Solid Q3 for MACOM with record $130.7M revenue

MACOM, a US supplier of high-performance analogue RF, microwave, millimeterwave and photonic semiconductor products, has announced its financial results for its fiscal third quarter ended July 3, 2015.

GAAP revenue was $130.7 million, compared to $124.9 million in the prior fiscal quarter and $112.4 million in the previous year's fiscal third quarter. Gross profit was 45.8 percent, compared to 43.2 percent in the prior fiscal quarter and 44.7 percent in the previous year's fiscal third quarter. Operating income was $10.2 million, compared to $3.3 million in the prior fiscal quarter and $7.3 million in the previous year's fiscal third quarter.

Net income was $8.0 million, or $0.15 income per diluted share, compared to net loss of $7.5 million, or $0.15 loss per diluted share, in the prior fiscal quarter and net income of $1.2 million, or $0.02 income per diluted share, in the previous year's fiscal third quarter.

Non-GAAP results were also up on last quarter and 2014. Gross profit was 54.0 percent, compared to 53.1 percent in the prior fiscal quarter and 51.7 percent in the previous year's fiscal third quarter. Operating income was $32.3 million, or 24.7 percent of revenue, compared to $30.3 million, or 24.3 percent of revenue, in the prior fiscal quarter and $23.9 million, or 21.3 percent of revenue, in the previous year's fiscal third quarter;

EBITDA was $35.6 million, compared to $34.1 million for the prior fiscal quarter and $27.2 million for the previous year's fiscal third quarter; and

Net income was $23.1 million, or $0.42 per diluted share, compared to net income of $21.3 million, or $0.41 per diluted share, in the prior fiscal quarter and net income of $15.8 million, or $0.33 per diluted share, in the previous year's fiscal third quarter.

John Croteau, MACOM's president and CEO stated: "I am pleased to announce another quarter of solid execution. During the fiscal third quarter Networks grew on the back of strong demand in 100G for long haul and metro and lasers in the access market. In addition, we saw weakness in multi-market, including industrial. That said, end market demand across the full breadth of our catalogue portfolio including Networks and A&D more than offset this weakness and actually grew sequentially.

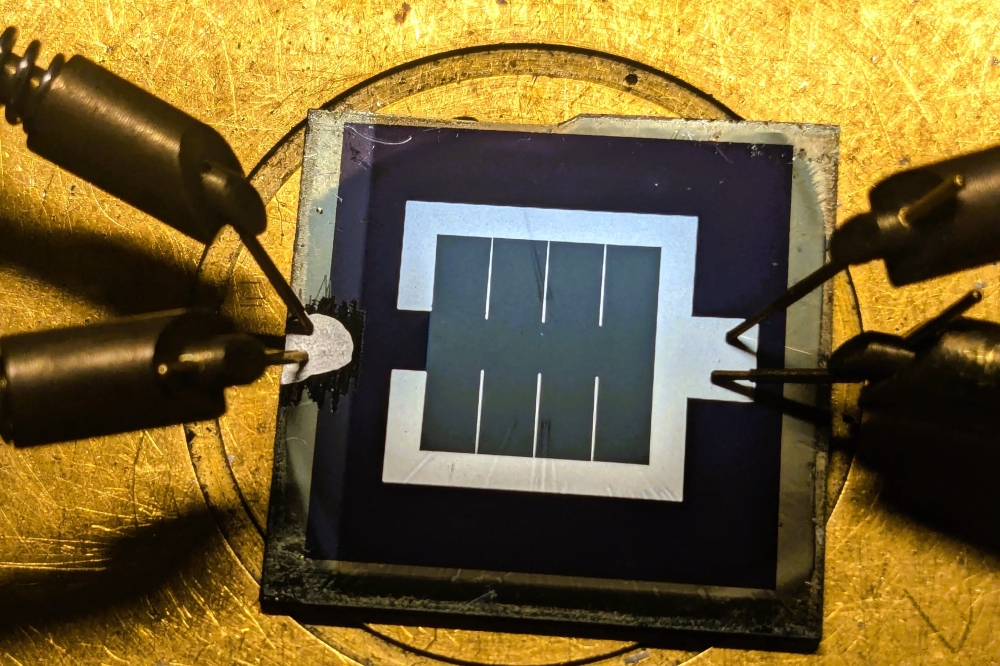

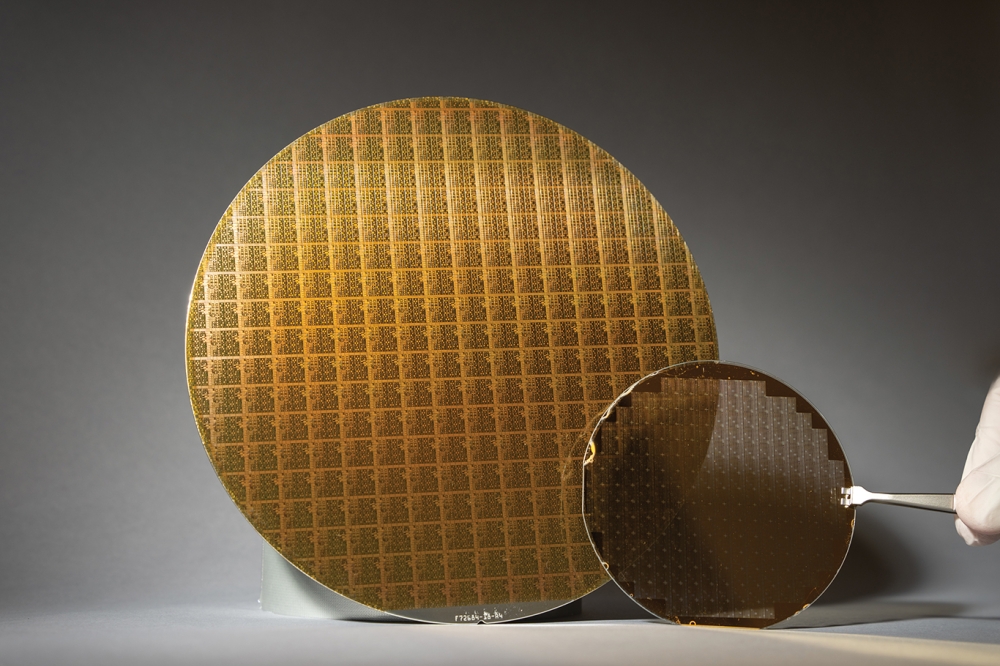

"During the quarter, we successfully achieved our goal of doubling laser production capacity at our Ithaca fab. We remain on track to double production capacity using our Lowell fab by the beginning of calendar 2016. These expansion efforts will enable us to address the next secular growth opportunity in datacenters."

Croteau concluded: "In mid-July we announced a definitive agreement to divest our automotive business to Autoliv ASP Inc. This divestiture supports MACOM's strategy to be a pure-play high performance analogue company. We expect it will significantly accelerate our ability to meet our target operating model of 60 percent non-GAAP gross margin and 30 percent non-GAAP operating margin. We anticipate our optical and laser businesses will continue to outperform allowing us to meet our growth and profit objectives."

Business Outlook

For the fiscal fourth quarter ending October 2, 2015, MACOM expects another quarter of growth with revenue expected to be in the range of $133 to $137 million. Non-GAAP gross margin is expected to be between 53 and 55 percent, and non-GAAP earnings per share between $0.43 and $0.46 on an anticipated 55.5 million shares outstanding, based on an increased share count following the public offering of common stock completed in February.