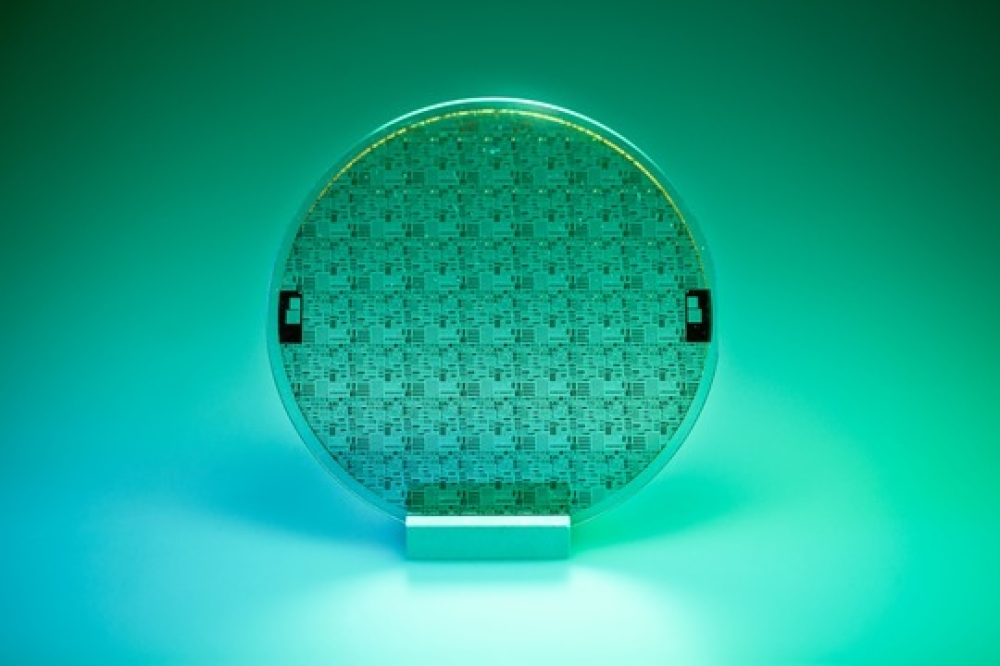

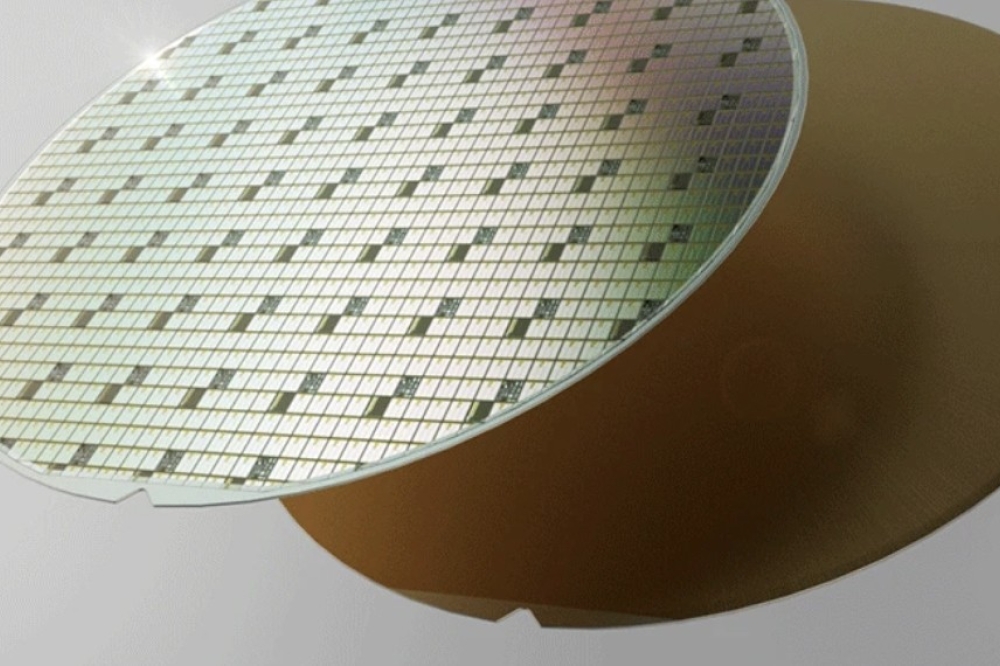

Kymera to acquire SiC specialist Fiven

Kymera International, a specialty materials company, has signed an agreement to acquire Fiven from OpenGate Capital.

With production facilities in Norway, Belgium and Brazil, as well as a global distribution network, Fiven develops SiC materials to a wide range of markets. Through recent R&D initiatives, Fiven has developed high purity materials for power electronics including semiconductors and lithium-ion batteries.

“Fiven has all of the strong attributes we look for in an acquisition. They have an excellent reputation for quality and service, are aligned with Kymera’s strategy of focusing on attractive end markets such as electronics, aerospace and defence, and have an outstanding management team and dedicated workforce,” comments Barton White, CEO of Kymera. “We are excited to partner with Falk [CEO Falk Ast] and his team to continue growing Fiven and capitalise on the numerous operational and commercial synergies we have already identified.”

Kymera has been owned by affiliates of Palladium Equity Partners, LLC, a middle market private equity firm with over $3 billion in assets under management, since 2018.

“The acquisition of Fiven will accelerate Kymera’s mission to become a high-growth specialty materials and chemicals platform, and unlocks substantial organic growth opportunities for the combined business,” adds Adam Shebitz, partner at Palladium Equity Partners.