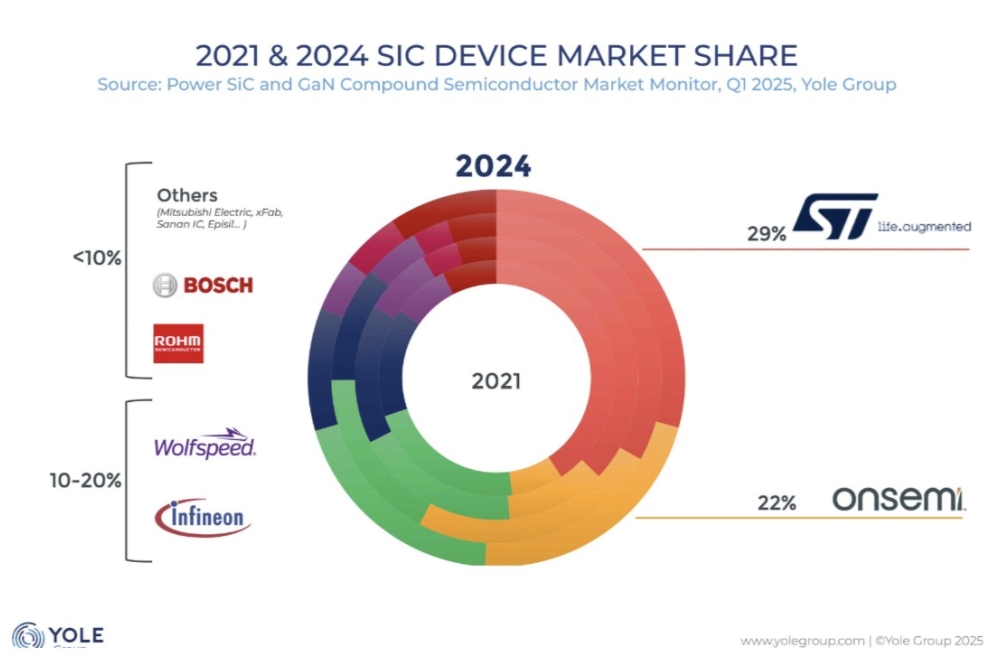

In the next 5-10 years, IDMs are expected to become the dominant force in the power GaN ecosystem, as has been evident in the SiC industry, as correctly foreseen in Yole Intelligence’s last Power GaN report.

