InP: great expectations

As AXT buys Crystacomm, Morris Young, AXT CEO, tells Compound Semiconductor about plans for six inch InP substrate growth, mobile markets and more.

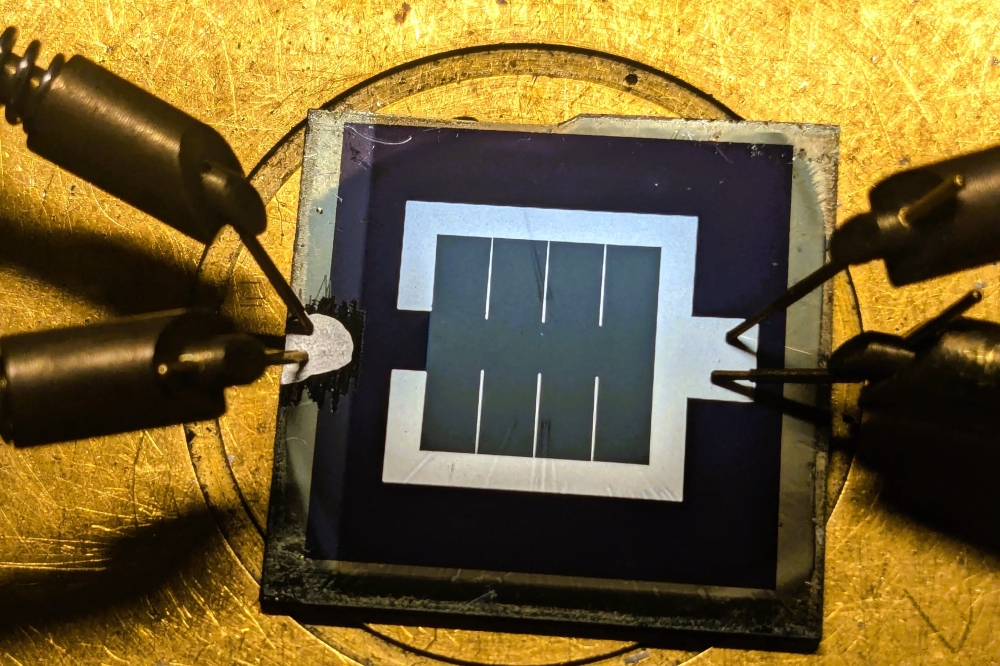

InP hope: Can AXT grow six inch InP substrates for next generation wireless markets?

In late July, compound semiconductor substrate maker, AXT, acquired California-based InP substrate developer, Crystacomm in an all-cash deal.

While AXT is perhaps best known for supplying wireless device markets worldwide with GaAs substrates, the California-based business also grows InP substrates, which begs the question; why buy Crystacomm? The answer lies in markets and quick, cost-effective crystal growth.

Ten years ago, AXT's GaAs substrate sales were rising rapidly, largely thanks to increasing GaAs content in mobile products and a resurgent LED industry.

Smartphones, netbooks and more, were supporting new features that demanded an increasing number of power amplifiers and switches, reliant on GaAs substrates.

Meanwhile automotive and display lighting was driving LED sales with two-, three- and four-inch GaAs substrates scooping the lionshare of the market.

Fast forward a decade and the semiconductor market is a different place. "The cellphone switch business, which we supplied with GaAs pHEMTs, has been beaten back by SOI taking market share," points out AXT chief executive Morris Young. ""The GaAs landscape has taken this on the chin; for example, Hitachi Cable went out of business."

"Also, business opportunities do exist for LEDs, but pricing pressures have been very severe, so we don't have a lot to report here," he adds.

But amid the struggle, InP has become, in Young's words, 'AXT's bright spot'. As the chief executive highlights: "In 2010, InP substrates were a small portion of our revenue contribution, but this business segment has since grown very nicely and InP now claims the largest proportion of our revenue."

New applications

Right now AXT's InP substrates are largely supplied to manufacturers of lasers and photodetectors for fibre-optics network applications, including fibre-to-the-home as well as data centre communications.

However, device manufacturers are increasingly keen to harness the material's high electron mobility in the fabrication of HBTs and HEMTs. Indeed, looking to the future, 5G mobile networks could hold tremendous promise for this flavour of substrate.

According to Young, next generation wireless communications networks will demand frequencies as high as 25 GHz, which devices fabricated on silicon substrates, and even GaAs wafers, will struggle to support.

"InP is the natural choice as it has the properties to enable the increasing requirements of 5G, and is also lower in cost and power consumption than GaN," he says. "We know a very large wireless device maker has been looking at InP very seriously."

And this where AXT's latest acquisition is important. Crystacomm was the first to deliver two, three and four inch commercial InP substrates and is also leading the development of six inch InP technology, which could prove vital to the development of cost-effective, InP-based transistors for 5G wireless devices.

What's more, while AXT has pioneered Vertical Gradient Freeze (VGF) growth for InP, and other substrates, Crystacomm has focused on Liquid Encapsulated Czochralski (LEC) growth.

Compared to LEC growth, VGF growth can produce substrates with relatively low defect densities and higher mechanical strengths, leading to better epi-layer quality and higher circuit yields during device production, as well as superior device performances. But when it comes to six inch InP wafers, VGF growth is simply too expensive.

As Young asserts: "If you want a substrate with a very low etch pit density and low stress then VGF is the way forward, in fact VGF has won the race in producing materials for GaAs-based devices."

"But in HEMT and HBT applications, LEC has hung onto the market for quite a while, and has this unique opportunity to bring the larger diameter of six inch InP into play at potentially higher yields," he adds.

Young won't yet confirm that, for example, the etch pit densities, in six inch, LEC-grown, InP substrates will be sufficiently low enough for next generation wireless devices.

Six inch InP substrate growth is in its infancy, and as he highlights: "Six inch GaAs took a US Defense Production Act Title III program and millions of dollars in funding to achieve. This is a fairly major task and we still need partners."

But the prospect is clearly there and in the meantime, he is keen to offer AXT customers a choice of VGF- or LEC-grown substrates.

"Internally we will allow the technologies to compete," he says. "If, for example, you can tolerate a slightly higher etch pit density, then we could provide you with an LEC material at, perhaps, a discounted price."

Work in progress

Right now, Crystacomm's crystal-growth equipment and processes are being installed at AXT's Fremont facility. Crystacomm founder and chief executive, George Antypas, is leading activities and will stay on as a consultant to AXT.

Equipment includes a six inch crystal growth prototype system but as Young emphasises, the prime focus will be to repeat what Crystacomm can do with its two, three and four inch crystal growth equipment at the Fremont facility. The team intends to turn to the six inch system in a year, to a year and a half.

Looking to the longer term, Young is excited about the potential market opportunities for InP substrate providers. As he highlights, right now, only a few InP providers exist including, AXT, Sumitomo Electric, WaferTech and InPACT.

"During the nascent stage of GaAs, there were around twenty substrate makers worldwide although many have now dropped out," he says. "In comparison, in InP, we only have a few. The material is very challenging but I believe we can develop it."