SCI reports growth in revenue and profits

Revenue up 54 percent and profits up 11 percent for the first six months of 2019 compared to 2018

SCI Engineered Materials, a supplier and manufacturer of materials for physical vapour deposition thin film applications, has reported results for the six months and three months ended June 30, 2019.

Jeremy Young, president and CEO, said: “We achieved a 54 percent increase in revenue and an 11 percent increase in gross profit for the first six months of 2019 compared to last year. Second quarter gross profit margin increased sequentially from the first quarter and was lower than the same period in 2018 due to product mix. During the most recent quarter we expanded our presence in niche markets with the addition of new customers for SCI’s optics and photonics products. Order backlog was $6.6 million at June 30, 2019, which is above the previous quarter-end amount and higher than on the same date last year.”

Young added: “We continue to position SCI for sustained growth in all of our markets. During the second quarter we completed construction of a mezzanine area above our manufacturing operations in Columbus, Ohio. That project is in the final stage of code approval and we look forward to utilising this additional space to enhance our R&D and manufacturing capabilities. Additionally, production equipment was installed at our joint partner’s facility in Zhejiang, China, during the second quarter and product qualification has been initiated. This facility is expected to be an integral part of SCI’s thin film solar growth plans in China.

“China is expected to remain the world leader for installed photovoltaic solar capacity and the long-term outlook for thin film solar remains strong despite near-term economic uncertainties, most notably related to U.S.-China tariffs. SCI’s revenue for 2019 is expected to be above the prior year while product mix, specifically related to lower than planned thin film solar revenue, will adversely impact the year-over-year net income comparison.”

Revenue

Revenue for the six months ended June 30, 2019, increased 54 percent to $6,756,986 from $4,390,609 for the same period last year. This was attributable to higher pricing, driven by year-over-year increases in a key raw material, and higher volume for photonics products. Thin film solar product volume was lower for the first half of 2019 compared to a year ago. Tariffs impacted thin film solar order rates and shipments throughout the second quarter of 2019. Revenue increased nearly 8 percent to $2,741,948 for the second quarter of this year from $2,543,751 in 2018.

Order backlog was $6.6 million at June 30, 2019, compared to $6.4 million at March 31, 2019, and $6.3 million on the same date last year.

Gross profit

Gross profit increased 11 percent to $1,390,971 for the first half of 2019 from $1,251,541 the prior year. In 2019, gross profit particularly benefited from higher volume and pricing of photonics products, driven by increases in a key raw material. Second quarter 2019 gross profit decreased 12 percent to $694,669 compared to $789,529 last year. This was principally due to product mix, particularly lower thin film solar sales compared to the same period in 2018.

