IPG back on track with diode laser ramp

IPG Photonics, the US company that dominates the high-power fiber laser business, has posted another large increase in sales and growing profit for the opening quarter of 2008.

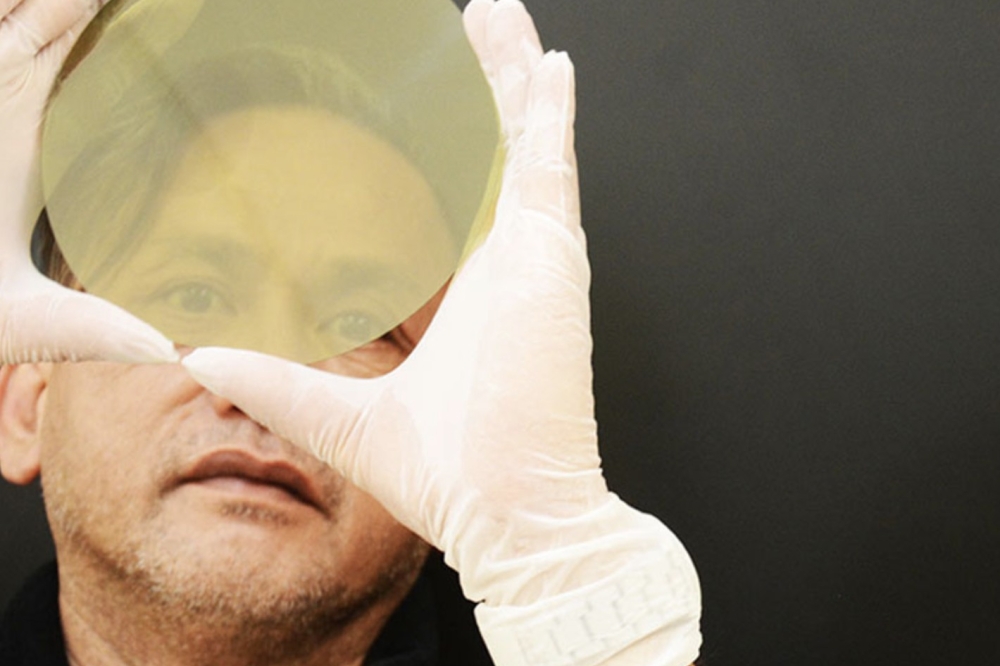

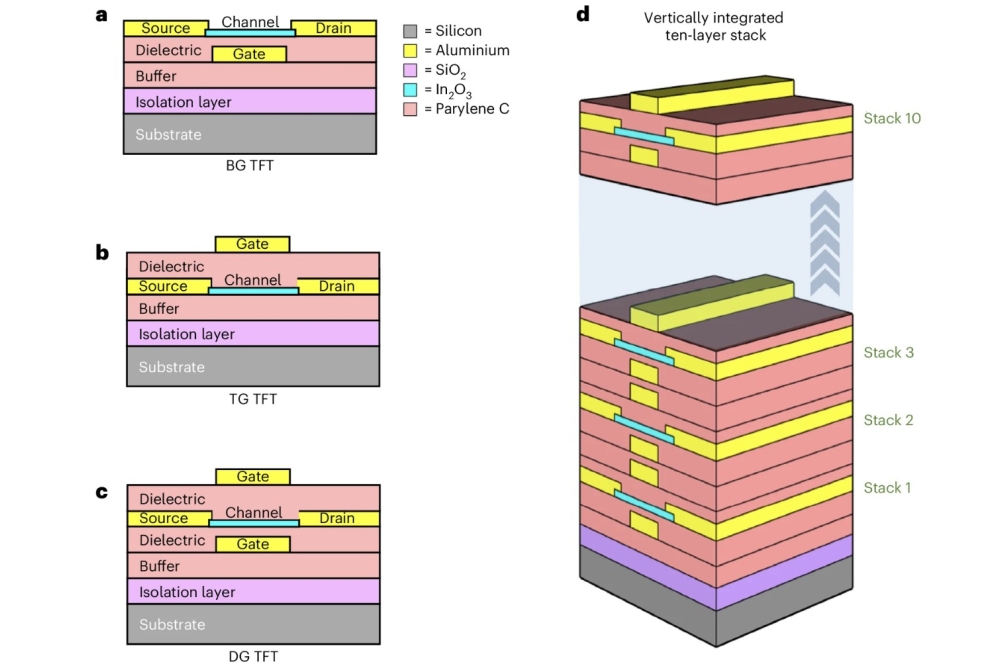

Part of the reason for that was better utilization of its chip manufacturing facility in Oxford, MA, where it produces high-power laser diodes using molecular beam epitaxy.

