Moov Announces EU Expansion

Moov, the world’s largest marketplace for pre-owned semiconductor equipment, is excited to welcome Eric Tribolet as Director of European Sales. A 25-year semiconductor industry veteran, Tribolet spent the last decade developing an expertise in chemicals used in front end semiconductor processes, working with clients that include top European semiconductor manufacturers. Most recently, Tribolet held the position of Global Business Director Europe for CMC Materials (acquired by Entegris).

“We are excited to welcome Eric to Moov as we expand our presence in European markets,” said Moov CEO and cofounder Steven Zhou. “Eric’s wealth of experience working with top European semiconductor manufacturers and his technical expertise in process and analytical equipment will be an asset to Moov and our customers as we help shape the future of European semiconductor manufacturing by enabling more economically and environmentally sustainable capital equipment investment.”

Over the course of his two-and-a-half decades in the semiconductor industry, Tribolet held various sales and marketing management positions at Ashland Electronic Chemicals Division, Air Products and Chemicals, KMG, and Cabot Microelectronics. For the last 14 years, Tribolet’s primary focus on chemicals used in semiconductor processing has afforded him in-depth technical expertise in front end processes such as wet cleaning, etching, and stripping.

“I’ve had the opportunity to build trusted relationships with leading European chipmakers as their supply chain partner for the past 25 years,” said Tribolet, “I look forward to expanding these relationships at Moov by bringing European fabs a better solution for sourcing and disposing of both front and back-end equipment. As Europe strives to grow its share of global semiconductor manufacturing capacity, a solution like Moov, which allows fabs to more nimbly scale capacity and recoup capital on underutilized assets, is more critical than ever.”

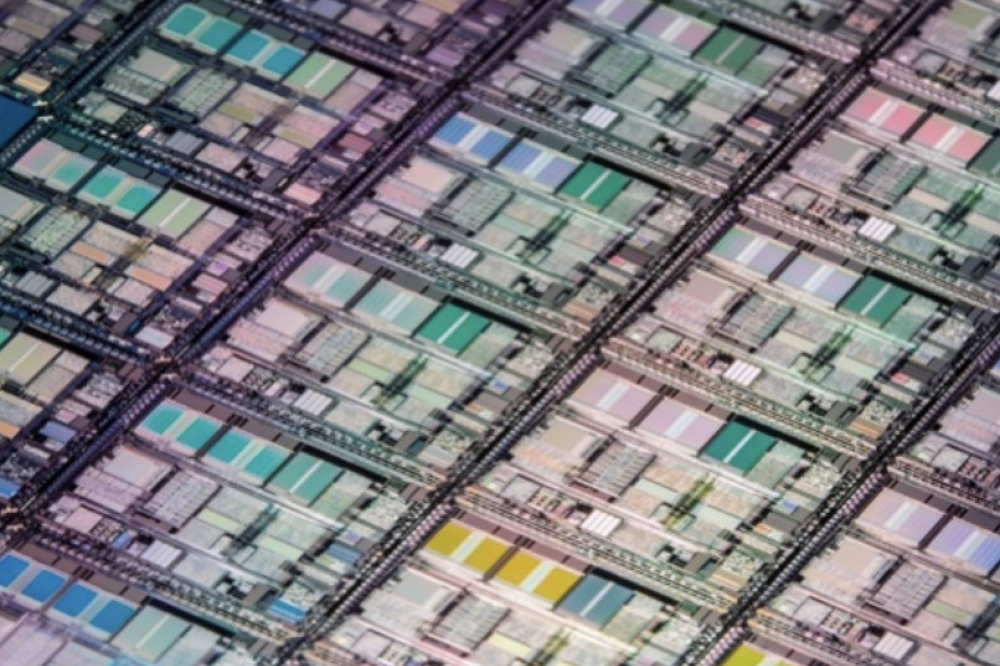

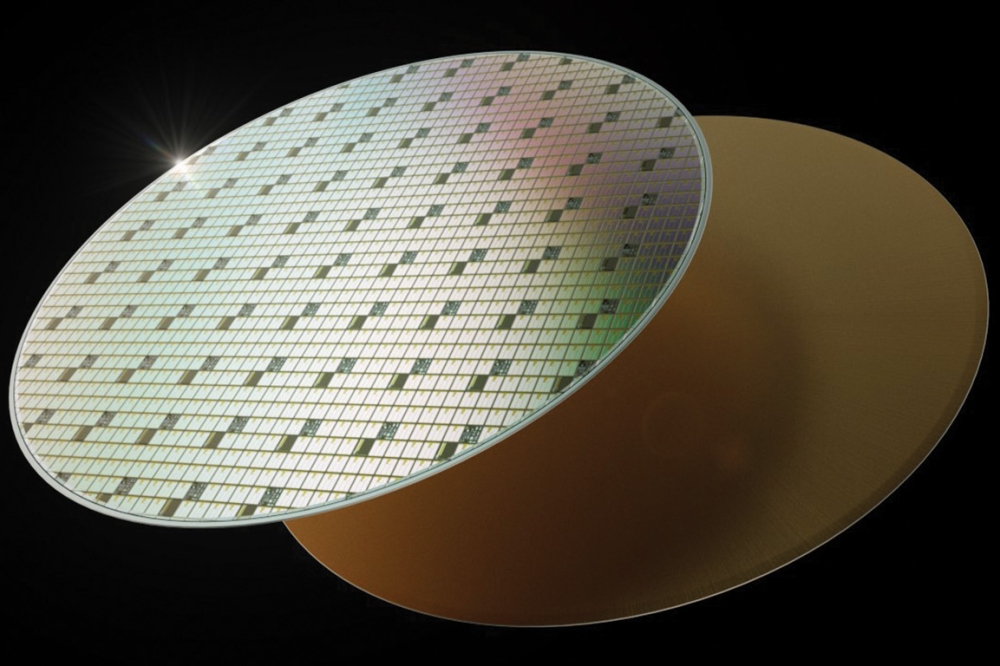

The EU Chips Act, passed in July, 2023, allocates €43 billion in public and private investment to double the EU’s global market share in semiconductors, from 10% now to at least 20% by 2030.

Leading global semiconductor manufacturers are advancing plans to expand their manufacturing footprint in the EU. TSMC will break ground this year on a 10-billion-euro plant in Dresden, Germany; GlobalFoundries and Amkor kicked off their partnership to enable a “comprehensive EU supply chain” opening a facility in Porto, Portugal in January of this year; and Intel has announced plans to spend 30 billion euros on two fabs in Magdeburg.

To better serve manufacturers looking to ramp up capacity in the EU, Moov has plans to increase headcount in Europe in 2024. Zhou said Moov has already seen substantial interest from European manufacturers in Moov’s new equipment management software announced in January, as part of the broader platform Moov offers to help chipmakers maximize returns on capital equipment.

“As chipmakers look for ways to cost effectively expand their manufacturing footprint in Europe, it will be crucial for them to have an ecosystem of supply chain partners, like Moov, that can help them scale up (or down) capacity quickly,” said Zhou. “And, with Europe’s increased focus on environmental sustainability across all sectors, the concept of a more circular manufacturing equipment economy – which Moov enables – is a natural fit for this market.”