Cree to Restructure LED business

US LED firm Cree has announced a restructuring of its LED business due to recent market trends that have resulted in higher LED average selling price erosion than previously forecast and the continued under-utilisation of Cree's LED factory.

As of this process, company plans to reduce excess capacity and overhead to improve the cost structure moving forward. Additionally, it is increasing LED reserves to reflect the more aggressive pricing environment experienced in the current quarter, and to factor in a more conservative pricing outlook for fiscal year 2016.

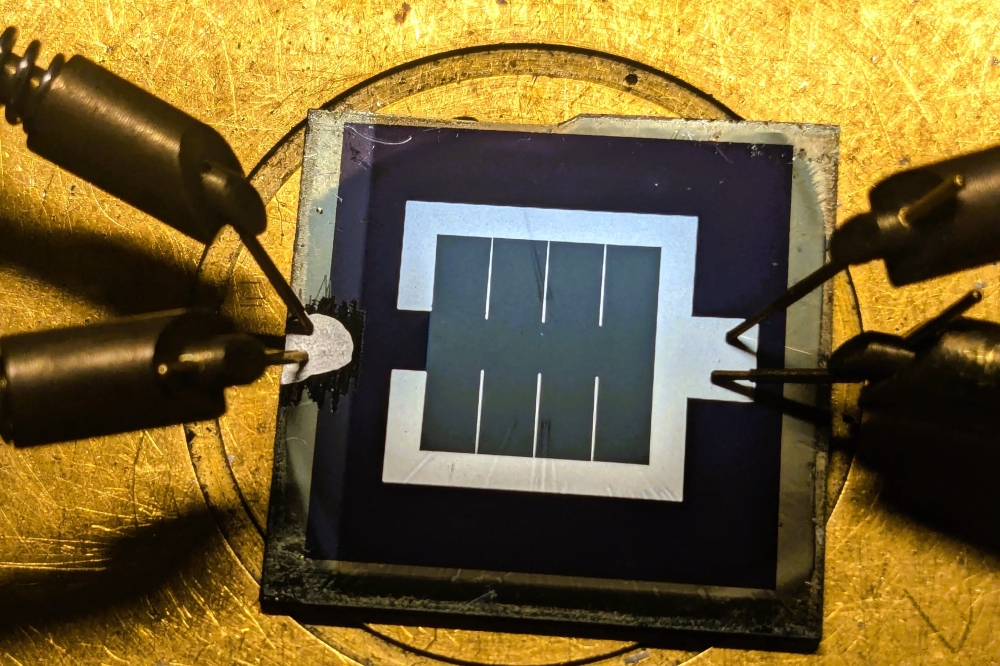

The restructuring charges are targeted to be approximately $85 million and the anticipated amounts by category are as follows, including what will be included in GAAP and Non-GAAP results:

![]()

The company anticipates that the majority of the capacity and overhead related charges will be reflected in operating expenses for the fourth quarter of fiscal year 2015 ending on June 28, 2015, with the balance in the first half of fiscal year 2016. The company anticipates that the channel revenue reserves will be reflected as a reduction of revenue in fiscal Q4, and the inventory reserves will be reflected as an increase in cost of revenue in fiscal Q4.

For fiscal Q4, the company now targets revenue to be approximately $375 million, which includes the $27 million revenue reserve discussed above.

"¢ Lighting Products revenue is targeted to increase slightly sequentially, as strong growth in commercial lighting is expected to more than offset a greater-than-targeted seasonal slowdown in consumer bulb sales.

"¢ Power & RF Products revenue is tracking in-line with the company's targets for fiscal Q4.

"¢ LED Products customer unit demand is generally in-line with our targets for the quarter; however, the combination of the revenue reserves and lower pricing in the quarter is forecast to reduce fiscal Q4 revenue by approximately $35 million.

"¢ Overall gross margin and operating margin are now forecast to be lower than previously targeted due to the restructuring costs, the more aggressive LED pricing environment, and the larger than targeted seasonal slowdown in consumer lighting.

"¢ During fiscal Q4, the company completed the previously announced $550 million share buyback program by repurchasing 4.8 million shares of its common stock at an average price of $33.37 per share, with an aggregate value of $160 million. For fiscal year 2015, the company repurchased 16.0 million shares of its common stock at an average price of $34.33.