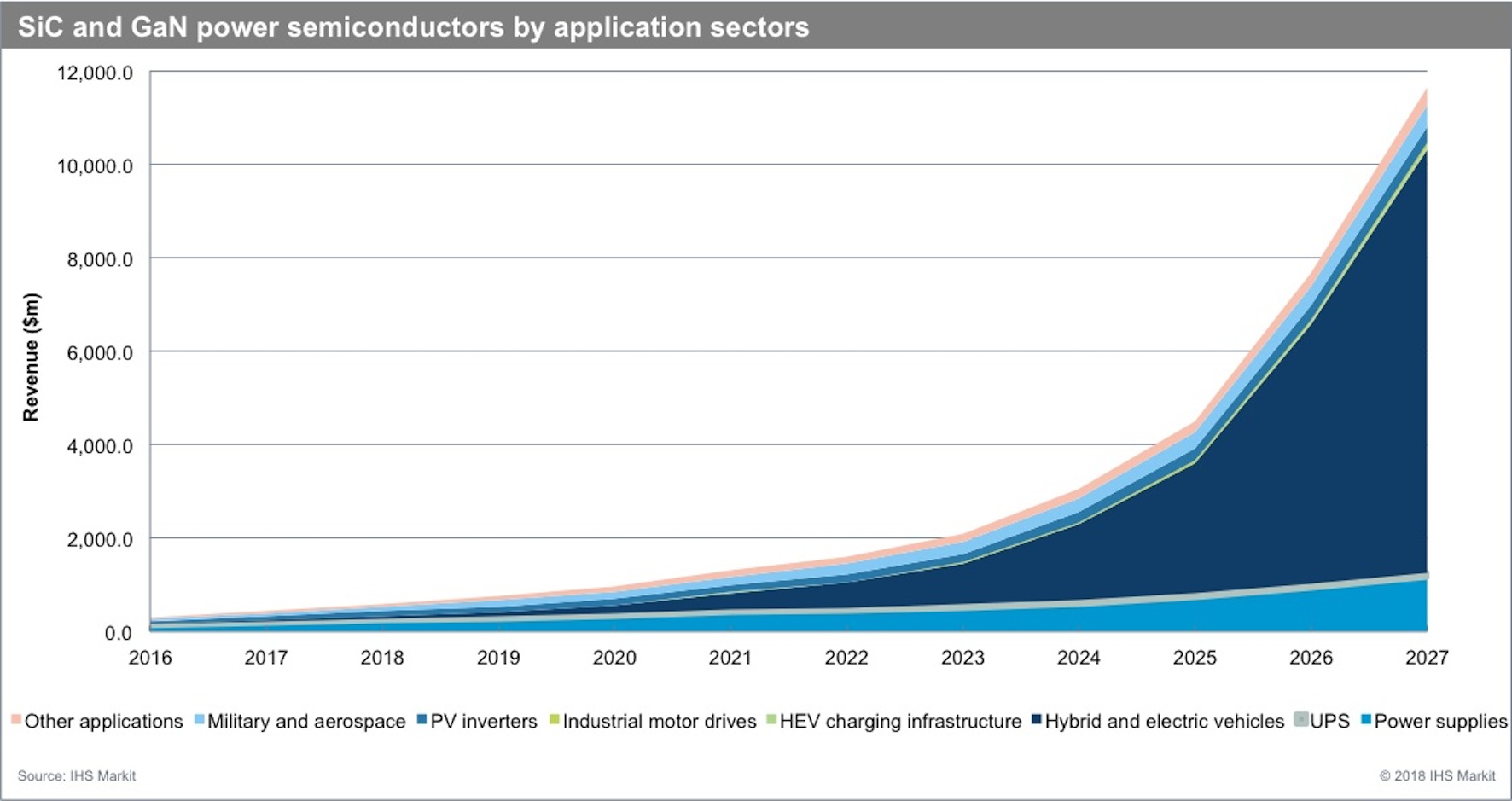

GaN and SiC power chips to top $10B in 2027

IHS Markit says power semiconductors in the main powertrain inverter in hybrid and electric vehicles will lead to revenue rising at CAGR of over 35 percent after 2017

The emerging market for SiC and GaN power semiconductors is expected to reach nearly $1 billion in 2020, energised by demand from hybrid and electric vehicles, power supplies and photovoltaic (PV) inverters, writes Richard Eden, principal analyst, power semiconductors, IHS Markit, in a new report.

Adoption of SiC and GaN power semiconductors in the main powertrain inverter in hybrid and electric vehicles will lead to revenue rising at a compound annual growth rate (CAGR) of over 35 percent after 2017, reaching $10 billion in 2027, he says.

By 2020, GaN-on-silicon (Si) transistors are expected to achieve price parity with silicon MOSFETs and IGBTs, while also providing the same superior performance. Once this benchmark is reached, the GaN power market is expected to reach $600 million in 2024, and climb to over $1.7 billion in 2027.

Prospects for continuing strong growth in the SiC industry are high, fuelled predominantly by increasing sales of hybrid and electric vehicles. Market penetration is also growing, particularly in China, with Schottky barrier diodes, MOSFETs, junction gate field-effect transistors (JFETs) and other SiC discretes already appearing in mass-produced automotive DC-DC converters and on-board battery chargers.

It looks increasingly likely that powertrain main inverters - using SiC MOSFETs, instead of Si insulated-gate bipolar transistors (IGBTs) - will start to appear on the market in three to five years. As there are many more devices used in main inverters, than in DC-DC converters and on-board chargers, the required quantity will also rapidly rise. There might come a time when inverter manufacturers eventually choose custom full SiC power modules over SiC discretes. Integration, control and package optimisation are the major strengths of module assemblers.

Not only will the number of per-vehicle SiC devices increase, but new, global registration demand for both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) will also increase ten-fold between 2017 and 2027, as many global governments aim to reduce air pollution and lower dependence on vehicles burning fossil fuels. China, India, France, Great Britain and Norway have already announced plans to ban cars with internal combustion engines in the coming decades, replacing them with cleaner vehicles. The prospects for electrified vehicles generally, and for wide band-gap semiconductors specifically, are therefore very good.

The biggest inhibitor to massive growth for SiC components could be GaN components. The first automotive AEC-Q101 qualified GaN transistor was launched in 2017 by Transphorm, and GaN devices manufactured on GaN-on-Si epiwafers boast considerably lower costs. They are also easier to manufacture than anything produced on SiC wafers. For these reasons, GaN transistors could become the preferred choice in inverters in the late 2020s, ahead of more expensive SiC MOSFETs.

The most interesting story for GaN power devices in recent years has been the arrival of GaN system integrated circuits (ICs), which are GaN transistors co-packaged with Si gate driver ICs, or monolithic, all GaN ICs. Once their performance is optimised for mobile phone and laptop chargers and other high-volume applications, usage may become prevalent in wider applications. In contrast, commercial GaN power diode development never really started, because they would not offer significant benefits over Si devices, and developing them proved too costly to be viable. SiC Schottky diodes already work well for that purpose and a have a good pricing roadmap.