GaAs: Safe for now

Technavio analyst, Sunil Singh, provides insight to the future of GaAs in the complex communications landscape. Rebecca Pool reports.

Smartphones are set to drive future demand for GaAs power amplifers.

As rising sales of Smartphones worldwide fuel demand for GaAs power amplifiers, device vendors are jostling for more and more market share.

GaAs semiconductors are already the incumbent and state-of-the-art technology in cellular handsets that use at least one GaAs-based power amplifier, and industry can expect more of the same in the coming years.

In his recent report, 'Global GaAs devices market 2016 to 2020', Technavio analyst, Sunil Kumar Singh, points out the leading players and highlights those that he believes have an edge.

"All vendors in this market are focusing on cellular communications due to the deployment of 3G, 4G and LTE networks and the trend towards 5G," he says.

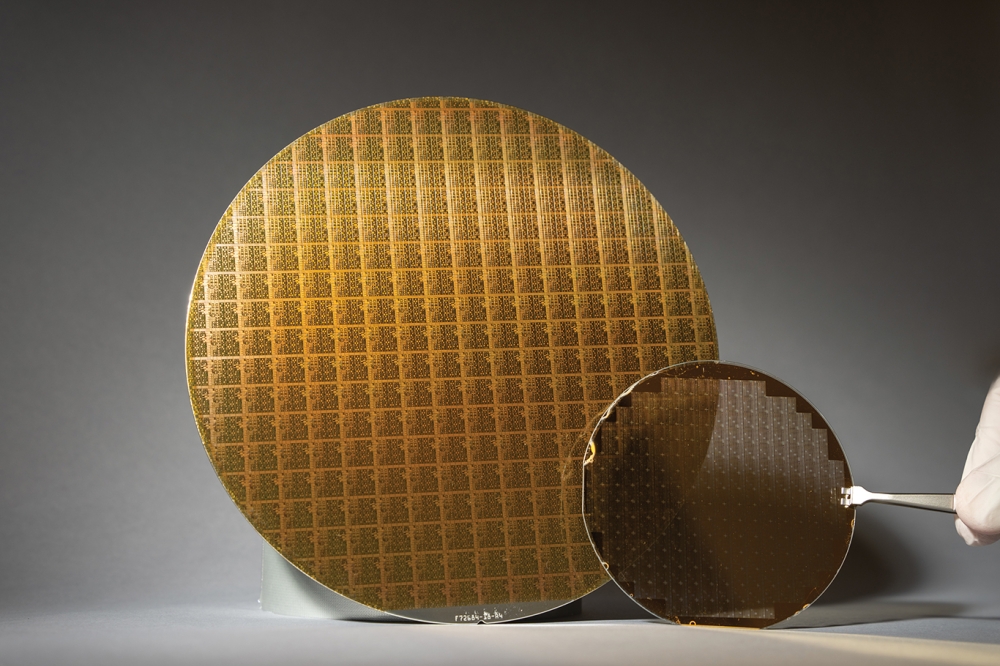

"Global wafer capacity for GaAs devices is increasing with every company operating at, at least, an 85 percent production rate," he adds. "So competition is intense but Skyworks and Qorvo are the key vendors and cover a substantial amount of market share."

According to Singh, right now, Skyworks can produce around ten million chips a day using proprietary processes.

And while its key market driver is data traffic, the company also has a huge product portfolio from amplifiers and attenuators to power management devices and voltage regulators covering defence, aerospace, automotive markets and more.

Meanwhile, the merger of RFMD and TriQuint Semiconductor sees Qorvo also delivering a vast product portfolio of GaAs-based devices serving mobile device, network infrastructure as well as aerospace and defence markets.

But, as Singh highlights, the company's recent acquisition of GreenPeak Technologies, a developer of CMOS wireless controller chips for the Internet of Things markets, signals more change is afoot.

With GreenPark in tow, Qorvo could diversify into CMOS technology, joining the ranks of Skyworks, Avago Technologies - now a Broadcom company - and other competitors.

Indeed, Skyworks, claiming proficiency in both technologies, promotes GaAs for its linearity and its power efficiency and CMOS for its easy integration, low cost and low power consumption.

And, with more industry players owning each competing technologies, convergence becomes a real possibility.

"I'm not saying this will happen but could we see GreenPeak CMOS chips equipped with broadband GaAs power amplifiers?" asks Singh.

"In this case, GreenPeak is a fabless company so Qorvo may have to first develop a foundry for CMOS chips which could take time," he adds. "But in the near future, [the company] could be looking at technology convergence here."

Convergence aside, according to Singh, Avago Technologies, recently merged with Broadcom, is the other key player in the GaAs device market space. And at the same time, Advanced Wireless Semiconductor, Anadigics, M/A-COM and Analog Devices, having acquired Hittite Microwave, all provide stiff competition.

"Analog Devices has such a strong financial background I can now see it becoming one of the top competitors for Skyworks and Qorvo," he highlights. "At the same time, M/A-COM sells directly to companies without third party sales channels and if it can deliver the volumes in accordance with current market demand I definitely see it taking more market share in the future."

CMOS threat?

Without a doubt, cheaper silicon CMOS power amplifiers provide the prime threat for GaAs devices in this market. And thanks to developments such as envelope tracking, the performance gap between the two technologies has narrowed. Still, Singh is adamant GaAs is safe for now.

"If CMOS was to rapidly increase in RF front end modules, the vendors operating in this space would struggle with [the existing] manufacturing capacity to mass produce these CMOS devices," he says. "But when it comes to GaAs devices, vendors such as Qorvo, Win Semiconductor and Anadigics do have the capacity [to ramp up production], which is a huge advantage."

At the same time, other power amplifier technologies are gathering market momentum. For example, Skyworks, has revealed plans to use SiGe power amplifier technologies in RF front end modules to boost power and efficiency in future wireless communications devices.

Still, Singh believes GaAs devices will remain ahead of up and coming power amplifier technologies based on GaN-on-SiC as well as SiGe for now.

"GaAs can be directly substituted with these emerging technologies but this isn't happening in the near future, at least until 2020," he says. "Device manufacturers will be considering, for example, form factors, load requirements, matching and filtering... and GaAs devices are ahead of the game here, compared to any other technology."