Aixtron posts strong Q1

Best quarter in many years but low order intake reflects reluctance of customers to invest

Deposition equipment firm Aixtron has announced its financial results for the first quarter 2019 with orders and revenues in line with forecast.

Revenues increased to €68.7 million (+10 percent) compared to previous year. Order intake reduced year-on-year to €53.6 million (-32 percent). Gross profit of €26.7 million was stable compared to previous year. Operating result (EBIT) was up on previous year to €9.7 million (+23 percent). Operating expenses were down further year-on-year (-10 percent)

The first quarter of 2019 was mainly influenced by the expected reluctance of customers to invest in the expansion of their production capacities. However, the prospects for our core optoelectronics and power electronics business are intact.

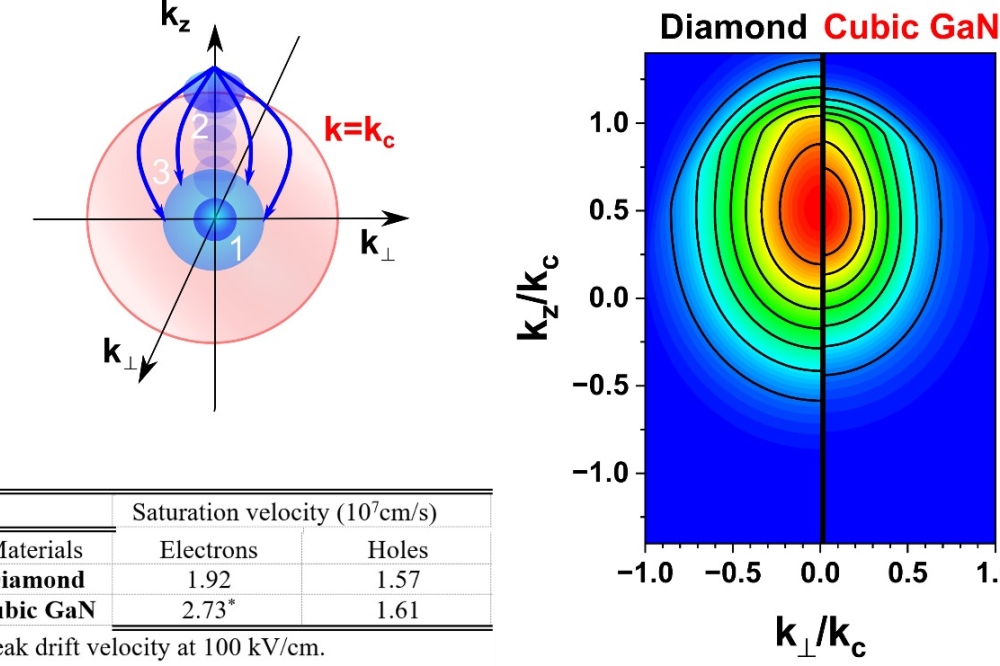

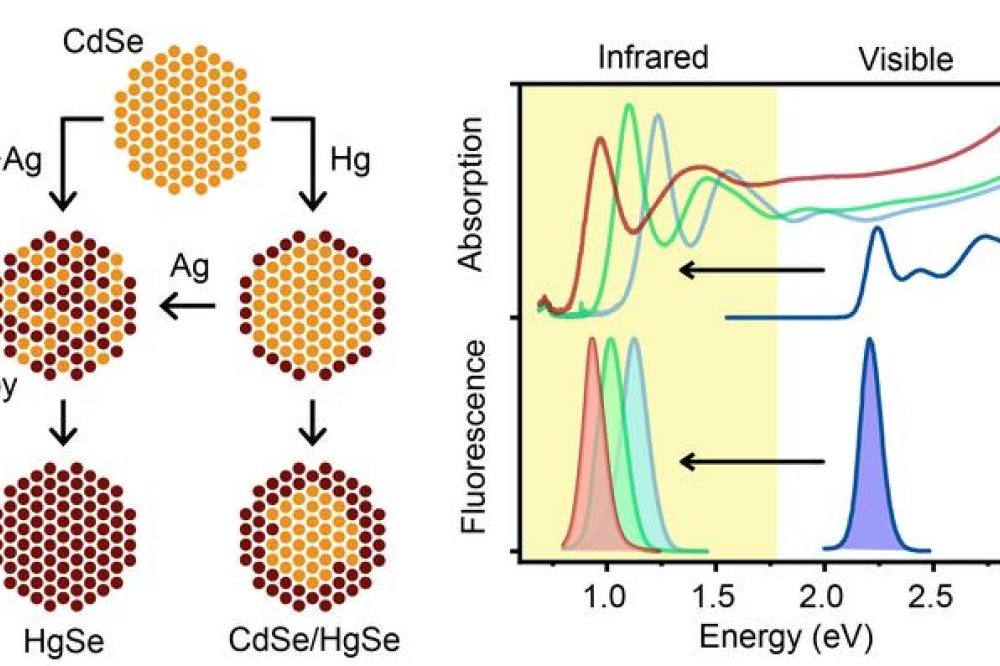

Aixtron continues to anticipate an increasing demand for lasers in these areas due to increasing applications in 3D sensor technology, security infrastructure or optical data transmission as well as the increasing use of LEDs and special LEDs in display and other applications. In addition, the company expects an increased use of GaN or SiC-based devices for energy-efficient communication and energy management in automobiles, consumer electronics and mobile devices.

