Rubicon's Q3 results affected by LED substrate factory closure

Rubicon Technology, a provider of optical and industrial sapphire products, has reported financial results for its Q3 ended September 30, 2016.

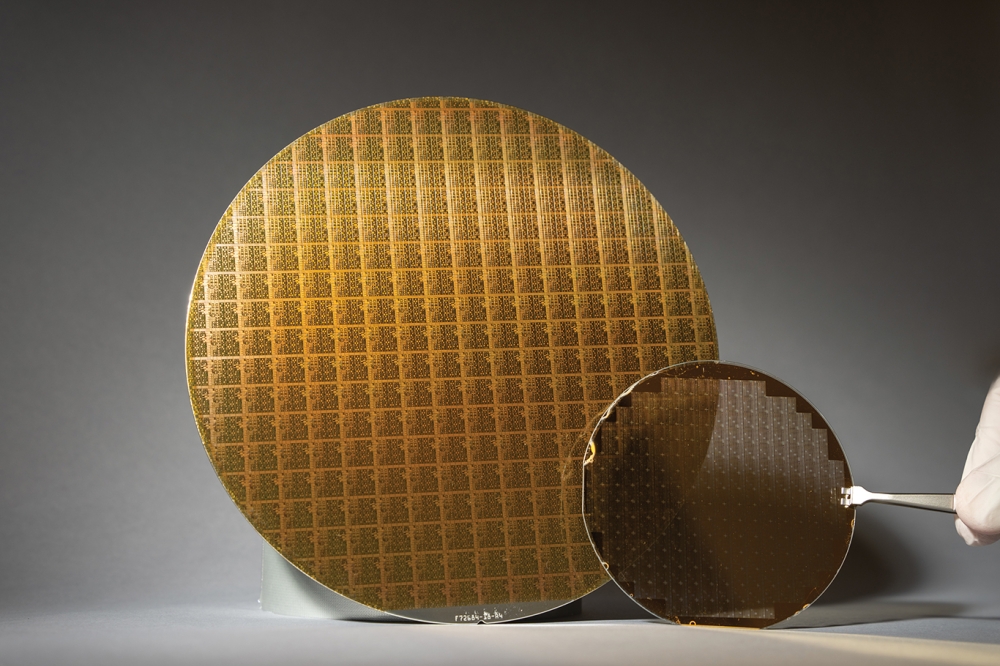

The company reported Q3 revenue of $7.1 million, $3.6 million higher than the prior quarter revenue. Revenue from wafer sales in the Q3 was $5.5 million as compared with $1.8 million in the prior quarter. The higher wafer revenue was the result of increased orders from a key patterned wafer customer along with that customer drawing down all wafers in consignment inventory.

The company's Q3 loss per share was $0.94 as compared with a loss per share of $0.31 in the prior quarter.

The company's Q3 results were impacted by the decision made in September this year to cease all production activities and shut down its Penang, Malaysia facility. The facility has been primarily engaged in producing polished and patterned substrates for the LED market and the decision was made in order for the company to focus on the optical and industrial sapphire market for the foreseeable future.

Production activities at the Penang facility are expected to cease by November 30, 2016, with the shutdown of the facility to be completed by the end of the year.

Bill Weissman, the company's CEO, said: "While margin pressure in the LED and mobile device segments of the sapphire market continue to be severe, there remains good margin opportunity in the optical and industrial segments. We believe that the actions we are taking will improve our operating results, strengthen our cash position and allow us to grow in strategic markets that are better aligned with our strengths while offering stronger margin potential. Once the changes are fully implemented, our revenue will be smaller for a period of time, but the optical and industrial sapphire markets are growing with potential new applications for sapphire emerging.

"Once our Malaysia facility ceases production activities, our wafer revenue will significantly decrease beginning in the fourth quarter of 2016 and into future periods."

One-time charges in the quarter related to the decision to exit the LED market and close the Malaysia facility included; a $10.2 million asset impairment for writing the Malaysia assets down to liquidation value, a write-down of $4.0 million in excess raw material inventory, and $900 thousand in accrued severance. In addition, the company recorded a write-down of $2.3 million of excess two-inch core inventory, which is sold primarily into the mobile device market, and severance of $180 thousand for reduction of staffing in the US.