LEDs: Two decades of glorious growth

BY BOB STEELE, INDEPENDENT CONSULTANT IN SOLID-STATE LIGHTING

IN A HIGH-TECH INDUSTRY, a great deal can happen in 20 years. That's certainly the case for the LED: It has evolved from being deployed in low-brightness indicator lamps and alphanumeric displays to being incorporated in high-performance white-light sources that have captured more than one-third of the $80 billion global lighting market.

In this article, we attempt to summarize many of the major developments occurring over this timeframe "“ which spans the publication of the very first edition of Compound Semiconductor to this twentieth anniversary issue.

TechnologyThe LED predates this publication by many years, and its origins can be traced as far back as 1907, when British radio engineer Henry Joseph Round discovered the device completely by accident. While investigating the electrical properties of a metal-semiconductor SiC rectifier, he witnessed the first light emission from a solid-state material driven by an electrical current.

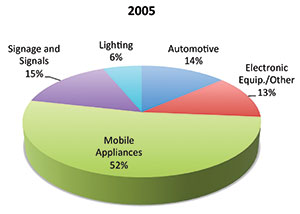

However, for the next fifty-five years or so, progress of this device was relatively slow, until the invention of the visible red LED in 1962, followed later by the commercialization of GaP-based and GaAsP-based yellow-green and red devices (see "The early years: LED development prior to 1995" for a more detailed history of this period). Making blue and true green LEDs proved particularly challenging. A major breakthrough came in the early 1990s, when Nobel-Prize winner Shuji Nakamura produced a film of low-resistance p-type GaN by annealing this material in a nitrogen atmosphere. In late 1993, Nichia announce the commercial introduction of AlGaN-InGaN-GaN double heterostructure, high-brightness blue LEDs with a luminous intensity 1 cd. At the same time Toyoda Gosei introduced metal-insulator-semiconductor blue GaN LEDs with a luminous intensity of 100 mcd.

By the following year Nichia's blue LEDs were selling at $15, for orders of reasonable quantity. However, significant sales only came in 1995, when volume pricing plummeted to $3. By then Toyoda Gosei had abandoned the metal-insulator-semiconductor devices in favour of the much-more-efficient double heterostructure configuration, and had started to sell these LEDs.

Nichia launched true green (525 nm) InGaN LEDs with volume pricing at just over $2. These devices featured an indium content of up to 50 percent in the active layer. Around the same time, Nichia switched from a double heterostructure to a single-quantum-well structure to increase efficiency. Green LEDs were soon available from multiple sources, with Toyoda Gosei launching them on the market in 1997.Early electronic calculators featured an LED numeric display. Shown here is a HP-35, Hewlett- Packard's first pocket calculator and the world's first scientific pocket calculator. It was introduced at US$395 and was available from 1972 to 1975. Credit: Seth Morabito

Japan's monopoly on the manufacture of GaN LEDs did not last long. Since the late 1980s, Cree had been quietly working on its own approach based on substrates made from SiC rather than sapphire, for which it received its first patent in 1989. Unlike Nichia and Toyoda Gosei, Cree supplied chips only, rather than packaged LEDs, releasing its first superbright GaN-on-SiC chip in June 1995.

Many lighting applications require white light, and equipping LEDs to do this via phosphor conversion represented the next big breakthrough for this solid-state device. First introduced by Nichia in 1996, the LED produced white light by colour-mixing blue emission with broad emission in the yellow, created by using a 455-nm blue chip to pump a Ce:YAG phosphor. The Japanese firm kept its technology in house, developing and producing its Ce:YAG phosphor and maintaining a very strong patent position in this technology.

Initially, white LEDs were only available in high colour temperatures, such as those greater than 5,000 K. It took until 2002 for customers in search of a warm-white to have their wishes fulfilled, when Lumileds launched devices with a colour temperature below 4,000 K. A combination of a red and Ce:YAG phosphor broadened the output of the blue-pumped device.

The number of manufacturers of GaN LEDs swelled throughout the late 1990s and beyond. The likes of Hewlett-Packard and Siemens Opto Semiconductors launched products, and a number of Taiwanese companies, such as Epistar, UEC, Epitech and Arima, focused on the production of chips (first InGaAlP, then GaN) rather than packaged devices. Other Taiwanese LED companies, such as Liteon and Everlight, packaged those chips. Many Japanese companies, including Stanley Electric, Matsushita, Toshiba, and Citizen also entered the packaged GaN blue, green and white LED market. However, the strong patent positions held by Nichia and Toyoda Gosei constrained them to buying GaN chips from Cree or Toyoda Gosei and packaging them, rather than manufacturing their own chips.

