Aixtron increases Q3 revenue by 35 percent

German deposition equipment company Aixtron has announced financial results for the first nine months and the third quarter 2015. Q3/2015 revenues improved to €54.6m and were 35 percent up against the previous quarter (Q2/2015: €40.4m). Revenue growth was based on a wide range of different applications such as LEDs, laser, memory chips and power electronics.

For the first time since Q4/2013, EBITDA was positive in the third quarter at €4.1m (Q2/2015: -€15.3m). It also improved by 36 percent year-on-year (9M/2015: -€17.6m; 9M/2014: -€27.5m). The main reasons, says the company, are an improved gross margin in Q3 due to a more favourable product mix and lower operational costs, including a payment from a contractual settlement.

As a result of this development, Q3/2015 EBIT also came in positive with €1.5m (Q2/2015: -€17.9m; 9M/2015: -€25.2m; 9M/2014: -€39.4m).

Q3/2015 total order intake including spares and service came in at €34.4m, 34 percent below the previous quarter (Q2/2015: €52.5m). Total equipment order backlog at €72.3m as at September 30, 2015 was 2 percent up compared with the previous year (September 30, 2014: €70.7m) but 21 percent down against the previous quarter (June 30, 2015: €91.2m). This backlog figure continues to exclude tools from the order of the major Chinese customer.

