News Article

IQE plans IPO of Taiwan subsidiary

Initial phase of listing expected in first half of 2025

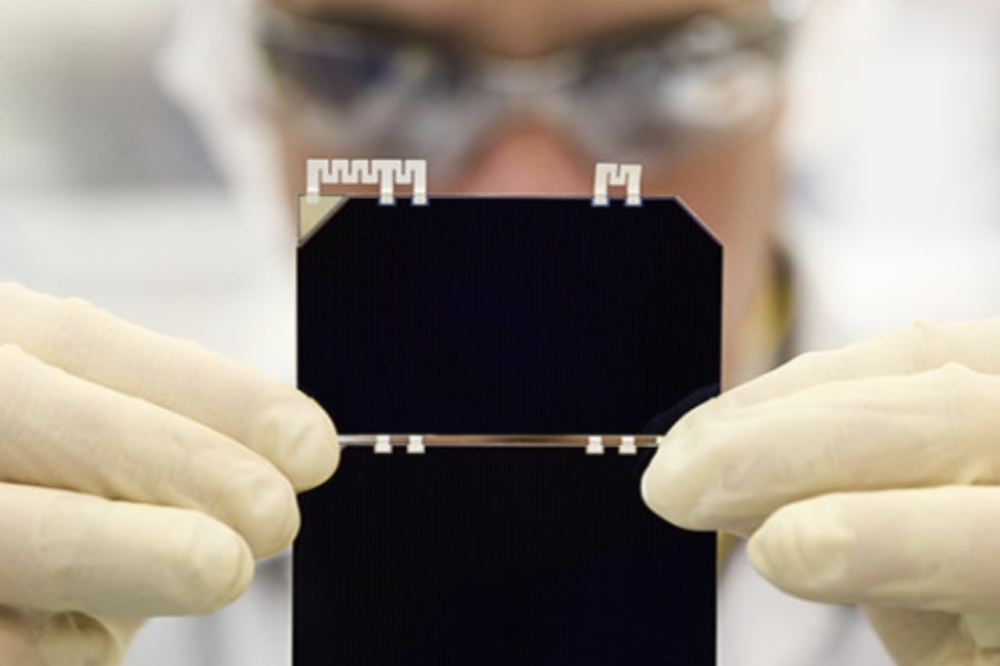

IQE plc, a supplier of compound semiconductor wafer products and advanced materials, has announced the planned initial public offering (IPO) of the group’s Taiwanese operating subsidiary (IQE Taiwan) on the Taiwan Stock Exchange (TWSE).

The intention is to list IQE Taiwan on the TWSE and to sell a minority shareholding through a public offering. It plans to retain control of IQE Taiwan and will continue to leverage its strategic value, with the proceeds of the public offering intended to be utilised across the Group to fund the growth strategy.

Whilst the process is currently at an early stage, IQE has engaged Taishin Securities Co. Ltd as its financial advisor to assist in preparing IQE Taiwan for the IPO. The IPO will be a two stage process, with the initial phase of listing on the Emerging Market Board expected in H1 2025, subject to usual regulatory procedures and requirements.

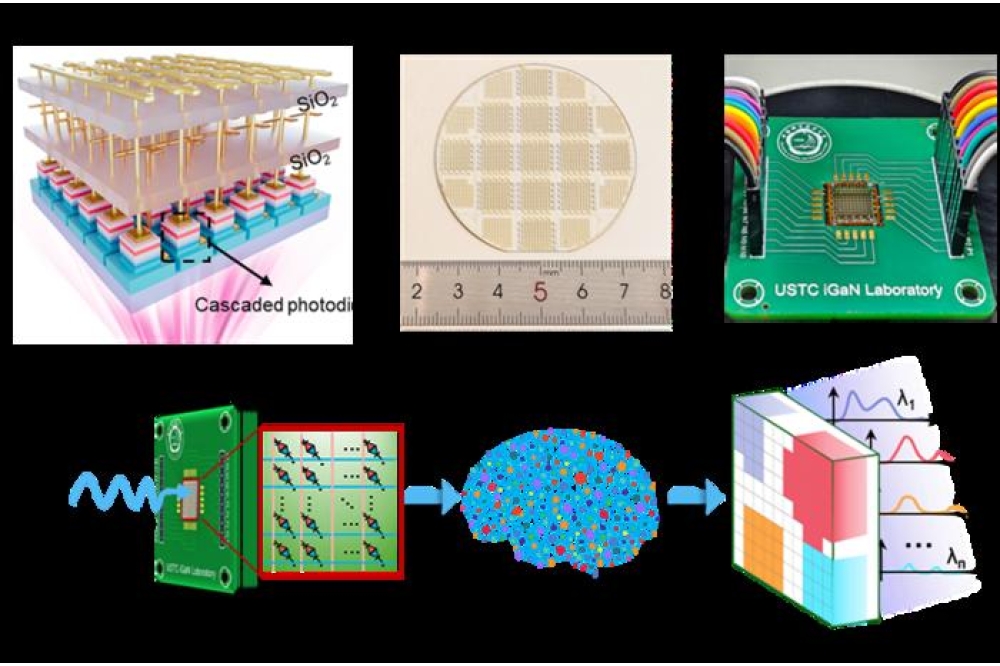

Americo Lemos, CEO of IQE, commented: “This is an exciting opportunity for IQE and will accelerate the investment in our strategy for growth as we capitalise on the market opportunities ahead, including in GaN Power. A successful IPO of IQE Taiwan will allow us to maximise the value of our asset whilst continuing to offer a secure and resilient supply chain for our global customers.”