Lighting Not Driving LED Growth in 2017

Automotive and signage segments growing as much as lighting in 2017, says IHS Markit analyst

Strong growth in packaged LED lighting revenue from 2007 to 2014 was the result of consumers replacing incandescent and fluorescent lighting with LED lighting. However, price erosion due to competition and the trend toward less robust, inexpensive 2835 packages caused revenues to decline by 9 percent in 2015 and only 1 percent in 2016, according Jamie Fox, principal analyst, lighting and LEDs group, IHS Markit.

Starting in 2017, revenue growth is expected to increase by 3 percent as prices settle. In 2017, automotive and signage segments are growing as much as lighting, with each of the three applications forecast to be $200 million higher than packaged LED revenue in 2016. Furthermore, horticulture is projected to see the fastest growth in 2017 although the absolute increase in dollars will be lower compared with automotive, lighting and signage.

If not lighting, then what?

Automotive is boosted by increasing LED use on vehicle exteriors, in headlamps and other areas such as daytime running lights, rear lighting, turning lights and interior vehicle illumination for both cars and heavy vehicles such as trucks and buses. Automotive packaged LED revenue is forecast to grow 9.2 percent in 2017, from $1.9 billion to $2.1 billion.

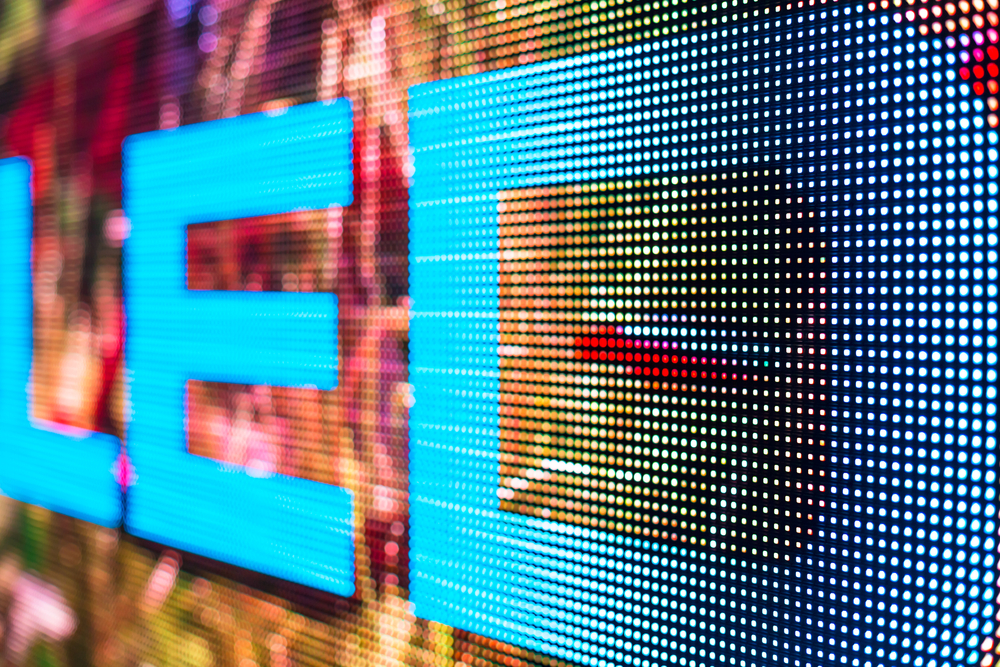

Signage use is boosted by the trend towards finer pitch displays and the fact that LED displays are not a mature market; growth is possible by finding new business, not only replacement. Signage markets include large full color displays known as videowalls, as well as road signs, traffic lights and building lettering. Signage is forecast to grow 11.5 percent from $1.8 to $2.0 billion.

Horticulture is a smaller market but in percentage terms will grow even faster in 2017 than signage and automotive.

Lighting growth should resume after 2017

Lighting growth from 2018 to 2022 is forecast to increase 6 to 7 percent per year due to a strong forecast for LED lamp shipments and reduced price erosion at the packaged LED component level. Due to basic material costs, company overheads and the slow reduction of subsidies in China, it will not be possible for prices to fall as quickly as they did from 2007 to 2014. In CAGR terms, lighting still is forecast to have a slightly lower 2016-2022 CAGR (6.1 percent) than automotive exterior (7.9 percent) and signage (8.5 percent).

How LED manufacturers are reacting

LED manufacturers are no longer focused on only packaged LEDs for lighting for growth. Now most companies have entered automotive, signage or horticulture segments, or are considering doing so. The era of specialists is over; now, everyone does everything.

To deal with reduced growth in visible LEDs, LED manufacturers are increasingly producing more infrared and ultraviolet LEDs to create new revenue streams. In addition, in a slow trend that already started some years before, LED manufacturers are now more vertically integrated, selling complete modules and light engines, and sometimes complete LED lamps.