Business Development

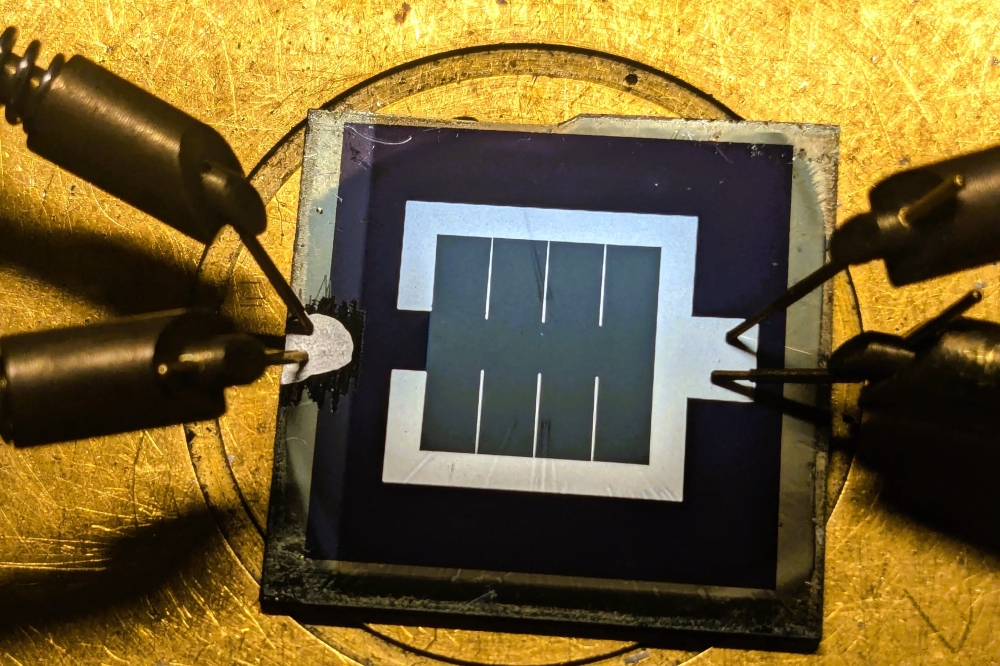

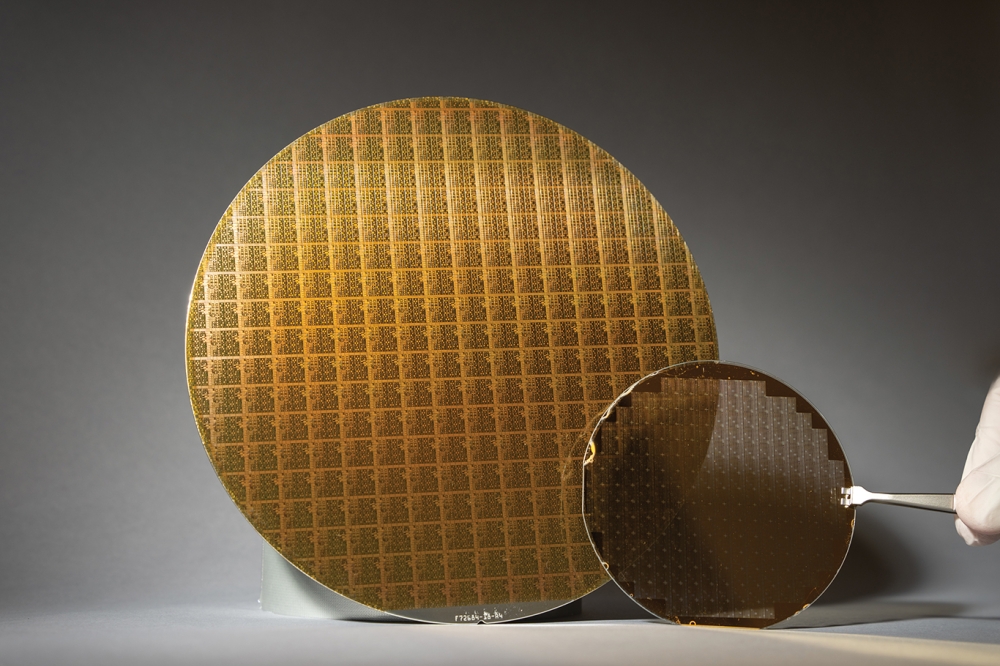

The global penetration of LED technology in the lighting market continues. Because of the continuing qualification processes of the AIX R6 showerhead tool, the demand for this system type remained subdued. The revenue development in Q3/2015 was based on a wide range of different applications such as LEDs, laser, memory chips and power electronics. Overall, demand in the first nine months 2015 remained relatively slow.

Revenues at €54.6m in Q3/2015 were 35 percent higher compared to the previous quarter (Q2/2015: €40.4m). On a nine-month basis, 9M/2015 revenues were in line with the previous year (9M/2015: €135.3m; 9M/2014: €135.8m).

Third quarter cost of sales at €36.8m was flat sequentially (Q2/2015: €36.8m) despite higher revenues. On a yearly comparison, cost of sales in 9M/2015 fell slightly by 1 percent to €105.1m (9M/2014: €106.5m).

This resulted in a Q3/2015 gross profit of €17.8m, significantly improved on a quarterly basis (Q2/2015: €3.6m; 9M/2015: €30.2m; 9M/2014: €29.2m). While the gross margin on an annual basis remained unchanged (9M/2015: 22 percent; 9M/2014: 22 percent), it improved by 24 percentage points to 33 percent in Q3/2015 points due to a better product mix (Q2/2015: 9 percent). This is in line with the range targeted by Aixtron.

Mainly due to better cost control and income from a contractual compensation recorded in other operating income, operating costs in Q3/2015 fell to €16.3m sequentially (Q2/2015: €21.5m). On a nine-month comparison, they decreased by 19 percent to 55.4m (9M/2014: €68.7m).

As a result of the above-mentioned business development, the third quarter 2015 EBIT improved to €1.5m both sequentially and compared to the previous-year period (Q2/2015: €-17.9m, 9M/2015: €-25.2m; 9M/2014: €-39.4m).

The net result for Q3/2015 rose to €0.3m compared to the previous quarter (Q2/2015: -€18.1m) and improved by 37 percent on a nine-months basis (M9/2015: €-27.3m; 9M/2014: €-43.4m).

Aixtron's total order intake including spares & service in the third quarter 2015 decreased 34 percent sequentially to €34.4m (Q2/2015: €52.5m). Compared to the previous-year period total order intake fell by 9 percent to €135.8m (9M/2014: €149.4m). This development reflects the lower overall market demand in the reporting period as well as the effects from the ongoing qualification processes for the AIX R6.

Management review

"Due to postponed shipments, in particular of the AIX R6 showerhead system, we have recently revised our revenue expectations for the current financial year. However, we work intensively with our customers to push forward and to successfully complete the qualification processes", says Martin Goetzeler, president and CEO of Aixtron SE.

"We continue to proceed in the strengthening of our product and technology portfolio. In the area of OLEDs, we have received a first order for our encapsulation technology OPTACAP. The test runs of our Gen8 demonstrator for the production of large-area OLEDs are moving forward on schedule and therefore, we anticipate results from customer demonstrations within the coming months. In addition, we were able to score in applications such as LED, laser, telecommunication and power electronics as well as in Memory products. The margin improvement resulting from it supports our recently communicated profit expectations for the current financial year. The third quarter also proves that markets in Europe and the U.S. are still of great importance."

Guidance

Based on the results of the first nine months of 2015 and the assessment of Aixtron's risks and opportunities, management expects 2015 full year revenues of €190m to 200m, based on the USD/€exchange rate of 1.12 as of September 30, 2015. The guidance was revised due to a postponement of shipments to a major Chinese customer which were planned for delivery in 2015. These deliveries are now expected for 2016 depending on the progress of the ongoing milestone based qualification process.

Management reiterates its target to reach EBITDA break-even within the second half of 2015. Year-on-year, EBIT and net result are expected to improve but to remain negative for the full year 2015.