From this time to the late 2000s, the efficacy and lumen output of InGaAlP and InGaN devices increased dramatically. Milestones from this period include the introduction, in 1998, of the first high-power (1 watt) white LED by Hewlett-Packard that was based on a 1 mm x 1 mm chip. During this era, efficiency improvements resulted from several refinements to the device design: an improved epitaxial layer structure, including the introduction of multiple quantum wells; chip shaping to increase light extraction efficiency; and improvements in packaging to enhance heat removal from the chip. Throughout the 2000s a "˜horse race' took place among the major LED manufacturers, as they all strived to announce the next improvement in efficacy, especially in white LEDs.

The remarkable progress in white LED efficiency and cost reduction during this period is illustrated in a plot of lumen output produced by a 1 W package (this is approximately equivalent to lumens/watt), and price, expressed in dollars-per-kilolumen (see Figure 1). Over a period of one decade, the price plumetted from $300 per kilolumen to $11 per kilolumen, while light output from a 1 W package shot up from 15 lumens to 130 lumens.

An alternative approach to considering the progress of the LED is to see the improvement in wall-plug efficiency over the years (see Figure 2a). This approach provides a superior measure of the relative performance of various types and wavelengths of LEDs, because it avoids considering the sensitivity of the human eye to the emission wavelength, which is incorporated in figures of luminous efficacy (lumens/Watt).Figure 1. Developments in white LED light output and price (Typical 1-W cool-white LED package) Source: Strategies Unlimited.

Yet another method for measuring the progress of the LED is the formulation that has come to be known as "Haitz's Law" (see Figure 2b). It was developed by LED pioneer Roland Haitz, a former R&D manager of Hewlett-Packard's Semiconductor Products Division who went on to hold the same position at the spun-out company, Agilent Technologies. In this remarkable analogue to Moore's Law for silicon semiconductors, Haitz's Law shows that the cost-per-lumen of LEDs declines by 90 percent per decade, while the output of LEDs (flux per lamp, measured in lumens) rises by a factor of 20 with every decade.