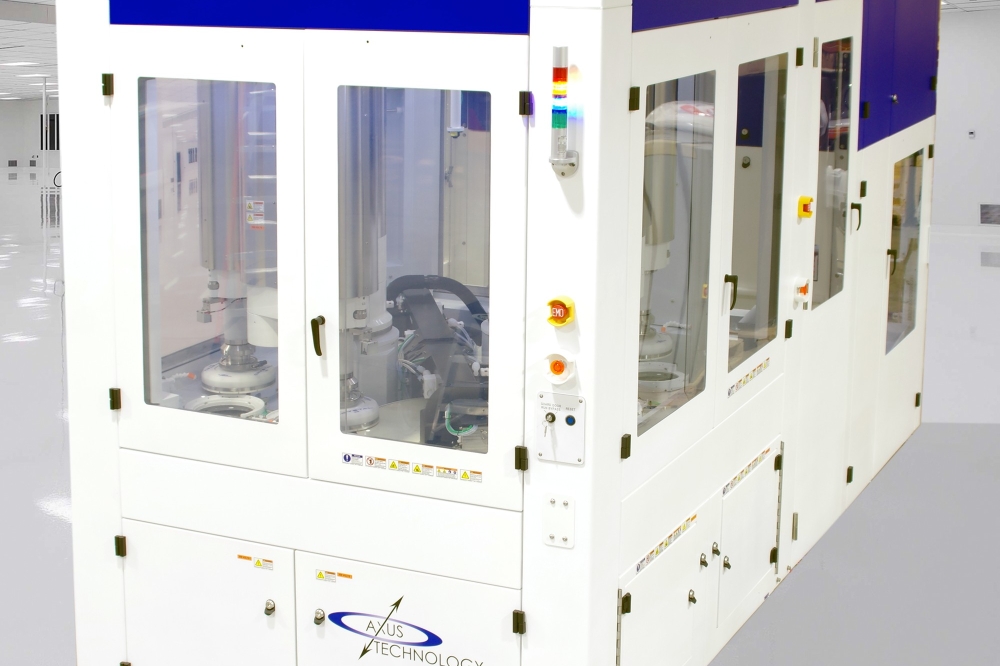

In organic electronics, the group took a further step towards OVPD technology qualification during the first quarter of 2019 with the commissioning of the Gen2 OLED system on a customer pilot production line. In the coming months, the facility is expected to deliver test results that will serve as the customer's decision basis, support the customer's decision-making process, and further advance the development of the technology.

Bernd Schulte, president of Aixtron SE, comments: "Business development in the first quarter of 2019 was in line with our expectations. Against this background, we confirm the forecast for 2019 issued in February. While in terms of revenues Q1/2019 was the strongest first quarter in many years, order intake reflects the current reluctance of our customers to invest. Our continued productivity gains and lower costs, combined with a favorable USD/€exchange rate, are positive factors supporting both our gross margin and our results. "

"There has been no change in the medium- and long-term positive assessment of our core markets. We remain firmly convinced that Aixtron will benefit from numerous forward-looking technology trends due to its product portfolio. As market and technology leader in optoelectronics, we are excellently positioned in laser and special LED applications as well as in power electronics, where we will be launching a new generation of systems this year. We are also optimistic about our subsidiary APEVA, which in the first quarter of 2019 took another important step on the road to production qualification with the commissioning of the Gen2 OLED system at our customer's site," adds Felix Grawert, president of Aixtron.

Guidance

On the basis of the results for the first three months of the 2019 financial year and the internal assessment of the development of demand, the Management Board maintains its forecast for the 2019 financial year given in the Annual Report.

Accordingly, a stable to slightly growing sales development compared to 2018 is expected for the financial year as a whole. Incoming orders of the first quarter reflect the aforementioned reluctance of customers to make investment decisions in optoelectronics, and the further development in the second half of 2019 cannot yet be accurately predicted at the moment.

Based on the results in Q1/2019, the current assessment of the order situation and the budget exchange rate of 1.20 USD/EUR, the Management Board expects incoming orders in a range between €220 million and €260 million for fiscal year 2019. These expectations include an expected order from the OLED customer for a large-scale test system as part of the ongoing qualification process for OVPD technology for the OLED display industry.

With expected sales revenues in a range between €260 million and €290 million, the management board expects a gross margin of between 35 percent and 40 percent and EBIT of between 8 percent and 13 percent of sales in fiscal year 2019.

Furthermore, the board expects to generate a free cash flow of between €15 million and €25 million in fiscal year 2019. Expectations for 2019 fully include the results of Aixtron's APEVA subsidiary, including all necessary investments to continue the development of OLED activities.