Applied Optoelectronics posts record Q3 revenues

Applied Optoelectronics Inc (AOI), a US provider of fibre-optic access network products for datacentres, broadband, and fibre-to-the-home markets, has posted record revenues for its third quarter ended September 30, 2015.

"Our strong topline results were driven by accelerated shipments for our 40G datacenter products, partially offset by lower than expected revenue for our CATV products," said Thompson Lin, Applied Optoelectronics, Inc. (AOI) Founder and CEO.

"Revenue for our datacenter products grew 30 percent sequentially and 92 percent year-over-year, bringing our year-to-date growth to 71 percent, which is well above our initial annual target. Looking into the fourth quarter, given the accelerated datacenter demand in the third quarter and consolidation activities in CATV, we expect revenue to decline sequentially and to return to more normalized order patterns in the first quarter of 2016."

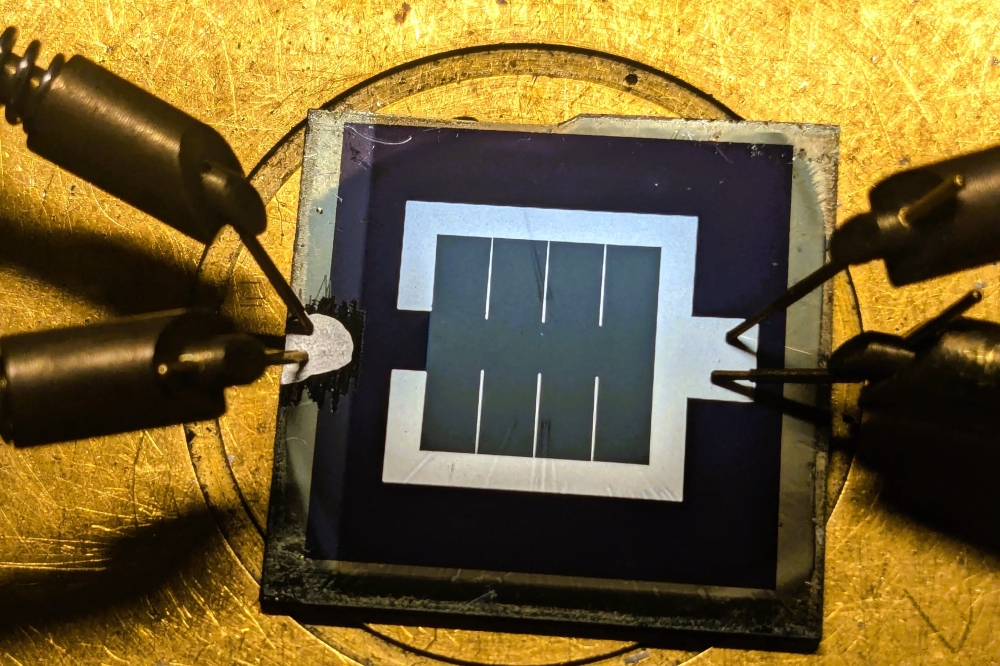

Lin continued, "We believe AOI is very well positioned to continue to grow from the move to advanced optics in the datacenter as 40G deployments continue and the transition to 100G is just beginning. AOI was recently awarded two 100G design wins from two hyperscale datacenter customers. Leveraging our vertically integrated manufacturing model to internally source key components such as 25G laser diodes and 100G light engines helped enable us to rapidly bring 100G transceivers to market," continued Lin.

Total revenue grew to $57.1 million, up 56 percent compared with $36.5 million in the third quarter 2014 and up 15 percent compared with $49.6 million in the second quarter 2015.

GAAP gross margin was 31.6 percent, compared with 33.2 percent in the third quarter 2014 and 33.7 percent in the second quarter 2015. Non-GAAP gross margin was 31.7 percent, compared with 33.3 percent in the third quarter 2014 and 33.7 percent in the second quarter 2015.

GAAP net income was $2.7 million or $0.16 per diluted share, compared with net income of $1.6 million or $0.10 per diluted share in the third quarter 2014 and net income of $6.1 million or $0.38 per diluted share in the second quarter 2015.

Non-GAAP net income was $6.7 million or $0.40 per diluted share, compared with non-GAAP net income of $3.1 million or $0.20 per diluted share in the third quarter 2014 and non-GAAP net income of $6.1 million or $0.38 per diluted share in the second quarter 2015.

On September 30, 2015, cash, cash equivalents, short-term investments and restricted cash totaled $50.1 million, compared with the June 30, 2015 balance of $44.3 million.

Outlook

For the fourth quarter of 2015, the company currently expects revenue in the range of $49.0 million to $52.0 million; and non-GAAP gross margin in the range of 33.5 percent to 34.5 percent. Non-GAAP net income is expected to be in the range of $4.9 million to $5.9 million, and non-GAAP fully diluted earnings per share in the range of $0.28 to $0.33 using approximately 17.7 million shares.