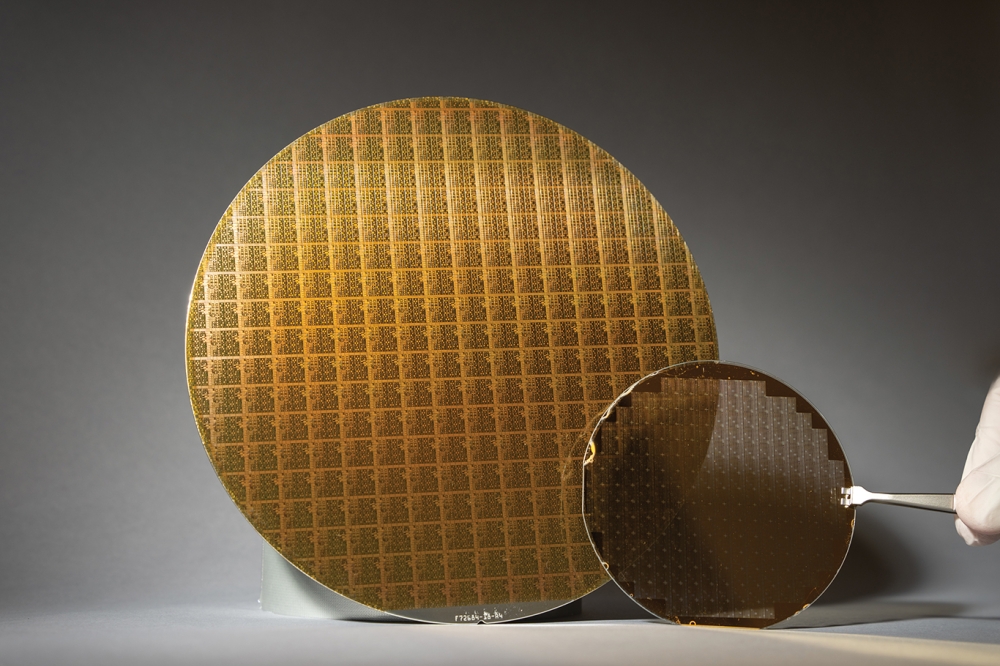

Advances in device efficiency have gone hand-in-hand with substantial improvements in packaging technology, especially in high-power LEDs, including dramatic reductions in material content. This, coupled with increasing production volumes, has spurred a rapid decline in the cost-per-lumen of LEDs in general, and in particular, white emitters. A move to chip-scale packaging, in which the entire package is barely larger than the LED die, has been a major accomplshment within this industry. Packaging technology has also evolved to address an increasing array of application requirements, especially in lighting. This evolution is evident in Lumileds' line of high-performance packages, which began with the standard 3 mm and 5 mm lamp packages that were driven at 20 mA, (<0.1 W), and now include ultra-high-power chip-on-board packages capable of handling input powers of more than 100 W (see Figure 3).Figure 2 (a) Historical evolution of LED performance - red, blue, green and phosphor-converted white LEDs; (b) Haitz's Law. Source: M.H. Crawford et. al. "Solid-State Lighting: Toward Smart and Ultra-Efficient Materials, Devices, Lamps and Systems", published in D.L. Andrews, Ed., Photonics Volume 3: Photonics Technology and Instrumentation (Wiley 2013).

From mobiles to lighting

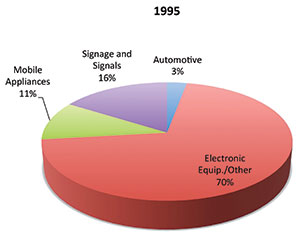

Increases in the brightness and range of colours produced by LEDs have enabled this device to serve more applications. Prior to the development of high-brightness LEDs, most applications were limited to indoor or quasi-indoor use, but the unfurling of new InGaN and InGaAlP high-brightness LEDs enabled the construction of full-colour outdoor signs, including video screens, in the mid-to-late 1990s.

Single-colour red and amber signs, including highway signs, also became a significant market. Although small at first, the use of red LEDs in traffic signals also began in the mid-1990s. This use of LEDs later expanded to include green and yellow signals, as well as amber and white pedestrian signals. By the early 2000s, the use of LEDs in traffic signals became mainstream, thanks to the higher energy efficiency and reduced maintenance of these solid-state sources compared to filtered incandescent lamps.

Figure 3. Evolution of LED package technology. Source: George Craford, Lumileds, "Innovations in LEDs", US Department of Energy Solid-State Lighting R&D Workshop, San Francisco, January 27, 2015.

Later in the 1990s, the large-volume introduction of high-brightness LEDs into the automotive market began. LEDs were first used in interior automotive applications such as instrument panel lighting, primarily in Europe, with Siemens Opto Semiconductors (later Osram Opto Semiconductors) being the leading supplier.

In exterior automotive applications, Hewlett-Packard (later Lumileds) led the way with its high-flux InGaAlP products that were used in centre high-mounted stop lamps. In 1999, GM introduced the first all-LED rear combination lamp, using Lumileds LEDs, on its Cadillac DeVille model. During the decade that followed, exterior automotive applications extended to all functions, including stop, turn and tail lamps, daytime running lamps, and headlamps.

During the early 2000s, the use of LEDs in mobile phones "“ as backlights for LCD displays, keypad backlights and camera flash "“ became widespread, driving the growth of the market through 2005. LED backlights for LCD displays also spread to other portable electronics applications, such as digital music players, digital cameras, and laptop computers. And with time, LEDs won adoption in larger screens, with huge market growth beginning in 2010 as these devices were deployed as backlights in LCD TVs and monitors.

As other applications have matured, lighting has taken over as the leading driver of growth for the LED market. The tipping point has been the passing of the 100 lm/W mark for white LEDs, which are getting cheaper with every year that passes. White LEDs started to be adopted in general lighting functions by most lighting manufacturers in 2009, and the growth in this sector since then has been nothing short of spectacular. Market research firm Strategies Unlimited predicts that the penetration, by revenue, of LED-based products into the lighting market will be 50 percent for lamps ($10.4 billion) and 39 percent for luminaires ($23.9 billion) in 2015. Adoption of LEDs in general lighting has grown so fast in recent years that lighting has outpaced all other LED applications, and is now the largest segment by a wide margin. In terms of LED component revenue, in 2015 lighting is projected to account for 40 percent of the market, equating to $6.9 billion (see Figure 4).

LCD TV with thin profile enabled by an LED backlight.