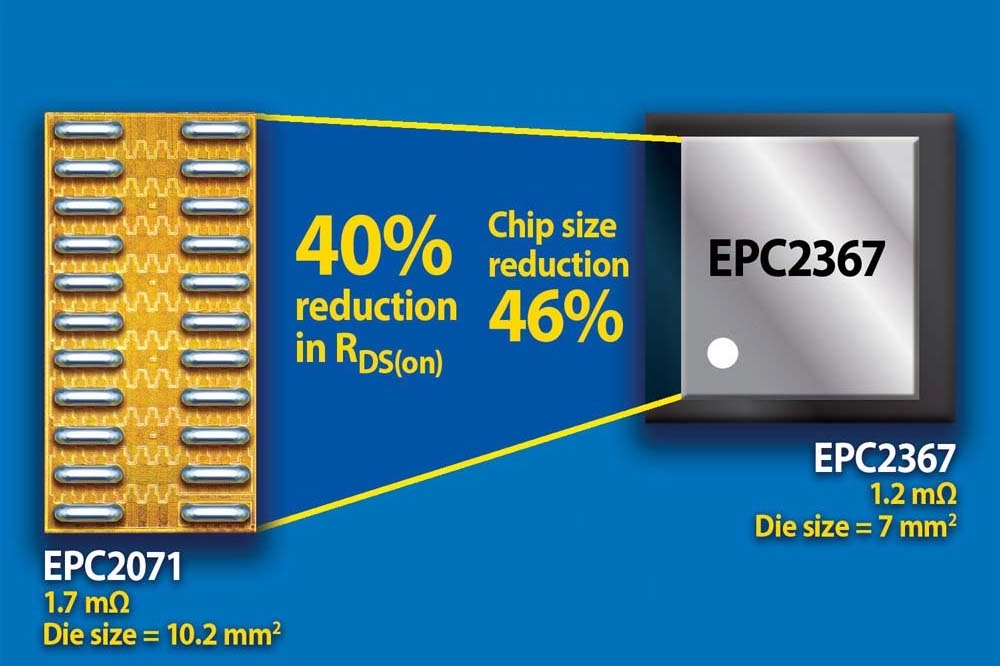

While some fabless companies will co-exist by expanding into different markets – for example Navitas, which has entered the SiC sector by acquiring GeneSiC – Yole Group’s analysts expect to see more M&As. Start-ups such as Wise Integration and Cambridge GaN Devices, or older companies like EPC, a leader in low-voltage devices, could be acquired in the near future. VisIC, which is particularly focused on the automotive sector, could also be an attractive target.

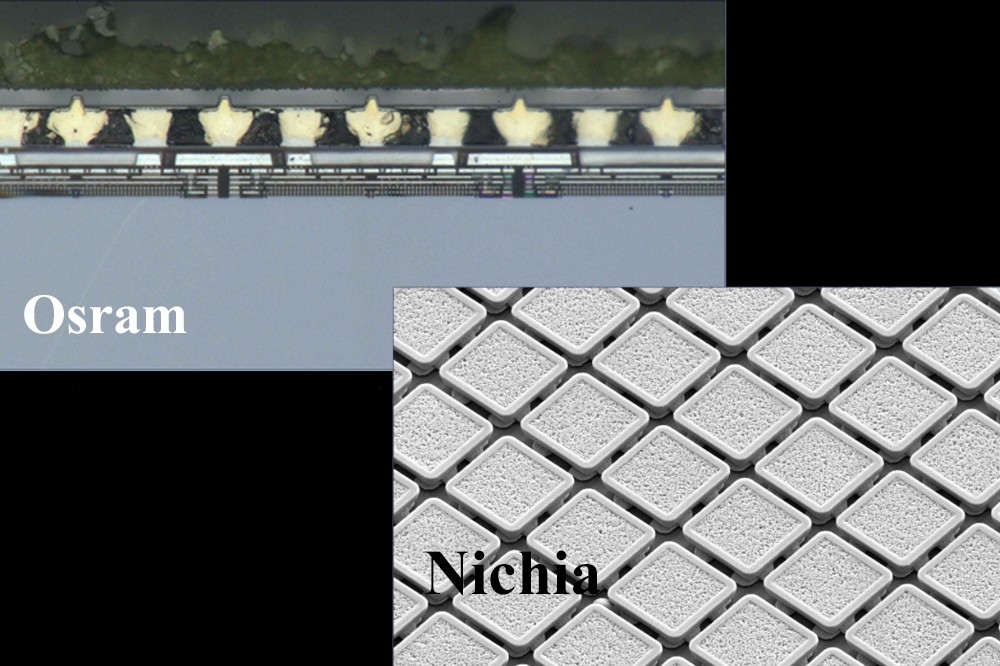

In addition to established power electronics semiconductor IDMs acquiring fabless companies, the industry is set to see newcomers outside of the power electronics industry. These could be players that have GaN LED activity, such as Osram, LG Electronics, and Ennostar, thanks to the synergies with the power GaN technology in terms of epitaxy and device fabrication.

The power GaN industry is set for an exciting evolution in the coming years. More generally, we have recently witnessed several investments from Japanese players in the WBGs, such us Rohm introducing its first GaN products, Denso and Mitsubishi investing $1B in Coherent for SiC wafers, and many others – follow Yole Group’s analysis to hear about these developments first.