Qorvo delivers solid Q2

Qorvo, a provider of RF and other technologies for mobile, infrastructure and aerospace/defence applications, has announced financial results for its fiscal 2016 second quarter, ended October 3, 2015. Qorvo also announced a new one-year $1 billion share repurchase program which expires on November 4, 2016.

Share prices rose nearly 15 percent in response.

"The Qorvo team delivered a solid September quarter, with quarterly revenue increasing 12 percent year-over-year, led by strong 19 percent year-over-year growth in Mobile Products, " said Bob Bruggeworth, president and CEO of Qorvo.

"Design activity during the quarter was particularly robust, as we secured multiple opportunities to expand content in the marquee smartphones launching in calendar 2016 and 2017 and positioned IDP to accelerate growth across its target markets."

Steve Buhaly, chief financial officer of Qorvo, said: "In the nine months since Qorvo's formation, revenue has grown 25 percent from the same period in the prior year while non-GAAP operating income has nearly doubled. We're proud of this performance and are excited about our opportunities in the coming year."

On a GAAP basis, September quarterly revenue was $708.3 million, gross margin was down slightly at 40.2 percent (41.5 percent previous quarter), operating income was greatly increased at $18.0 million (compared to a $1.3 million loss in Q1) and net income was up to $4.4 million (compared to $2.0 in Q1), or $0.03 per diluted share based on 150.8 million shares outstanding.

On a non-GAAP basis, September quarterly revenue increased sequentially to $707.4 million and gross margin was 49.7 percent (down from 51.5 percent in Q1). Operating expenses declined sequentially, yielding operating income up at $194.8 million (compared to $187.8 million in Q1), or 27.5 percent of sales. Net income was $183.3 million, or $1.22 per diluted share based on 150.8 million shares outstanding.

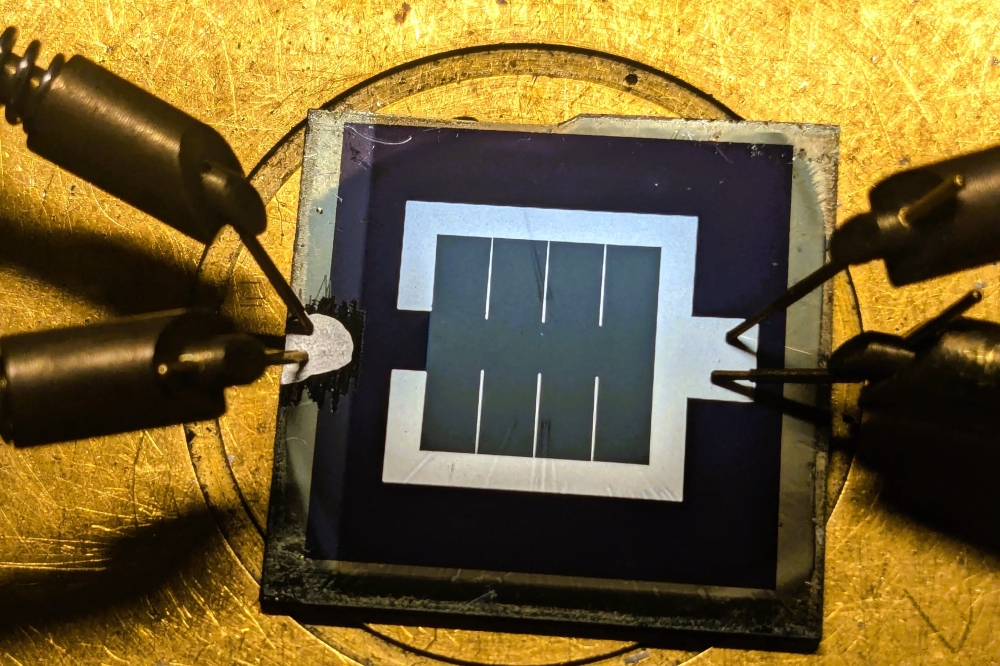

Strategic highlights include capturing multiple LTE reference design wins for multimode PAs, multimode transmit modules, switches, duplexers, and multiplexers; capturing BAW (bulk acoustic wave) filter and amplifier wins at Tier 1 automotive suppliers; solidifying long-term defence and aerospace market position by establishing multiple multi-year supply agreements; participating in pre-5G and 5G demos at major basestation OEMs; sampling high performance GaN-based macro cell PAs to the five leading base station OEMs; capturing an increasing percentage of DOCSIS 3.1 sockets with hybrid GaAs and GaN products.

Outlook

Qorvo's non-GAAP expectations for the December 2015 quarter are: quarterly revenue of approximately $720 million to $730 million; gross margin of approximately 50 percent; a tax rate of approximately 10 percent; and diluted EPS of $1.25 to $1.30 based on approximately 147 million shares.