Infineon with Wolfspeed: the future

What does a stronger Infineon mean for power and RF markets, asks Compound Semiconductor.

With Wolfspeed in tow, Infineon intends to steer the future of power and RF markets.

In a move to raise resources and become a more focused LED lighting company, Cree has sold its power and RF arm, Wolfspeed, to Infineon for $850 million cash.

In the words of Cree chief executive, Chuck Swoboda: "This [decision] unlocks value, increases management focus and supports our mission to build a more valuable LED lighting technology company." But for Infineon, the move could mean so much more.

While the Germany-based semiconductor vendor is already the power market leader, acquiring Wolfspeed's SiC-based product portfolio, strengthens its dominance even further.

For years, the company has focused on high performance SiC JFETs, only delivering its first SiC MOSFET earlier this year following customer demand. But acquiring Wolfspeed provides instant access to MOSFET production that can be introduced to company fabs around the world.

As Richard Eden, senior analyst of power semiconductors at IHS Technology, highlights: "It's taken Infineon a few years to realise that end users are more comfortable with MOSFETs, but this acquisition speeds up the introduction of Infineon SiC MOSFETs."

"The SiC MOSFET market has been dominated by Cree/Wolfspeed and Rohm, so Rohm will be feeling the pressure by now," he adds.

Meanwhile, the acquisition also strengthens Infineon's RF power presence. The company already has a strong Si-LDMOS offering and is developing GaN-on-silicon products. But now it also has access to Wolfspeed's GaN-on-SiC products.

Each technology is critical to next generation cellular communications, from high-end LTE and 4.5G to 5G, but GaN-on-SiC will now allow Infineon to deliver products for 80 GHz frequency, 5G applications of 2020 and beyond.

Indeed, Infineon chief executive, Reinhard Ploss, has said that Wolfspeed will help his company's target of leading the entire RF market. However, the latest deal will also extend Infineon's reach into high growth sectors, including IoT infrastructure, renewable generation and electric vehicles.

"For example, electric vehicle and charging station development is massive in China with DC to DC conversion of battery charging and plug-in station markets moving rapidly," highlights Eden. "This is a big growth sector for SiC due to its efficiency benefits over silicon, and Infineon would now like to use Wolfspeed products to build the strength and position of its sales network across China."

![]() Reinhard Ploss, CEO of Infineon Technologies, and Chuck Swoboda, Cree Chairman and CEO (right).

Reinhard Ploss, CEO of Infineon Technologies, and Chuck Swoboda, Cree Chairman and CEO (right).

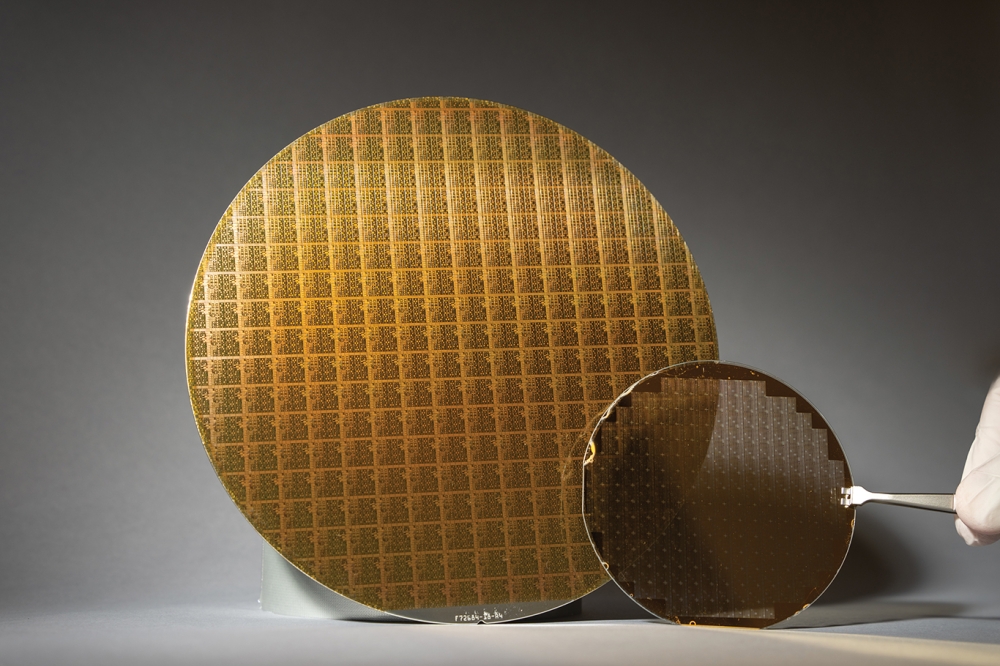

But MOSFETs and RF markets aside, the latest deal provides one final, over-riding advantage; Infineon now owns Cree's SiC wafer substrate business for power and RF applications.

Wolfspeed had been a leading market supplier of wafers on which to manufacture SiC devices. But as Eden points out: "Infineon is now vertically integrated and can offer everything in house. It can make the wafers, process the wafers in its own fabs, and make the modules from the devices that have been formed on its wafers."

Infineon's Ploss has stated that Wolfspeed will continue to supply wafers to third parties in, say, mobile network base station markets. But in-house wafer production will likely lead to Infineon's device prices falling.

"This applies to MOSFETs but Infineon's existing range of diodes could also probably become cheaper as the company will get wafers at cost rather than sourcing them from a commercial third party supplier," says Eden.

Cost aside, Infineon's vertical integration could also have ramifications on power and RF markets around the world. According to Eden, silicon vendors have developed SiC and GaN power devices to defend market positions while companies such as GaN Systems, Cree, EPC and Transphorm have delivered devices to disrupt the silicon supply chain.

"By buying Wolfspeed, Infineon is firmly positioning itself for the future," says Eden. "It's not just defending sales, its looking forward to expand GaN and SiC sales; to try and push the market ahead like this is a very forward view."

So, with the acquisition scheduled for completion by the end of this financial year, what next?

For power markets, better quality devices could be on the cards. Eden's sources tell him that SiC MOSFETs from General Electric are more reliable and can switch at higher currents than offerings from Wolfspeed and Rohm. "Infineon will know what to do to enhance these MOSFETs from the Wolfspeed acquisition," he says.

And eventually, industry can expect Wolfspeed to be fully integrated to Infineon. The company acquired International Rectifier in early 2015, and has since maintained the company's established brand.

But for the shorter-lived Wolfspeed, integration is expected to be cheaper and easier. Ploss has been reluctant to provide detail on the acquisition process, but has publicly stated the company is aiming for complete integration in the long-term.

"I hadn't seen this acquisition coming, but when you think about it, it's not surprising," concludes Eden. "Infineon has the money, it's now removed the competition from the market and it's strengthened its product range, so why not?"