CIGS to Become a solar Game Changer

While conventional crystalline-silicon solar technologies are approaching their theoretical conversion limit, alternative photovoltaic (PV) technologies are setting the bar higher and higher, gradually changing the landscape of the global solar market, according to "˜Chasing the Sun: Searching for Game Changers in Disruptive Photovoltaic Technologies', by Innova research.

In this new report, Innova has estimated that the share of solar PV production capacity by conventional crystalline-silicon solar technology accounts for 84.7 percent of the total global capacity in 2014. This share is forecasted to further decline to 78.4 percent by 2019 encroached by the emerging PV technologies. Innova Research believes that CIGS and CPV have the greatest potentials and will become the game changers in the global solar market.

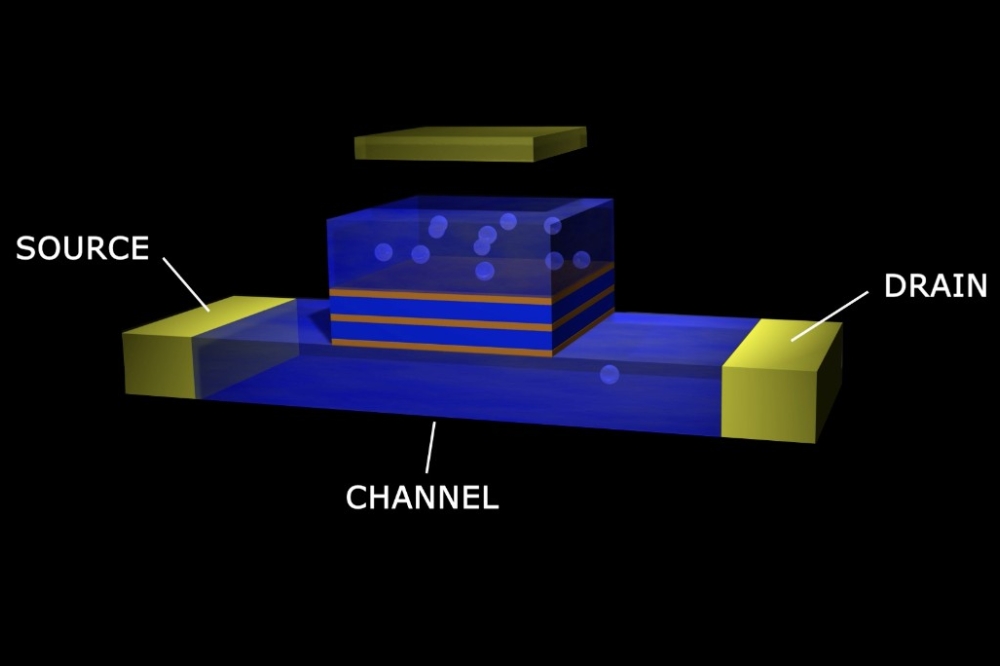

In the report, alternative solar technologies are analysed and ranked based on a matrix analysis of key technologies indexes, patent publications, and mergers and acquisitions activities. Innova research classified the emerging solar technologies into three major categories, namely thin-film PV, including CIGS, CdTe, thin film-silicon; concentrated PV (CPV), including LCPV and HCPV, and the third generation solar technologies, including organic PV (OPV), dye-sensitised solar cell (DSSC), copper zinc tin sulphide (CZTS), quantum dot (QD), and perovskite solar cells.

Nancy Wu, research director of Innova Research and the lead author of the report said: "Thin-film and CPV technologies are poised for large commercialisation in the near future while the 3rd generation PV technologies will still have a long way to go towards that goal. We believe that the winners among the emerging PV technologies will be CIGS and high-concentrating PV (HCPV), both are benefiting from their outstanding cost reduction potentials and the feasibility for massive adoptions."

CIGS leads the thin-film PV expansion with production capacity growth from an estimated 1.8 GW in 2010 to a forecasted 5.6GW in 2019, followed by CdTe, from 2.5GW to 3.5 GW for the same period. Meanwhile, the production capacities for CPV modules are forecast to grow from 1.5GW in 2010 to 2.4GW in 2019, with over 60 percent of the capacity contributed by high-concentrating PV in 2019.

Thin-film accounts for the largest number of mergers and acquisitions in the alternative solar technology field, followed by CPV, with 24 and 14 deals closed, respectively, from 2010 to 2014. The total dollar values of mergers and acquisitions in the thin-film and CPV fields were estimated at $1.08 billion and $247 million, respectively, in the same period.

US leads the IP publications in CdTe, CIGS, and CZTS, while Asian countries, including China, Japan, and South Korea are catching up in DSSC, QD, and perovskite PV technologies in the past five years. The increasing research focuses on the alternative solar PV technologies, particularly on their efficiency enhancement and the stability of the systems, will greatly drive up their commercialisation in the next few years.

The report, "˜Chasing the Sun: Searching for Game Changers in Disruptive Photovoltaic Technologies' is part of the Innova Research Renewable Energy and Environmental Technologies service.