Veeco's Q2 revenue up 38 percent

Process equipment company Veeco Instruments has announced financial results for its second fiscal quarter ended June 30, 2015.

It achieved revenue of $131.4 million, an increase of 38 percent compared with the same period last year. Non-GAAP adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation) was up to $12.8 million or around 10 percent of revenue. The company has also reported narrowing GAAP loss to ($0.21) per diluted share.

Non-GAAP earnings grew to $0.20 per diluted share and it generated $7.7 million in cash from operations.

![]()

"We delivered solid second quarter results, achieving financial performance in line with our expectations across all P&L guided metrics. Revenue grew by around 38 percent year-over-year and adjusted EBITDA increased to nearly 10 percent of revenue. These results illustrate our continued focus on driving growth and operational execution," commented John R. Peeler, chairman and CEO

"Our top line growth has been fueled by the rapid adoption of our TurboDisc EPIKTM700 MOCVD system. This latest generation product offers lower cost of ownership for our customers and improved margin contribution for Veeco, as compared with prior generation tools. We have now successfully demonstrated the tool's capabilities across multiple customers, which enabled us to begin recognising revenue upon shipment towards the end of the second quarter.

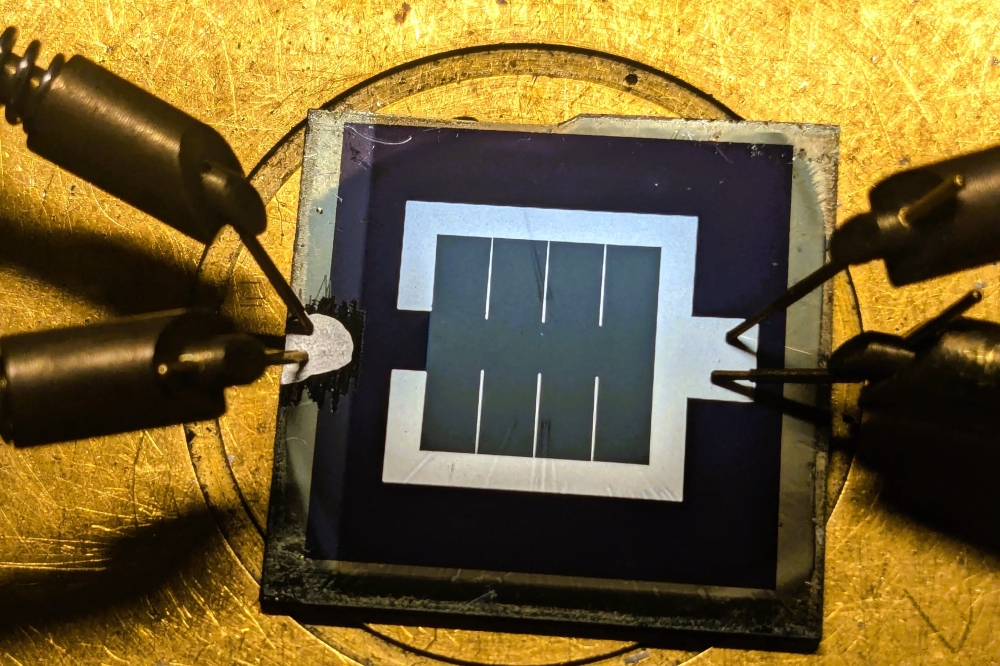

"Our Precision Surface Processing (PSP) business is performing exceptionally well and demand for these products remains healthy. Our differentiated and highly flexible process technology is well established in the broader MEMS market and gaining momentum in the Advanced Packaging space," Peeler concluded.

Guidance and Outlook

For Veeco's third fiscal quarter 2015: revenue is expected to be in the range of $135 million to $160 million; adjusted EBITDA is expected to be in the range of $14 million to $24 million;GAAP earnings (loss) per share are expected to be in the range of ($0.05) to $0.19; and non-GAAP earnings (loss) per share are expected to be in the range of $0.22 to $0.40