Growth in Smartphone Production Drops to 8.5 percent

India’s second wave of coronavirus impacting smartphone market, says TrendForce

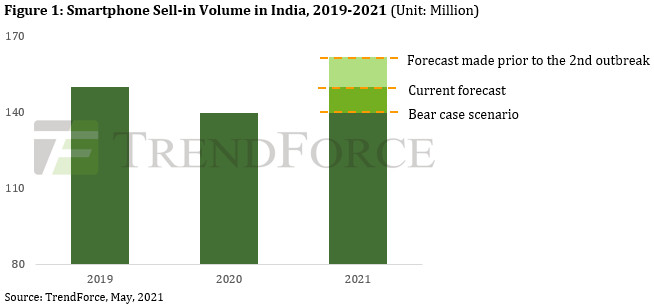

TrendForce’s investigations find that India has become the second largest market for smartphones since 2019. However, the recent worsening of the COVID-19 pandemic in the country has severely impaired India’s domestic economy and subsequently dampened various smartphone brands’ production volume and sales (sell-in) performances there. TrendForce is therefore revising the forecasted YoY growth in global smartphone production for 2021 from 9.4 percent down to 8.5 percent, with a yearly production volume of 1.36 billion units and potential for further decreases going forward.

TrendForce further indicates that the top five smartphone brands (Samsung, Apple, Xiaomi, OPPO, and Vivo) have either set up assembly plants in India or sought assistance from EMS providers with operations in the country. Hence, the share of made-in-India smartphones has been on the rise over the years, even though the majority of the domestically manufactured devices are still for meeting the demand of the home market.

Judging from the current state of Indian smartphone manufacturing, TrendForce expects the second wave to reduce the country’s smartphone production volume for 2Q21 and 3Q21 by a total of 12 million units, in turn resulting in a 7.5 percent YoY decrease in smartphone production in India for the whole year.

In India, the second wave of COVID-19 has heavily impacted the middle and upper classes and weakened the sales of smartphones in 2Q21

India’s demographic dividend has generated an enormous demand in the domestic smartphone market. As well, the Indian government has been actively promoting domestic electronics manufacturing so as to boost the economy and create new job opportunities.

On one hand, the Indian government has instituted a more restrictive tariff policy to force the localization of the supply chain. On the other hand, it is offering incentives to international smartphone brands so that they will expand the share of local device production. According to local news, people from the more affluent middle and upper classes are being hit the hardest by the second wave. This development will directly impact the country’s smartphone market in 2Q21 by weakening domestic consumer demand and in turn causing a drop in the ASP of smartphones.

Smartphone brands are therefore expected to closely monitor their inventories of whole devices and adjust their subsequent production plans accordingly.

The top four smartphone brands in India, which are Xiaomi, OPPO, Samsung, and Vivo, with respective market shares of 25 percent, 23 percent, 22 percent, and 16 percent, collectively account for about 86 percent of the country’s total sales.

As these brands primarily focus on the $100-$250 product segment, the worsening pandemic has had an impact on all of them. With regards to manufacturing operations, most factories are reportedly operating normally without being disrupted by the pandemic. However, the accelerated spread of the coronavirus may adversely affect the lower and middle classes, who comprise the vast majority of the labor force.

Should the health crisis in India remain unaddressed, TrendForce believes that the country’s import/export operations may come to a standstill as a result, and transportation of key smartphone components may also be disrupted.

On the whole, if the pandemic were to remain uncontained in India throughout 2Q21, then the country’s economic outlook for 2H21 would likely be less than optimistic, and there would be a further reduction in global smartphone production for the year. If these developments were to take place, then TrendForce proposes a “bear case scenario” in which the global smartphone production for the year increases by less than 8 percent YoY.