ASM to acquire Italian SiC epitaxy firm

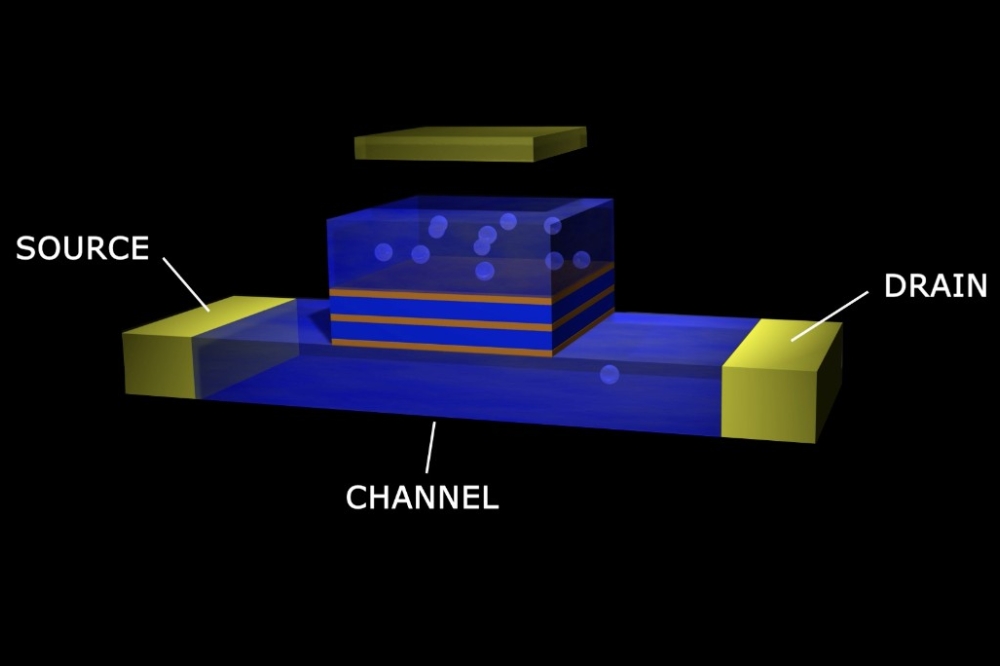

SiC capability to complement portfolio of silicon epitaxy solutions for power electronics, analogue and wafer markets

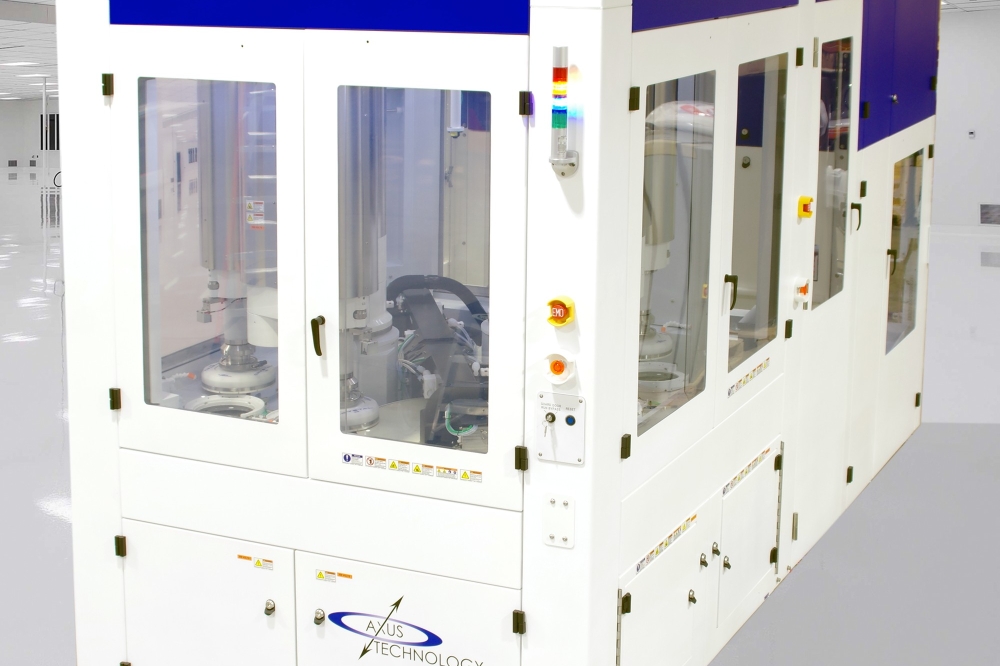

ASM International has reached an agreement under which ASM will acquire all outstanding shares of LPE, a manufacturer of epitaxial reactors for SiC and silicon, based in Italy.

