Downsizing the car radar

System Plus Consulting's latest teardown report shows European companies are leading the automotive radar market

According to Yole Développement (Yole), the radar market for automotive and mobility applications should reach more than $10.5 billion, with an 11 percent CAGR between 2019 and 2025.

Radar systems were introduced in 2000, with SRR systems dedicated to blind-spot detection or rear cross-traffic alert. Today, vehicles from several suppliers are already offering ‘level 2+’ automation whereby drivers are on standby but can be hands-off for periods of time. These vehicles integrate around five radar systems, including SRR and LRR, which support emergency breaking and adaptative cruise control.

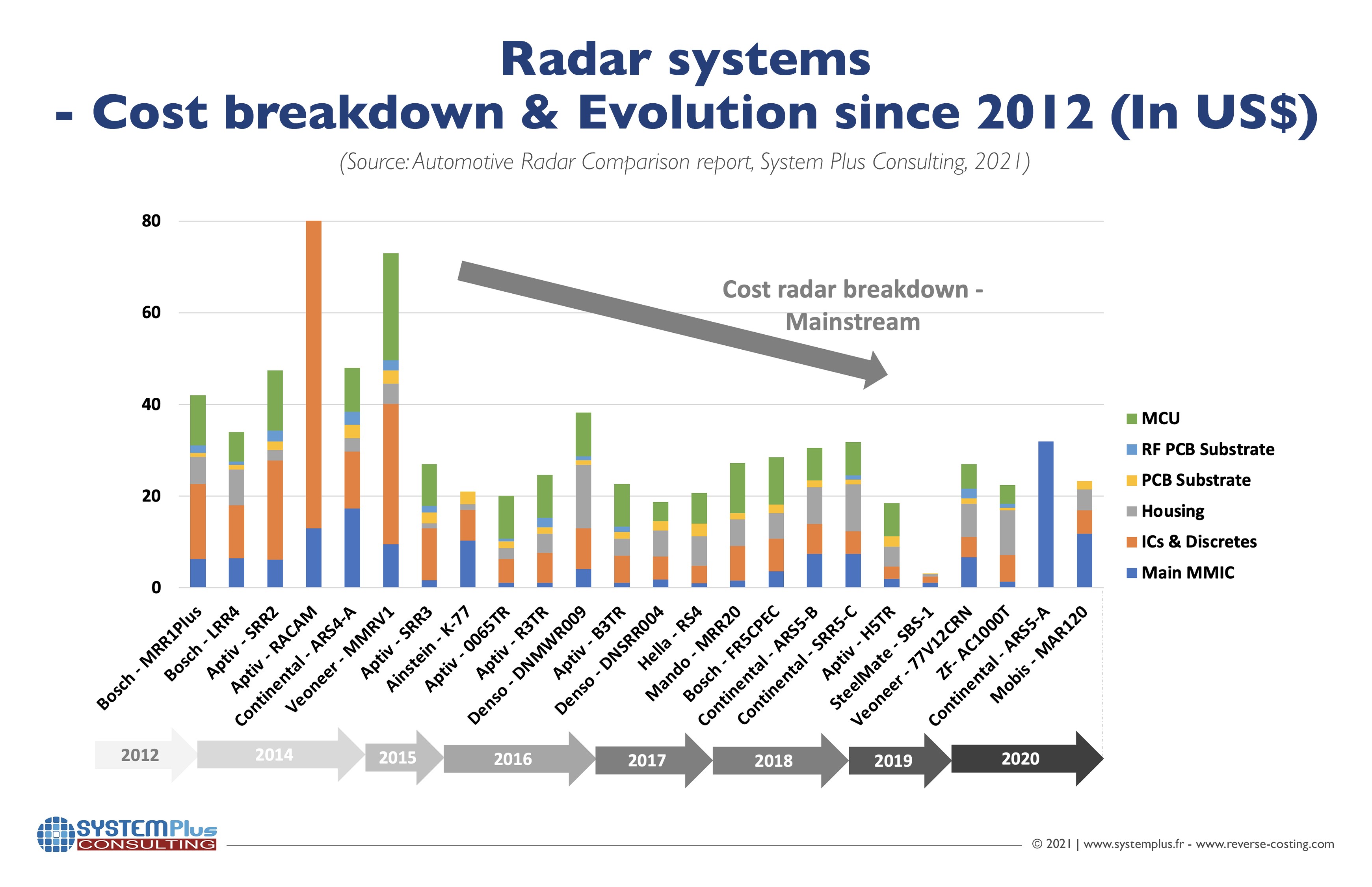

Yole partner company System Plus Consulting, the reverse engineering and costing company, has carried out a new comparative technology study, Automotive Radar Comparison 2021, of 15 radar systems from leading OEMs, such as Veoneer (formerly Autoliv), Robert Bosch, Aptiv (formerly Delphi Technologies), Denso, ZF/TRW, Hella, Hyundai/Mobis, and SteelMate. This report also analyses the first imaging radar from Continental, which has also been evaluated through a dedicated teardown: Continental ARS5-A ARS540 4D Long-Range Radar (66 31 5 A55 CB1).

Through teardowns of a large variety of radar systems, System Plus Consulting, has extracted the main RF chipsets and boards and physically analysed them. The company has also sectioned the RF boards to point out the various OEMs’ technology and economic choices.

European companies lead the automotive radar market. The key technology trend is downsizing of the RF board. Continental SRR and LRR radar sensors are showing the least integration: both devices are based on the same RF board area and MMIC integration is also the same for both devices. Infineon Technologies and NXP are both MMIC market leaders, and the trend is to integrate more digital functions per die.

“Market share differs depending on the frequency and the automotive application,” explains Stéphane Elisabeth from System Plus Consulting. “At 24 GHz, STMicroelectronics’ solution is at the low end. At 77 GHz, Infineon Technologies and NXP have led the way for many years. But it appears that Texas Instruments is catching up.”

The 2nd edition of the radar comparison report is a significant analysis of state-of-the-art radar technologies. This study points out the technical strategy of each leading company, the OEMs and module makers, and the supply chain they have set up to support them. It highlights their vision of the automotive industry and how they expect to penetrate it.