Operating expenses

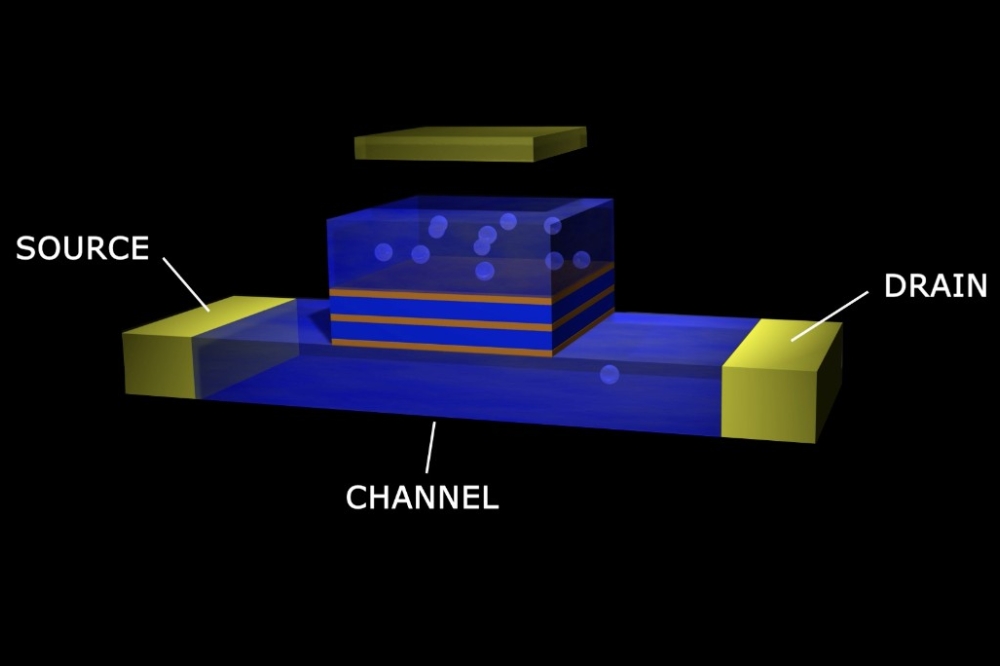

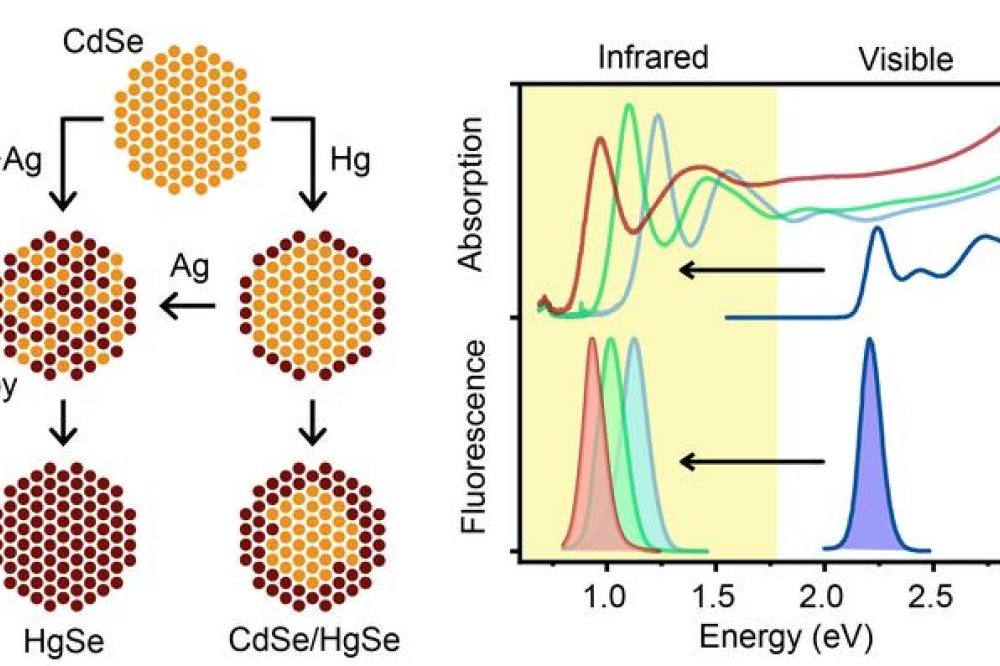

For the first six months of 2019, operating expenses (general and administrative expense, research and development expense, and marketing and sales expense) were $1,050,870 compared to $833,838 last year, an increase of 26 percent. General and administrative expense increased 34 percent on a year-over-year basis principally due to executive management transition expenses. General and administrative expense is expected to be lower during the second half of 2019 compared to the first half of this year due to completion of the transition. Research and development expense increased 33 percent for the first half of 2019 versus the same period last year as a result of higher compensation plus ongoing research initiatives. These include an innovative buffer layer for thin film solar cells, transparent conductive oxide systems for transparent electronics and thin film solar.

For the second quarter of 2019, operating expense increased nearly 12 percent to $513,582 from $460,039 last year. General and administrative expense was 24 percent higher than a year ago primarily due to the previously noted transition expenses, plus higher wages and compensation expense and start-up training costs in China directly related to the Company’s new bonding operation.

Income Applicable to Common Shares

Income applicable to common shares was $309,684, or $0.07 per share, for the first six months ended June 30, 2019, compared to $386,171, or $0.09 per share, for the same period in 2018. Second quarter 2019 income applicable to common stock was $160,380, or $0.04 per share, versus $314,972, or $0.07 per share, for the same period a year ago.