In a bid to ready itself for further increases in demand for very high power systems in the future, IPG has also decided to stockpile its laser chips so that it can respond more quickly to customer requirements.

In the opening three months of 2008, IPG registered sales of $52.9 million, up 27 per cent on the first quarter of 2007. Net income of $8.1 million was up 23 per cent year-on-year, despite a sharp increase in litigation costs.

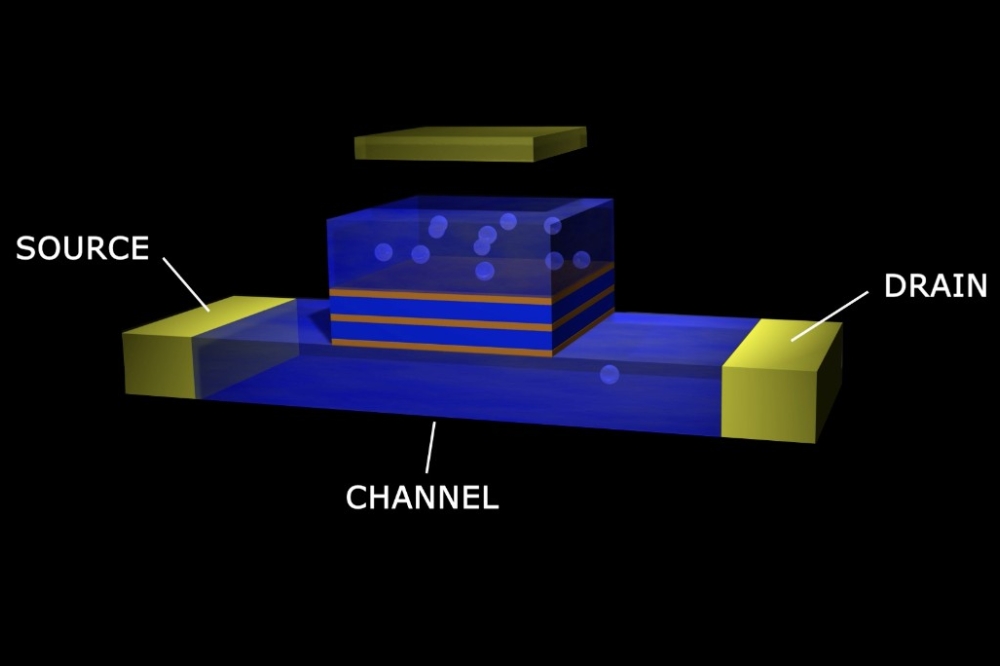

The increase in demand for its high-power pulsed lasers, which use large numbers of diode emitters, is largely behind that upturn. CEO Valentin Gapontsev said that a move among customers to more energy-efficient laser welding and cutting systems was increasingly a factor in IPG s favour, as its fiber lasers use electrical power much more efficiently than traditional high-power carbon dioxide lasers.

50kW military demo

With new customers requiring high-power fiber laser cutting systems for photovoltaics manufacturing, and a 50 kW laser project for a defense demonstration in the US under way, it seems likely that IPG s customer base is increasingly moving towards higher-power systems "“ and this means that more laser diodes will be needed.

IPG is still ramping up its manufacturing output, although it has largely completed its capital expenditure on this front. The ramp included the purchase of two MBE systems from Veeco a little over a year ago (see related story).

Referring to laser production problems that the company experienced in late 2007, CFO Tim Mammen declared that IPG had now "dealt with all of those yield issues", and that the capacity expansion would be completed in the third quarter of this year.

Gapontsev indicated that the extra capacity would be sufficient to sustain IPG s rapid growth for at least the next couple years, with no further expansion likely until 2010 or 2011.

Although most laser diode manufacturers do not tend to hold large amounts of stock in their inventory, IPG said that doing this was "strategically important", especially in the light of the previous yield problems.

That additional inventory should ensure a continuity of supply for the vertically integrated company, allowing it to respond to customers with shorter lead times in the future.

With Gapontsev saying that a number of customers may place multiple orders for 10 kilowatt systems within the next 12 months, the company feels that it is essential to have the laser stock available to meet those orders.

• Investors reacted positively to IPG s sales guidance of $52 million-$56 million for the second quarter, immediately sending shares in the company up 15 per cent to $19.40.