Market growth Prior to the introduction of high-brightness LEDs in the mid-1990s, the LED market had become mature, with very slow growth. With few new applications arising and the technology at a plateau, the conventional low-brightness market had stagnated at around $1.7 billion. However, with the opening up of new applications in the late 1990s, based on the new high-brightness devices, the market began to accelerate. From a modest level of $120 million in 1995 (see Figure 5) the high-brightness LED market grew at a compound annual growth rate (CAGR) of 59 percent to $1.2 billion in 2000, and then on to $3.9 billion in 2005, $11.3 billion in 2010, and is projected to be $17.5 billion in 2015. Following the initial 1995-2000 market ramp-up, the biggest "˜growth spurts' took place in 2001-2004 (a CAGR of 45 percent), with the widespread adoption of LEDs in mobile phones; and in 2009-2010 (a CAGR of 110 percent) with the dramatic growth in the use of LED backlights in LCD TVs and monitors.

Over the last five years, the LED market has grown at a slower pace. For this period, the CAGR has been 9 percent, a figure that is representative of a more mature market. However, during this time the lighting segment has experienced a CAGR of 54 percent, driven by the robust rate of adoption of LEDs in lamps and luminaires for general lighting.

Shifting suppliersIn addition to the dramatic changes in LED technology and markets over the last 20 years, there have been some major shifts in the structure of the LED industry (see Table 2). Companies that were leading the industry in 1995 have been displaced by those that were not even on the radar back then, and further changes to the industry landscape have resulted from mergers, acquisitions and spinoffs. Comparing the top ten firms in 1995 and 2015, only two crop up on both lists: Hewlett-Packard, in the form of its successor company Lumileds; and Siemens Opto Semiconductors, in the form of its successor company Osram Opto Semiconductors.

Figure 4: The market for conventional, low-brightness LEDs (based on GaP and GaAsP) declined slightly from 1995 until 2000, and data from beyond then is not available. Revenue for high-brightness LEDs (based on AlGaAs, InGaAlP and InGaN) has grown at a CAGR of 28.3 percent since 1995. Source: Strategies Unlimited

From a regional perspective, dominance by Japanese companies has disappeared. Seven firms were in the top ten in 1995, and now only Nichia is there "“ but it has held on to the top supplier spot since 2000, and with an estimated revenue of $2.1 billion in 2014, its sales are far beyond those of its rivals. The last decade has witnessed a shift to success of other countries in the Far East, with Korean companies such as Samsung, LG Innotek, Seoul Semiconductor and Lumens emerging as major LED suppliers, and China starting to make a big impact. Last year, a Chinese company "“ Mulinsen "“ achieved top 10 supplier status for the first time.

The changes in the LED industry over the last 20 years have been nothing short of staggering: the size of the high-brightness LED market has shot up by a factor of 150; the conversion efficiency, evaluated for GaN blue LEDs, has increased by a factor of 10; the input power capability of LED packages is 1000 times higher than before; and the cost-per-lumen has plummeted by a factor of 100. Underpinning all these advances has been a combination of the efforts of key individual researchers and countless engineers, large corporate investments in R&D and manufacturing, and the support of government programmes and incentives. From being niche products, LEDs have become ubiquitous in all aspects of modern life "“ from mobile phones to cars, TV sets, and now lighting, including the common light bulb. It has been a great technological adventure, and for those who have been involved with it from the beginning, it has been a fascinating and rewarding journey.

*Based on 2014 revenues.

**Siemens transferred its Opto Semiconductor group to its wholly-owned lighting subsidiary Osram in 1999. Osram was spun out of Siemens as a public company in 2013.

***Hewlett-Packard spun out Agilent Technologies, which included its LED operation, in 1999.

Agilent sold its Semiconductor Products Group, including the LED operation, to a private equity group in 2005, with the new company known as Avago Technologies. Hewlett-Packard formed a joint venture with Philips in 1997 known as Lumileds Lighting. After the spin-out of Agilent from Hewlett-Packard, Lumileds became a separate company focusing on high-power LEDs, with Agilent and Philips as 50/50 co-owners. Philips purchased Agilent's share in 2005. Philips announced the sale of 80 percent of its share in Lumileds to a private equity group in March 2015. Source: Strategies Unlimited.

Bob Steele is an independent consultant in solid-state lighting. He has been chair or co-chair of the Strategies in Light US conference since 2000 and chair of the Strategies in Light Europe conference since 2012. He was also a co-founder of the LED lighting startup QuarkStar LLC in 2010. From 1994 to 2010 he directed the LED market research programme at Strategies Unlimited, where he was responsible for all of the company's activities in LEDs, including conducting custom studies and preparing multi-client reports.