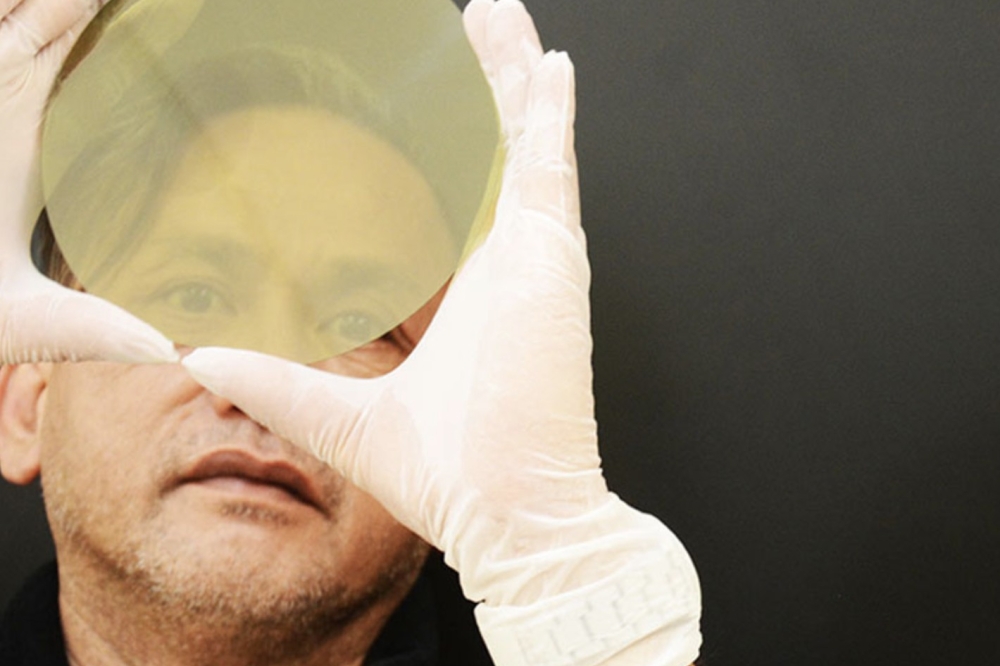

Founded in 1972, LPE has exclusively focused on designing, manufacturing and selling advanced epitaxy tools for power applications. SiC epitaxy is one area of expertise with many patents to date. LPE has a worldwide installed base of SiC epitaxy tools dedicated to manufacturing devices that address the rapidly growing electric vehicle market. Revenue expectations for LPE in 2023 are greater than €100 million, mainly driven by its SiC epitaxy equipment business.

“LPE with its strong culture of innovation and traction with SiC device makers, both for 150mm and 200mm substrates, is well positioned to serve the needs of global automotive customers and their decarbonisation drive,” said Benjamin Loh, president and CEO of ASM.

“Next to ASM’s expanding position in advanced Epi applications for the logic/foundry and memory markets, ASM is also a leader in silicon epitaxy solutions for the power electronics, analogue and wafer markets. LPE’s offering of advanced SiC epitaxy tools complements ASM’s offering. I’m confident that the combination of LPE and ASM will help our customers accelerate their roadmaps towards next-generation more efficient power electronics, which will enable the further electrification of the automotive industry.

"The acquisition of LPE adds another high-growth business to our portfolio of differentiated deposition technologies and presents meaningful opportunities to create value by leveraging our innovative epitaxy technologies to further differentiate the product offering of LPE, by building upon our significant customer base in the power electronics market segment, and by utilising our global field service network to address customer needs.”

Franco Preti, CEO of LPE, said: “We believe the acquisition by ASM will be attractive for LPE’s and ASM’s customers as well as for employees. The acquisition will additionally enable LPE to gain access to world-class R&D resources, as well as leverage on ASM’s global operations, sales and customer support network.”

Following the close of the transaction, LPE will operate as a product unit under ASM’s Global Products organisation. LPE will continue to be based in Italy, with technology and manufacturing centers in Milan and Catania. LPE is profitable and is expected to contribute to net earnings immediately after closing.

The transaction is subject to FDI and anti-trust approval in a limited number of countries and other customary closing conditions which are expected to be met by the long stop date of November 10, 2022. Absent a closing by this date, the parties will discuss in good faith on an exclusive basis for a period of six months with the aim to still close the transaction.

ASM will finance the transaction using a combination of cash and shares. At closing the purchase price will be paid with €283.25 million in cash, and with 631,154 ASM shares. At the date of signing, the payment represents an enterprise value of €425 million on a cash and debt free basis. An additional amount of up to €100 million will be paid by way of an earn out based on certain performance metrics over a two-year period after the closing of the transaction. The shares will be a combination of treasury shares (580,000) and a limited number of newly issued ASM shares (51,154). The earn outs are to be paid out exclusively in cash. The cash amounts will be financed from ASM’s net cash balance.