Cree cuts losses with 1 percent dip in revenue

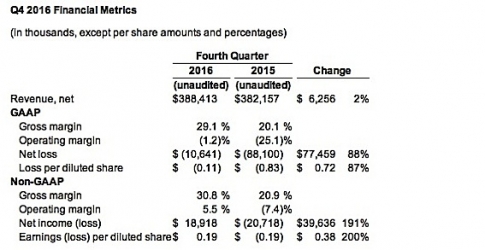

Cree, the US LED lighting firm, has reported revenue of $388 million for Q4 2016, ended June 26, 2016. This represents a 2 percent increase compared to revenue of $382 million reported for Q4 2015, and a 6 percent increase compared to Q3 2016. GAAP net loss for Q4 was $11 million, or $0.11 per diluted share, compared to GAAP net loss of $88 million, or $0.83 per diluted share, for Q4 2015.

On a non-GAAP basis, net income for Q4 2016 was $19 million, or $0.19 per diluted share, compared to non-GAAP net loss for Q4 2015 of $21 million, or $0.19 per diluted share.

For fiscal year 2016, Cree reported revenue of $1.62 billion, which represents a 1 percent decrease compared to revenue of $1.63 billion for fiscal 2015. GAAP net loss was $22 million, or $0.21 per diluted share, compared to net loss of $65 million, or $0.57 per diluted share, for fiscal 2015. On a non-GAAP basis, net income for fiscal year 2016 was $88 million, or $0.86 per diluted share, compared to $71 million or $0.63 per diluted share, for fiscal 2015.

"Fiscal 2016 was a year of progress towards our goal to build a more focused and valuable LED lighting technology company," stated Chuck Swoboda, Cree chairman and CEO. "We successfully restructured the LED business, improved commercial lighting fundamentals, refocused our consumer business on premium LED bulbs, and unlocked significant value with the agreement to sell Wolfspeed."

Business Outlook

For its first quarter of fiscal 2017 ending September 25, 2016, Cree targets consolidated revenue, which includes both continued and discontinued operations, in a range of $356 million to $378 million. Consolidated GAAP net income is targeted at $5 million to $6 million, or $0.05 to $0.06 per diluted share. Consolidated non-GAAP net income is targeted in a range of $10 million to $16 million, or $0.10 to $0.16 per diluted share.

Targeted consolidated non-GAAP earnings exclude $23 million of expenses related to stock-based compensation expense, the amortization or impairment of acquisition-related intangibles and transaction costs associated with the sale of the Wolfspeed business. The GAAP and non-GAAP targets do not include any estimated change in the fair value of Cree's Lextar investment.

For continuing operations, revenue is targeted in a range of $310 million to $330 million. GAAP net income from continuing operations is targeted at $2 million to $3 million, or $0.02 to $0.03 per diluted share. Non-GAAP net income from continued operations is targeted in a range of $6 million to $11 million, or $0.06 to $0.11 per diluted share.

Targeted non-GAAP earnings from continuing operations exclude $20 million of expenses related to stock-based compensation expense and the amortisation or impairment of acquisition-related intangibles. The GAAP and non-GAAP targets do not include any estimated change in the fair value of Cree's Lextar investment.

For discontinued operations, revenue is targeted in a range of $46 million to $48 million. GAAP net income from discontinued operations is targeted at $2 million to $3 million, or $0.02 to $0.03 per diluted share. Non-GAAP net income from discontinued operations is targeted in a range of $4 million to $5 million, or $0.04 to $0.05 per diluted share.

Targeted non-GAAP earnings from continuing discontinued operations exclude $3 million of expenses related to stock-based compensation expense, the amortisation or impairment of acquisition-related intangibles and transaction costs associated with the sale of the Wolfspeed business to Infineon for $850 million in cash.