Chinese OEMs driving RF front end innovation, says Yole

The RF front-end market for mobile devices is undergoing a massive transformation, according to the Yole Group's new report, 'RF Front-End Module for Mobile 2025'.

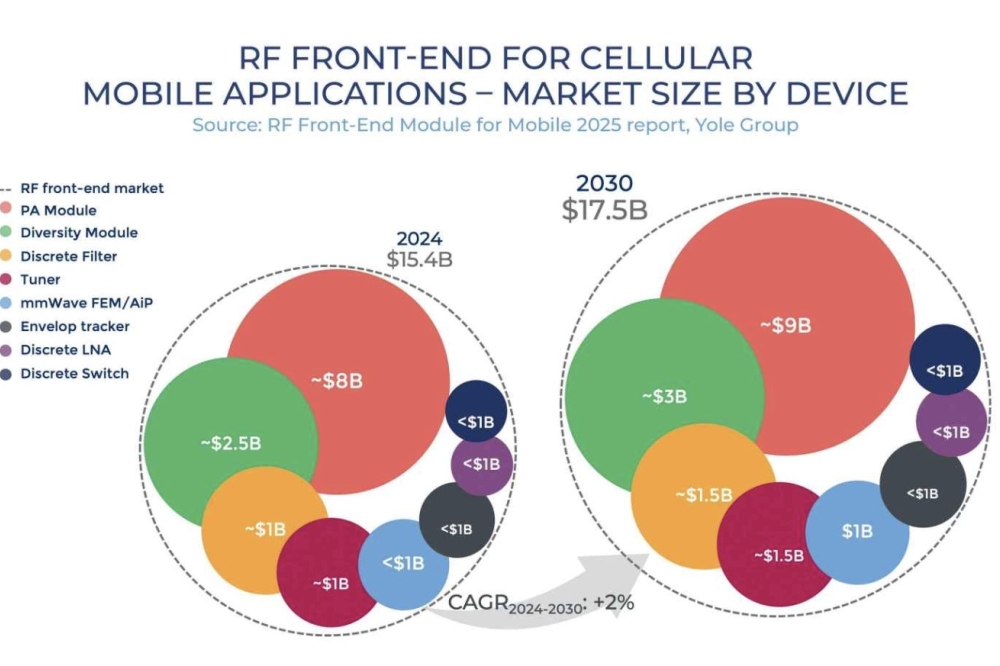

Valued at $15.4 billion in 2024, the market is characterised by a delicate balance of growth drivers, including continued 5G expansion and new 5G bands, and headwinds such as architectural simplification, intense cost pressure, and declining ASPs. Yole forecasts that despite a flat trend through 2027, the market will reach over $17 billion by 2030.

Hassan Saleh, senior technology & market analyst, Radio Frequency at Yole Group, said: "The RF front-end module market is entering a new era of competition. Many Chinese OEMs and suppliers are no longer followers. At Yole Group, we see that they are now setting the pace, driving innovation with an expanding domestic ecosystem of foundries and IDMs and technological capabilities. This rising pressure is forcing historical leaders to adapt quickly, streamline their architectures, and protect their market share in an increasingly cost-sensitive environment."

Chinese OEMs are the engine of this transformation, according to Yole. In 2024, the Chinese smartphone market grew by 6 percent year-on-year, fuelled by surging demand and AI-driven innovation. Huawei’s comeback has been spectacular, posting 25 percent YoY growth and reclaiming the premium segment, while Vivo captured the number one spot with a 17 percent share. Xiaomi, Oppo, and Honor maintained solid positions with 15 percent each, creating a highly competitive domestic landscape.

These market dynamics have empowered Chinese RF suppliers to propose innovative solutions and develop a vertically integrated supply chain, particularly at the filter level and including SAW and BAW. This ecosystem is supported by government incentives, and positions Chinese players to challenge long-established suppliers. (Yole Group investigates the filters market segment with two dedicated reports, SAW Filter Comparison 2025 and BAW Filters Comparison 2025.)

Traditional leaders such as Qualcomm, Broadcom, Qorvo, Skyworks, and Murata still control over 70 percent of the global market but are facing increasing competition. Qualcomm leads with a 21 percent share, thanks to its end-to-end platform strategy, followed by Broadcom with 18 percent, due to its FBAR filter solutions for Apple. However, pricing pressure and Chinese OEM preferences are reshaping design wins and margins.

For example, the Chinese player, Maxscend, leads among Chinese suppliers with a 4 percent share, dominating in discrete devices and growing its module business through vertical filter integration. Other Chinese companies such as Lansus, Vanchip, OnMicro, SmarterMicro, and HiSilicon are also gaining traction, benefiting from Huawei’s domestic supply chain realignment and its push to secure local design wins.

Yole says the next battlefield will be 6G, starting with 6 GHz band front-end modules and progressing to FR3 modules by the end of the decade. Unlike during the 5G rollout, Chinese companies are expected to enter 6G with full domestic capabilities, supported by strong government backing and an evolving foundry ecosystem — a shift that could redefine the global RFFE market balance.