SiC: all systems go

Cree's recent APEI acquisition is set to unlock the true potential of silicon carbide. Compound Semiconductor talks to company executives to find out more.

Cree has acquired APEI for its additional intellectual property and applications expertise at the systems level.

To say the last few months have been eventful for Cree's power and RF division would be something of an understatement.

In May, the US-based wide bandgap industry heavyweight unveiled plans to spin off this business as a separate company.

From word go Cree's LED and lighting sectors have overshadowed its power and RF arm, but this decisive move signalled the company's confidence in the growing SiC power device market.

And then in July, Cree acquired power module and electronics applications pioneer, APEI, US, to drive its high performance SiC module business forward.

Up until now, Cree's key four power markets have been switch-mode power supplies for servers, solar inverters, high frequency power supplies for industry applications and electric vehicle chargers. Clearly the company is now after more.

"We're trying to make a strong move into the power market," explains John Palmour, chief technology officer of Power and RF at Cree. "The larger, higher power markets really require power modules, and that's why we've acquired APEI."

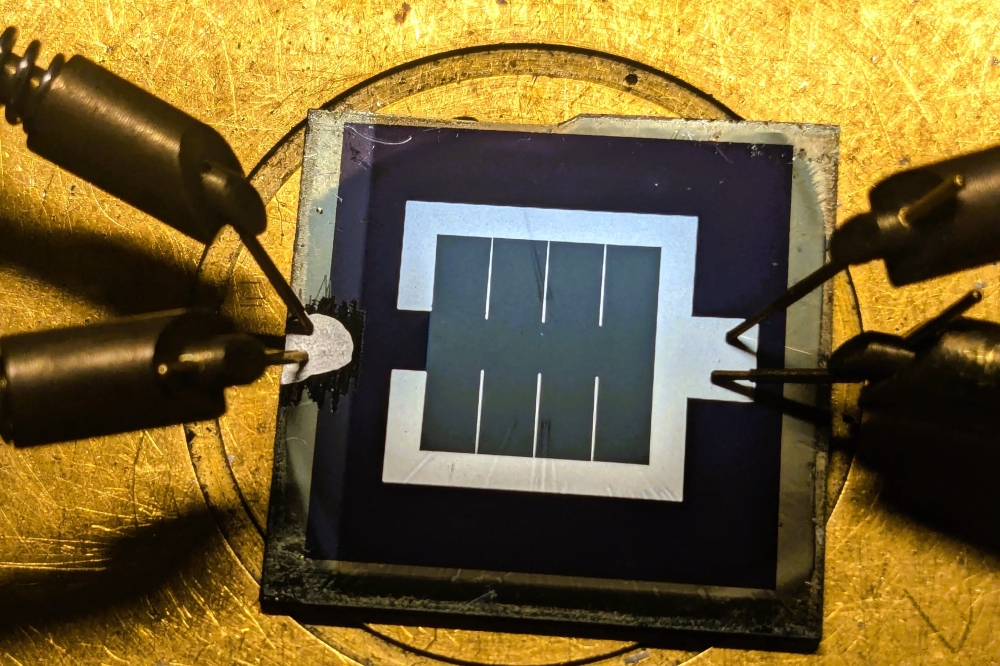

As Palmour highlights, APEI has not only developed high performance power modules, but has carried out extensive systems development to showcase its products.

"It's easy enough to talk about the electronics characteristics of silicon carbide but people don't often believe it until they see it in a system demonstration," he says "Only then do they fully realise, for example, the value of size reduction, weight savings, higher frequency operation."

"And whereas you see a lot of people dropping silicon carbide into pretty standard modules designed for silicon, APEI has started with the silicon carbide chip and built outwards to optimise everything about the module for this," he adds.

Packaging plans

While the merging of APEI with Cree is still very fresh in the minds of many industry players, the power pair has already collaborated on many government SiC power product-related contracts.

In 2014, for example, the companies developed a SiC-based plug-in hybrid electric vehicle battery charger through an ARPA-E program. And right now, development of a traction drive for automotive applications is underway.

Crucially, as part of such module development, APEI has designed packaging specifically for SiC modules, a strength that company president and chief executive, Alex Lostetter, is quick to point out.

"In the overall industry, power packaging [for modules] has focused on more traditional [development] that's tied to silicon," he explains. "Somebody needs to come in and push development for SiC and wide bandgap semiconductors, to bring out the advantages of these technologies."

"There's not many people doing this, so this is now one of our focuses," he adds. "Cree already has its standard module products so we're looking at strengthening those and combining forces on future iterations; some [developments] will be optimisations while some will be novel. We'll see what the future holds."

![]() Acquisition celebrations: Cree's John Palmour (right) and Alex Lostetter, APEI, now intend to rapidly integrate the two companies.

Acquisition celebrations: Cree's John Palmour (right) and Alex Lostetter, APEI, now intend to rapidly integrate the two companies.

Palmour concurs, but is reluctant to reveal details on development plans, simply saying, 'APEI has developed SiC packaging and we will be working on that together'. However, like Lostetter, he is keen to emphasise the importance of new packaging for SiC modules.

As he highlights, wide bandgap semiconductors operate at higher current densities than silicon devices, but today's standard module packages do not provide the power dissipation demanded for such high performance operation.

At the same time, the higher frequencies and switching speeds of SiC semiconductors are hindered by the high loop inductance in standard modules.

"If you use a standard module design you still get a lot of the SiC benefits but you're also leaving a lot of the performance on the table," says Palmour.

So, Cree's latest acquisition looks set to drive the SiC market forward faster than ever. APEI is to be called Cree Fayetteville and will continue to operate in Fayetteville, Arkansas, as part of Cree's Power and RF business.

According to Losetter, the 'new' company will be developing SiC modules for higher voltage markets. As he says: "Right now, we see the real opportunities are in the 1200 V to 1700 V ranges."

At the same time, Palmour is confident the industry supply chain is now 'pretty healthy' and highlights the several substrate vendors and power MOSFET players that now exist.

"Multiple companies are developing power modules around these MOSFETs, so an early supply chain is in place... we can reinforce this with APEI," he says.

And right now, the two executives are rapidly integrating the two companies. While talking to Compound Semiconductor, both Palmour and Lostetter were together at Arkansas, to, in the words of Cree's chief technology officer, 'work out how to get things moving as quickly as possible'.