Optical transceiver market to reach $24.7B in 2027

Increased IP traffic growth creates new demand for datacom and telecom optics, says Yole

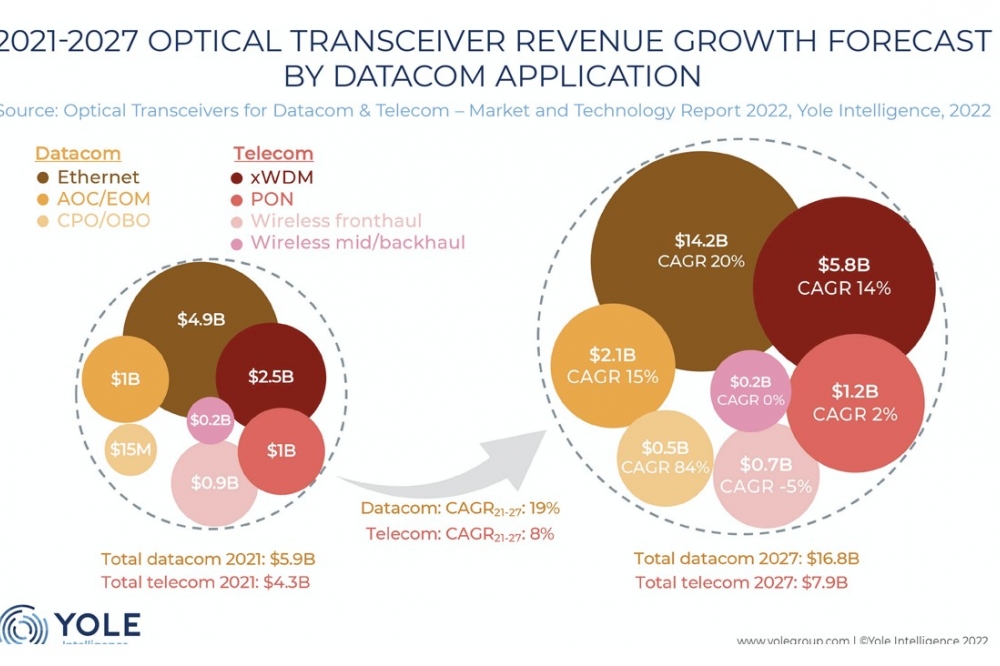

The optical transceiver market will reach $24.7 billion in 2027, according to Yole Group's latest research. Social networking, business meetings, video streaming in UHD, e-commerce, and gaming applications continue to drive growth. In addition, expanding machine-to-machine applications, such as smart meters, video surveillance, healthcare monitoring, connected drives, and automated logistics, contribute significantly to device and connection growth and push the expansion of data centre infrastructure.

Martin Vallo, senior analyst, Photonics, specialising in optical communication and semiconductor lasers within the Photonics and Sensing division at Yole Intelligence, part of Yole Group said: “Revenue generated by the optical transceiver market reached around $10.4 billion in 2021 and is expected to reach $24.7 billion in 2027, which is a 15 percent CAGR for 2021-2027. This growth is driven by high volume adoption of high-data-rate modules above 400G by big cloud service operators and national telecom operators requiring increased fibre-optic network capacity.”

The evolution of multiple technologies has enabled data rates of 400G, 600G, 800G, and beyond across data centre infrastructure and in long-haul and metro networks. 400GbE deployments are ramping across data centre networks. Many cloud providers and telecom operators are now starting to deploy an 800Gbps optical ecosystem to increase bandwidth capacity and keep pace with the growing demand for data.

Optical modules have become an essential technology in telecommunication infrastructure. The development of semiconductor technologies such as lasers, modulators, and DSPs has enabled increased bandwidth and accelerated data rates. Optical interconnects are ubiquitous and are intended to provide high bandwidth even for very short-reach applications, such as high-power computing and AI/ML applications within data centres. SiPh as a technology platform, co-packaged optics assembly as a new switch architecture, and coherence in compact form factors are the trends that will drive the market for the next five years.

This significantly simplifies electro-optic conversion within the switch system and accelerates the exchange of high-speed optical modules. We anticipate high popularity for 800G modules as they take advantage of 100G single-wavelength optics already proven in 400GbE systems and thus can be technically and cost-effectively implemented in QSFP-DD and OSFP form factors.