Veeco to acquire Ultratech for $815 million

Process equipment company Veeco Instruments has announced its intention to acquire Ultratech, a supplier of lithography, laser-processing and inspection systems, for around $815 million.

Ultratech shareholders will receive $21.75 per share in cash and 0.2675 of a share of Veeco common stock for each Ultratech common share outstanding. Based on Veeco's closing stock price on February 1, 2017, the transaction consideration is valued at approximately $28.64 per Ultratech share.

The implied total transaction value is approximately $815 million and the implied enterprise value is approximately $550 million, net of Ultratech's net cash balance as of December 31, 2016. Post transaction it is projected that Ultratech's hareholders will own approximately 15 percent of the combined company.

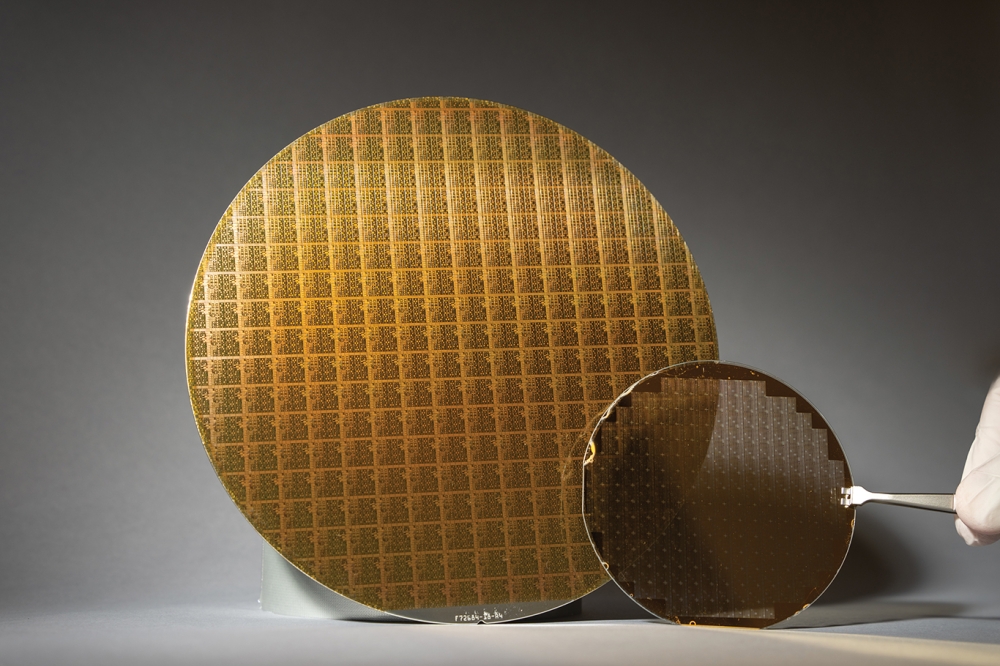

Ultratech, which has its headquarters in San Jose, California, is a recognised leader of lithography products for advanced packaging applications and for LEDs and is a pioneer for laser spike anneal technology used for the production of semiconductor devices.

In addition, the company offers wafer inspection solutions using its proprietary coherent gradient sensing (CGS) technology which address a wide variety of semiconductor applications.

"The strategic combination will establish Veeco as a leading equipment supplier in the high growth advanced packaging industry. Ultratech's leadership in lithography together with Veeco's Precision Surface Processing (PSP) solutions form a strong technology portfolio to address the most critical Advanced Packaging applications, " said John R. Peeler, Veeco's chairman and CEO

"˜We believe our complementary end market exposure and customer relationships will create the ideal platform to accelerate growth," he added. "Ultratech is a great fit with our strategy to profitably grow our business and diversify our revenue. We expect this transaction to be immediately accretive to adjusted EBITDA and non-GAAP EPS."

Ultratech chairman and CEO, Arthur W. Zafiropoulo said; "Both companies have a strong heritage of developing innovative and cutting-edge technologies. The combined company will create a formidable team to execute against growth opportunities and deliver significant value to customers and shareholders."

The transaction is expected to close in the second calendar quarter of 2017, subject to approval by Ultratech shareholders, regulatory approvals in the US and other customary closing conditions.